Dow Jones Index Futures

Dow Jones Index Futures are powerful financial derivatives that track the Dow Jones Industrial Average (DJIA)—one of the most widely followed equity benchmarks in the world.

They allow traders and investors to speculate on or hedge against movements in the DJIA without directly owning its 30 component stocks.

Key Benefits:

- Trade the U.S. stock market as a single instrument

- React to global news nearly 24 hours a day

- Hedge equity portfolios against downside risk

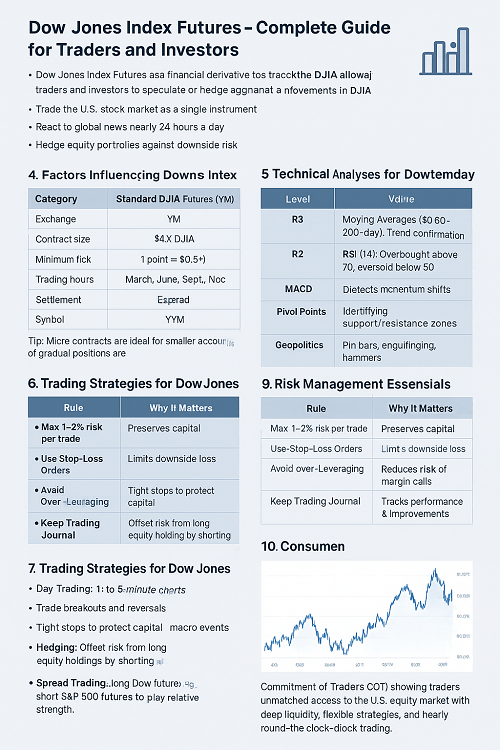

Dow Jones Index Futures Contract Specifications

| Feature | Standard DJIA Futures (YM) | Micro DJIA Futures (MYM) |

|---|---|---|

| Exchange | CME Group (CBOT) | CME Group (CBOT) |

| Contract Size | $5 × DJIA | $0.50 × DJIA |

| Minimum Tick | 1 point = $5 | 1 point = $0.50 |

| Trading Hours | Sun–Fri: 6:00 p.m.–5:00 p.m. ET | Same as standard |

| Settlement | Cash | Cash |

| Expiration Months | March, June, September, December | Same as standard |

| Symbol | YM | MYM |

Tip: Micro contracts are ideal for smaller accounts or traders wanting to scale into positions gradually.

How Dow Jones Index Futures Work

- Long Position: You expect the DJIA to rise → Buy futures.

- Short Position: You expect the DJIA to fall → Sell futures.

- Leverage: Margin requirements are a fraction of the full contract value.

- Mark-to-Market: Gains/losses are settled daily.

Factors Influencing Dow Jones Index Futures

| Category | Examples | Impact |

|---|---|---|

| Economic Data | CPI, PPI, GDP, job reports | Drives market expectations |

| Fed Policy | Interest rate changes, QE/QT | Alters borrowing costs & liquidity |

| Corporate Earnings | Apple, Microsoft, Boeing results | Moves index heavily |

| Geopolitics | Trade wars, political instability | Triggers risk-on/risk-off flows |

| Market Sentiment | VIX index, retail positioning | Influences short-term price swings |

Technical Analysis Tools for Dow Jones Index Futures

Technical traders use price data to forecast market direction. Key tools include:

- Moving Averages (50 & 200-day): Trend confirmation

- RSI (14): Overbought above 70, oversold below 30

- MACD: Detects momentum shifts

- Pivot Points: Identifies support/resistance zones

- Candlestick Patterns: Pin bars, engulfing, hammers

Example Pivot Points Table:

| Level | Value |

|---|---|

| R3 | 41,000 |

| R2 | 40,500 |

| R1 | 40,100 |

| Pivot | 39,800 |

| S1 | 39,400 |

| S2 | 38,900 |

| S3 | 38,500 |

Fundamental Analysis for Dow Jones Index Futures

Fundamental traders look at the bigger picture:

- Macro Trends: Is the economy expanding or contracting?

- Sector Performance: Which Dow sectors are leading or lagging?

- Policy Outlook: Expected changes in interest rates or government spending.

- Correlation Assets: Oil, gold, and Treasury yields often move alongside or opposite to Dow futures.

Trading Strategies for Dow Jones Index Futures

Day Trading

- Use 1- to 5-minute charts

- Trade breakouts and reversals

- Tight stops to protect capital

Swing Trading

- Hold for several days/weeks

- Combine daily chart patterns with macro events

Hedging

- Offset risk from long equity holdings by shorting futures

Spread Trading

- Long Dow futures vs. short S&P 500 futures to play relative strength

Risk Management Essentials

| Rule | Why It Matters |

|---|---|

| Max 1–2% risk per trade | Preserves capital |

| Use Stop-Loss Orders | Limits downside loss |

| Avoid Over-Leveraging | Reduces risk of margin calls |

| Keep Trading Journal | Tracks performance & improvements |

Contract Expiration and Rollover

- Quarterly expirations: March, June, September, December

- Last Trading Day: Third Friday of the expiration month

- Rollover Strategy: Close or switch to next contract before expiry to avoid settlement

Market Sentiment Indicators

- Commitment of Traders (COT): Shows institutional positions

- VIX Index: Measures market volatility

- Trader Polls & Forums: Gauge retail bias

Dow Jones Index Futures offer traders unmatched access to the U.S. equity market with deep liquidity, flexible strategies, and nearly round-the-clock trading. By mastering both technical and fundamental analysis, managing risk, and staying alert to market-moving events, traders can make the most of the opportunities these futures present.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F