Amid the buzz surrounding Nasdaq’s tech stocks, particularly Nasdaq NVDA, Nvidia’s quiet exit from its stake in SoundHound AI (SOUN) in late 2024 sparked immediate controversy. Shares of SoundHound plunged nearly 30% in a single day, and headlines rushed to ask whether Nvidia had blundered. Fast-forward into 2025, and SoundHound has posted strong revenue growth, raised its full-year outlook, and signed new voice AI partnerships.

So did Nvidia really make a mistake, or was this just a strategic reshuffling that says more about Nvidia’s priorities than SoundHound’s prospects? Let’s break down the full picture.

Nvidia’s Investment in SoundHound AI

Nvidia first invested in SoundHound years before its IPO, aligning with its interest in conversational AI and automotive applications. By late 2023, Nvidia still held about 1.7 million shares of SOUN—an endorsement that added credibility to SoundHound’s positioning as a leader in voice AI technology for cars, restaurants, and enterprise systems.

This relationship made sense. SoundHound’s platform is GPU-intensive, and its presence in connected cars overlapped with Nvidia’s autonomous driving ambitions. For retail investors, Nasdaq NVDA’s stake was a confidence signal.

Timeline: From Stake to Exit

- 2017–2022: Nvidia invests in SoundHound during its pre-IPO fundraising rounds.

- April 2022: SoundHound goes public via SPAC merger.

- 2023: Nvidia discloses its 1.7 million-share stake.

- Late 2024: Nvidia sells its entire position, triggering a 23–28% single-day plunge in SOUN stock.

At first glance, the timing looked questionable. SoundHound had just reported accelerating growth, and yet Nvidia sold before a wave of positive earnings news in 2025.

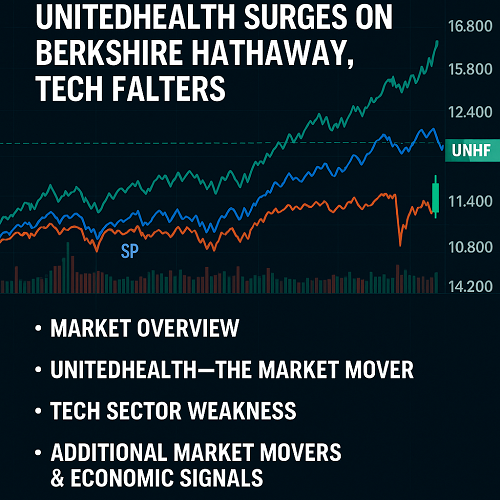

Immediate Market Reaction

The market interpreted Nasdaq NVDA’s exit as a vote of no confidence. Investors dumped shares, driving SOUN down by nearly one-third in one session.

SoundHound CEO Keyvan Mohajer responded bluntly, calling the sell-off “an overreaction.” He pointed out that SoundHound’s fundamentals were improving, with revenues climbing and contracts expanding in multiple verticals.

In hindsight, his comments have proven accurate: within months, SoundHound delivered results that far exceeded Wall Street’s expectations.

SoundHound AI’s Post-Exit Performance

Despite Nvidia’s exit, SoundHound has continued to build momentum:

- Q4 2024 results: $34.5M in revenue, adjusted net loss of $0.05 per share. Management raised full-year 2025 guidance to $157M–177M.

- Q2 2025 results: $42.7M in revenue, beating analyst consensus of $32.9M. Full-year revenue outlook reaffirmed at $160M–178M.

- Backlog & demand: SoundHound reported a multiyear contract backlog in the hundreds of millions, spanning automotive, restaurants, healthcare, and smart devices.

Clearly, SoundHound is executing well. Nvidia’s sale did not reflect deteriorating business conditions—it was a balance sheet decision.

Strategic Analysis: Did Nvidia Err?

Was the Sale Material to Nvidia?

From a financial perspective, Nasdaq NVDA’s exit was insignificant. Proceeds of ~$20–30 million represent a rounding error for a company with a market cap over $4 trillion and quarterly free cash flow in the billions.

Nvidia did not sell because it needed capital; it sold because the stake was immaterial.

Did the Sale Send the Wrong Signal?

Here’s where the controversy lies. Retail investors often view insider or strategic divestments as a red flag. Nvidia’s sale created panic that wasn’t necessarily justified.

By selling, Nvidia may have unintentionally caused a sharp but temporary markdown in SoundHound’s valuation. Long-term investors who bought the dip may end up benefitting more than Nvidia itself.

SoundHound’s Business Robustness

SoundHound continues to demonstrate traction across industries:

- Automotive: Partnerships with Hyundai, Kia, and Stellantis.

- Restaurants: AI drive-through ordering with White Castle and other fast-food chains.

- Healthcare & enterprise: Expanding into real-time transcription and multilingual support.

This diversified strategy reduces reliance on any one vertical and makes SoundHound a pure-play on conversational AI growth.

Nvidia’s Bigger Picture

Nvidia is strategically focused on autonomous driving platforms, AI cloud infrastructure, and partnerships with larger players like WeRide and Nebius. Divesting from a relatively small AI stock like SoundHound doesn’t imply weakness—it reflects portfolio streamlining.

What This Means for Investors

So, did Nvidia make a mistake? It depends on perspective:

- For Nvidia: Probably not. The stake was too small to matter. Nvidia remains laser-focused on trillion-dollar opportunities in GPUs, data centers, and AI platforms.

- For SoundHound: Nvidia’s exit caused temporary turbulence but didn’t derail its growth story. In fact, the company has since beaten revenue expectations and secured new partnerships.

- For retail investors: The lesson is that divestments by large institutions aren’t always about fundamentals. Sometimes, they’re just about capital allocation.

Frequently Asked Questions

Why did Nvidia sell SoundHound AI stock?

The most likely reason is portfolio realignment. The stake was financially immaterial, and Nasdaq NVDA wanted to redirect capital toward larger AI bets.

Is SoundHound AI stock a buy now?

SoundHound remains speculative, but with revenues growing above 50% year-over-year and contracts expanding, it offers high-risk, high-reward exposure to conversational AI.

Did Nvidia’s exit hurt SoundHound long-term?

No. The company has since reaffirmed guidance and reported strong growth. Nvidia’s sale hurt sentiment, not fundamentals.

In the end, Nvidia’s exit from SoundHound AI is more about Nasdaq NVDA than SoundHound. For the chip giant, the sale was trivial. For SoundHound, the initial stock plunge was painful—but fundamentals have since proven resilient.

Looking ahead, investors should watch:

- New automotive and enterprise partnerships

- Execution on revenue backlog

- Path toward profitability in the next 2–3 years

Bottom line: Nasdaq NVDA didn’t make a costly mistake—but investors who interpreted its exit as doom for SoundHound might have. For those who believe in the long-term growth of voice AI, the opportunity remains compelling.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F