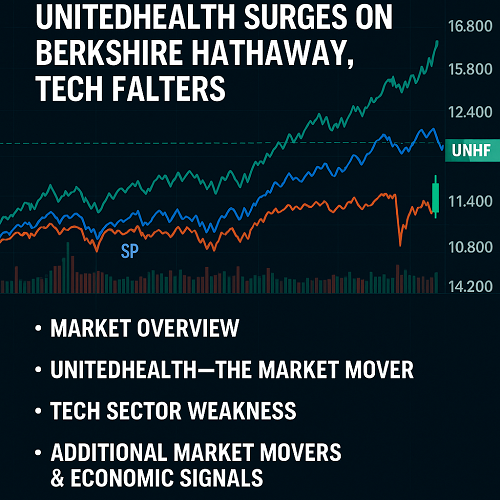

On August 15, 2025, the Dow Jones Industrial Average nearly closed at a record level, buoyed by a blockbuster rally in UnitedHealth following Berkshire Hathaway’s sizable stake. Yet, gains in the Dow Jones Industrial Average were tempered as tech and semiconductor stocks faltered, setting a nuanced tone heading into the weekend.

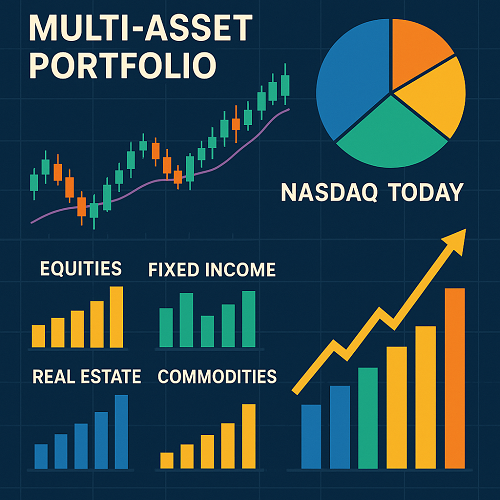

Major Index Performance

- Dow Jones: +0.1%, the DJIA experienced an intraday dip below 45,000 after briefly hitting a record high.

- S&P 500: –0.3%.

- Nasdaq: –0.4%.

- Russell 2000: –0.6%, pulling back after recent strength.

UnitedHealth’s Power Move

- UNH jumped 11–12% after Berkshire’s 5M-share acquisition (~$1.57B), signaling deep value pickup in healthcare.

- Weekly gains led by broadly diversified sectors, signaling rotation from tech-heavy leadership, and impacting the Dow Jones Industrial Average.

Tech & Semiconductors Under Pressure

- Applied Materials (AMAT) collapsed 14.1% after weak guidance, dragging KLA and Lam lower.

- Continued chip-sector weakness weighed heavily on Nasdaq indexes, influencing the performance of major metrics such as the DJIA.

Other Noteworthy Stock Moves

- Opendoor: +4.3% post CEO resignation, indicating shifts that might not directly impact the Dow Jones Industrial Average but are notable.

- Spotify: +5.5%, bouncing off its 50-day MA.

- Intel: A key player with its price moves having a significant impact on the DJIA.

- TeraWulf: another stellar session driven by AI news and a Google capital infusion.

Economic Data & Fed in Focus

- Retail Sales (July): +0.5%, matching expectations, reflects potential impacts on key measurements like the Dow Jones Industrial Average.

- Retail Sales (July): +0.5%, matching economic expectations.

- Continued monitoring of the DJIA alongside mixed signals from economic data like Treasury Yields: Mixed—reflecting uncertainty around inflation and Fed policy.

- Ninth: All eyes are on Fed Chair Powell’s Jackson Hole speech, as markets seek guidance on rate direction.

Key Takeaways for Investors

- Rotational Opportunity: The strength in healthcare and housing (via Berkshire’s Nucor, UNH, D.R. Horton, and Lennar positions) suggests diversification beyond tech, which could benefit the Dow Jones Industrial Average.

- Risk Management: The semiconductor pullback affected major indices such as the Dow Jones Industrial Average.Risk Management: The semiconductor pullback resulted in some caution for investors, especially considering the volatility of indexes like the DJIA.

- Market Analysis: Retail data and sentiment send mixed signals—stay tuned to Powell and PPI/CPI readings.

Quick Stats Snapshot

| Index / Performance | Change | Highlights |

|---|---|---|

| Dow Jones | +0.1% | The Dow Jones Industrial Average experienced a nearly record close, powered by UNH gains. |

| S&P 500 | –0.3% | Held back by tech underperformance |

| Nasdaq | –0.4% | Tech drag from AMAT, KLA & Lam |

| Retail Sales | +0.5% | Nearly aligning with forecasts but with slight variations that may affect the Dow Jones Industrial Average. |

| Fed Watch | — | Eyes on Powell speech, rate signals |

As the market’s story unfolds, the performance of the DJIA is shaped by big institutional bets, sector rotations, and mixed economic signals. Investors should stay nimble—balancing optimism from Buffett-backed moves with caution amid tech turbulence and shifting sentiment. Clearly, the performance of the Dow Jones Industrial Average hinges on both corporate strategies and wider market dynamics, as shifting sentiment could impact future outcomes.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

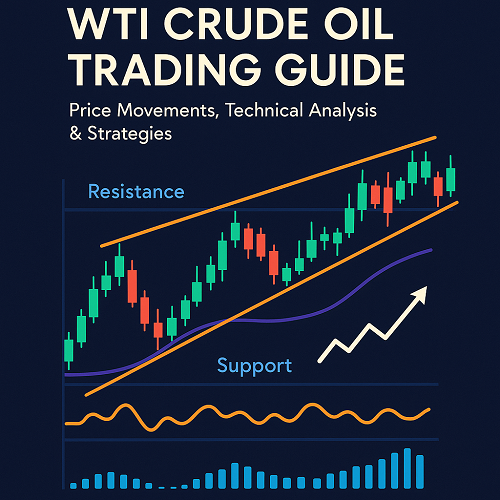

BULL CL=F

CL=F