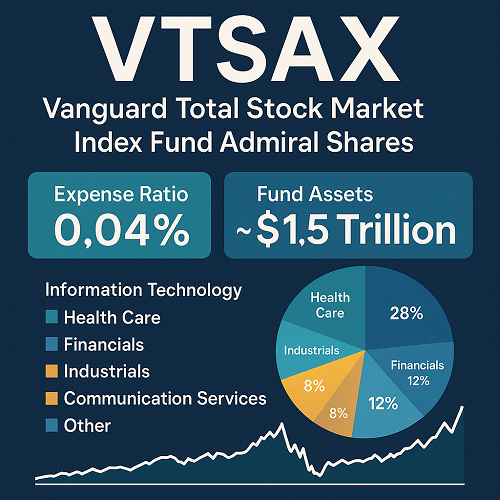

VTSAX — short for Vanguard Total Stock Market Index Fund Admiral Shares — is one of the most influential mutual funds in modern investing. With more than $1.5 trillion in assets under management, it provides investors with exposure to the entire U.S. stock market, including large-cap, mid-cap, small-cap, and even micro-cap companies.

The appeal of VTSAX lies in its simplicity, diversification, and cost efficiency. At an expense ratio of just 0.04%, investors gain access to over 3,500 U.S. companies, tracking the CRSP U.S. Total Market Index. For many long-term investors, it’s the “own-everything” solution — a single fund capable of delivering market-wide returns with minimal maintenance and fees.

But understanding what makes VTSAX powerful requires diving beneath the surface — into its structure, holdings, risk profile, and how it compares to its ETF twin, VTI.

Fund Overview and Key Facts

| Attribute | Details (2025) |

|---|---|

| Fund Name | Vanguard Total Stock Market Index Fund Admiral Shares |

| Ticker Symbol | VTSAX |

| Fund Type | Mutual Fund (Index Fund) |

| Issuer | Vanguard Group Inc. |

| Benchmark Index | CRSP U.S. Total Market Index |

| Expense Ratio | 0.04% |

| Minimum Investment | $3,000 (Admiral Shares) |

| Distribution Frequency | Quarterly (Dividends) |

| Launch Date | November 13, 2000 |

| Assets Under Management (AUM) | ~$1.5 trillion (estimated 2025) |

| Investment Objective | To track the performance of the entire U.S. equity market |

VTSAX is designed to mirror the performance of the U.S. equity market as a whole, meaning it includes companies of all sizes and sectors — from the tech giants dominating headlines to regional banks and small-cap manufacturers.

What VTSAX Tracks: The CRSP U.S. Total Market Index

The CRSP U.S. Total Market Index represents approximately 100% of the investable U.S. equity market. It captures companies across all market-capitalization tiers and is updated quarterly to reflect corporate actions and changes in the investable universe.

The index is market-cap weighted, meaning larger companies like Apple, Microsoft, and Amazon have a proportionally greater influence on performance. While this weighting can create concentration in mega-cap tech names, it also reflects the natural shape of the market itself.

Historical Performance (Updated 2025)

While past performance does not guarantee future results, VTSAX has demonstrated remarkably consistent returns since inception, matching the long-term trend of U.S. equities.

| Period (as of Sept 2025) | Annualized Return % |

|---|---|

| 1 Year | 15.4 % |

| 3 Year | 8.7 % |

| 5 Year | 10.2 % |

| 10 Year | 11.0 % |

| Since Inception (2000) | 7.6 % |

(Data sourced from Vanguard & Morningstar 2025)

The fund’s long-term performance closely mirrors that of the S&P 500, though VTSAX tends to outperform slightly during small-cap rallies due to its broader exposure.

Cost Advantage – Why the 0.04% Expense Ratio Matters

The expense ratio is one of the most critical metrics in long-term investing. At 0.04%, VTSAX costs just $4 per $10,000 invested per year — a fraction of the average actively managed fund.

This cost advantage compounds dramatically over time. Consider two investors each starting with $100,000 and earning 8% before fees for 30 years:

- Investor A (VTSAX @ 0.04%) ends with ≈ $998,000

- Investor B (Active fund @ 1%) ends with ≈ $761,000

That $237,000 difference — with identical returns — is the power of cost efficiency.

Portfolio Composition and Sector Allocation

VTSAX holds over 3,500 stocks, effectively representing the U.S. economy. As of 2025, the top ten holdings account for ≈ 26% of the fund:

- Apple Inc.

- Microsoft Corp.

- Amazon.com Inc.

- NVIDIA Corp.

- Alphabet Inc. (Class A & C)

- Meta Platforms Inc.

- Berkshire Hathaway Inc.

- Tesla Inc.

- UnitedHealth Group Inc.

- Exxon Mobil Corp.

Sector Breakdown (Approx. 2025):

| Sector | Allocation % |

|---|---|

| Information Technology | 28 % |

| Health Care | 13 % |

| Financials | 12 % |

| Consumer Discretionary | 10 % |

| Industrials | 9 % |

| Communication Services | 8 % |

| Consumer Staples | 6 % |

| Energy | 4 % |

| Utilities | 3 % |

| Real Estate | 3 % |

This composition ensures broad economic participation, though it naturally skews toward technology and large-cap firms.

Risk and Volatility Profile

While VTSAX is diversified across thousands of holdings, it remains 100% equity-based — meaning investors should expect market volatility.

- Standard Deviation (10 Years): ≈ 17%

- Beta vs S&P 500: ≈ 1.02

- Maximum Drawdown (2008): ≈ -52%

The key risk is market risk: if the U.S. economy contracts, VTSAX will fall alongside it. However, diversification minimizes company-specific risk, and over long time horizons, equities have historically outperformed other asset classes.

VTSAX vs VTI – ETF or Mutual Fund?

The Vanguard Total Stock Market ETF (VTI) is essentially the ETF version of VTSAX. Both track the same index and have nearly identical holdings.

| Feature | VTSAX (Mutual Fund) | VTI (ETF) |

|---|---|---|

| Expense Ratio | 0.04% | 0.03% |

| Minimum Investment | $3,000 | 1 share (~$260 as of 2025) |

| Tradability | End-of-day NAV | Real-time market price |

| Tax Efficiency | Slightly less efficient | Higher tax efficiency |

| Automatic Investing | Available | Depends on broker |

For investors prioritizing automation and simplicity, VTSAX fits well. For those seeking intraday flexibility and slightly lower costs, VTI may be preferable.

Suitability – Who Should Invest in VTSAX?

VTSAX is ideal for:

- Long-term investors building wealth over 10+ years.

- Retirement accounts (IRAs, 401(k)s) seeking tax-deferred growth.

- Hands-off investors wanting one-fund equity exposure.

- Cost-conscious investors minimizing management fees.

It may be less appropriate for:

- Those seeking active management or short-term trading.

- International diversification (VTSAX holds only U.S. stocks).

- Income-focused investors, as yields are typically < 1.5%.

Implementation & Tax Considerations

Because VTSAX is a mutual fund, trades settle at end-of-day NAV. Investors can automate monthly purchases directly through Vanguard.

- Tax Efficiency: While not as tax-efficient as ETFs, Vanguard’s patented “share class structure” allows VTSAX to share its ETF share class (VTI), greatly reducing capital-gains distributions.

- Dividend Yield: ≈ 1.4% (2025), paid quarterly.

- Tax Forms: Reported via Form 1099-DIV for taxable accounts.

- Rebalancing: Combines well with VBTLX (Vanguard Total Bond Market Index Fund) for a balanced 60/40 portfolio.

VTSAX in the Current Economic Context (2025 Outlook)

As of late 2025, U.S. equities have navigated a complex macro landscape: cooling inflation, gradual Fed rate cuts, and resilient corporate profits. While valuation multiples are slightly above historic averages, long-term fundamentals remain strong.

Tailwinds:

- Stabilizing inflation and interest rates.

- Ongoing AI and tech productivity growth.

- Strong labor market and corporate earnings.

Headwinds:

- Elevated market valuations (P/E ≈ 22 ×).

- Slower GDP growth forecast for 2026.

- Potential sector rotations (tech to value).

For disciplined investors using dollar-cost averaging, VTSAX remains one of the most reliable, low-maintenance ways to capture U.S. economic growth over time.

Alternatives and Complementary Funds

For investors seeking diversification beyond VTSAX, consider:

- VTI – ETF equivalent (trades intraday).

- VFIAX – Vanguard 500 Index Fund (large-cap only).

- VTIAX – Vanguard Total International Stock Index Fund (global ex-U.S.).

- VBTLX – Vanguard Total Bond Market Index Fund (for stability).

- VTWAX – Vanguard Total World Stock Index Fund (U.S. + international).

Combining VTSAX and VBTLX provides a classic, diversified foundation for retirement or wealth-building portfolios.

Key Takeaways

- Broadest U.S. Equity Exposure: Covers virtually the entire market.

- Ultra-Low Cost: 0.04% expense ratio is among the lowest in the industry.

- Consistent Performance: Mirrors the U.S. market’s long-term growth.

- Excellent for Passive Investors: No rebalancing needed within equities.

- Pairs Well with Bonds or International Funds for a balanced allocation.

Final Verdict – Should You Invest in VTSAX?

If your goal is long-term growth through U.S. equity ownership, VTSAX remains one of the most efficient and trusted vehicles available. Its unmatched diversification, microscopic fees, and decades of consistent performance make it a cornerstone holding for both beginners and experienced investors alike.

While short-term fluctuations are inevitable, the U.S. market’s long-term trajectory has been upward for more than a century. VTSAX allows you to capture that growth in the simplest, most cost-effective way possible.

Bottom Line: VTSAX is not just another mutual fund — it’s a framework for financial independence built on patience, discipline, and compounding.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F