Toronto-Dominion Bank (TD.TO) remains one of Canada’s largest financial institutions with diversified operations across Canadian personal & commercial banking, U.S. retail, wealth management, insurance, and wholesale banking. As of mid-2025, the stock shows stability, attractive dividend yield, and moderate valuation, but also faces headwinds in regulatory risk, economic cycles, and competition. This article delves into whether TD.TO is a strong buy, hold, or sell in the current macroeconomic environment.

Company Overview

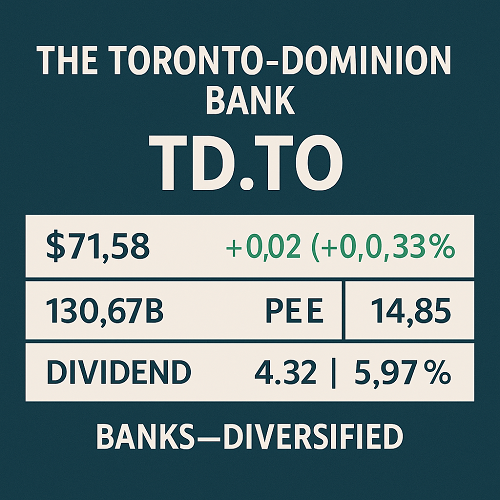

- Name: The Toronto-Dominion Bank (TD Bank Group)

- Ticker: TD.TO (Toronto Stock Exchange)

- Sector & Industry: Financials → Banks – Diversified

- Headquarters: Toronto, Ontario, Canada

- Founded: Through the merger of Bank of Toronto (1855) and Dominion Bank (1869) – established February 1, 1955

- Employees: ~101,577 full-time employees globally

- Segments:

- Canadian Personal & Commercial Banking

- U.S. Retail Banking

- Wealth Management & Insurance

- Wholesale Banking (Capital Markets, Corporate Banking)

Financial Performance (Recent, Trailing)

Revenue & Profitability

- The bank has seen consistent revenue growth, buoyed by both domestic operations and the U.S. retail segment. (Exact quarterly revenue numbers vary; see latest reports for up-to-date figures.)

- Profit margins are healthy across core banking operations; Wealth & Insurance tends to have tighter margins but provides diversification.

Key Statistics & Ratios

From Yahoo Finance / company filings:

- Market Cap (Canadian listing) reflects the total equity value as traded on TSX.

- P/E Ratio (Trailing/Predictive) compared to Canadian banks peer group. Lower P/E may indicate market concerns about growth or risk; higher P/E may imply premium for stability.

- Return on Equity (ROE): One of the most important metrics for banks; TD has historically delivered strong ROE relative to Canadian peers, but sensitive to capital requirements and credit losses.

Recent Trends

- Expenses have been managed, but rising interest rates, inflation, and regulatory compliance costs are squeezing margin expansions in some segments.

- Credit quality has been under watch: provisions for loan losses, delinquencies, especially in consumer and commercial portfolios. Given current economic uncertainty, that is a key risk.

Dividend & Yield Analysis

- Dividend yield: TD.TO offers a yield that is attractive compared to many large Canadian banks. (Exact current yield fluctuates around ~4-5-6%, depending on share price and recent dividends.)

- Payout ratio: Historically moderate. The bank balances returning capital to shareholders via dividends versus retaining earnings for capital and growth. A crucial factor is regulatory constraints and required capital adequacy.

- Dividend stability: TD has a record of stable and relatively steady dividends. However, future dividend increases may be moderated by macro risks, interest rate cycles, and regulatory capital demands.

Business Segments & Competitive Position

Canadian Operations

Strengths:

- Wide branch network, strong brand recognition in personal banking, credit cards, mortgages, and commercial lending.

- Deep integration in Canadian retail banking, benefiting from existing customer relationships and cross-selling.

Challenges:

- Low margin environment; regulatory oversight; competition from both traditional banks and fintechs.

U.S. Retail Banking

- Offers growth opportunity; U.S. banking less constrained by some of the regulatory headwinds in Canada; potential higher yields.

- Currency risk, interest rate policy differences, and regulatory regime differences are factors to watch.

Wealth Management & Insurance

- Provides diversification, but these are lower growth – often more capital intensive. Can be a buffer in downturns, but often pressures on margins and claims.

Wholesale / Capital Markets

- Subject to market cycles, interest rate dynamics; revenues more volatile. Good in periods of deal flows and favorable markets; can decline sharply in downturns.

Risks & Opportunities

Key Risks

- Economic slowdown in Canada or U.S. could increase loan defaults, reduce net interest margins.

- Regulatory risks, both domestic (OSFI, Canadian banking regulations) and international (U.S., global banking rules).

- Interest rate volatility: Rising rates can benefit net interest margin, but also increase funding costs; flattening yield curves can compress profitability.

- Credit risk: Particularly in commercial real estate (CRE), consumer debt with inflation, possibly weaker borrowers.

- Competition & technology disruption: Digital banking, fintechs, alternative platforms could erode fee income or force further investment.

Key Opportunities

- Interest rate tailwinds: In a rising rate environment, banks can often expand margins on newly issued loans or assets more quickly than liabilities.(Though depends on funding structure.)

- Growth in U.S. segment: Acquisitions, expansion in under-banked U.S. markets, cross-border services.

- Wealth & insurance expansion: As markets recover, demand for wealth management, financial advice, and insurance products may rise.

- Operational efficiencies: Digital transformation, cost rationalization, using technology to reduce overhead.

Valuation Metrics & Market Multiples

Here are metrics investors should be paying attention to when valuing TD.TO:

| Metric | Typical Value / Benchmark | What to Watch For |

|---|---|---|

| P/E (Trailing / Forward) | Compared to peers: RBC, BMO, CIBC, Scotiabank etc. | If P/E is significantly higher, the market expects higher growth; if lower, possibly risk discount. |

| P/B (Price-to-Book) | Banking tends to trade on P/B; values less than 1.5x may indicate undervaluation under stress; above 2x might be premium. | Book value sensitive to credit risk, write-downs, intangible assets. |

| Dividend yield vs payout ratio | Yield should be sustainable; payout ratio (earnings paid as dividends) should leave room for retained earnings. | High payout ratio may limit growth or leave little cushion. |

| Efficiency ratio | (Operating expenses / revenue) lower is better. | High efficiency implies lean operations; digitalization helps here. |

| ROE, ROA | Compared historically and against peers. | Declines may point to increased capital or lower profitability. |

In recent reports, TD’s valuation multiples have been moderate compared to peers, suggesting neither extreme overvaluation nor deep undervaluation. (Exact numbers depend on most recent quarter data.)

Technical & Charting Insights

(Note: for trading-oriented readers; fundamentals above more relevant for investing.)

- Trend: Over past 1-3 years, TD.TO has shown a steady upward trend, but interspersed with pullbacks tied to macroeconomic uncertainty.

- Support & Resistance: Key support levels are often previous lows during downturns or major correction points. Resistance levels near recent highs.

- Volume trends: Monitor for volume spikes on breakouts (positive earnings, favorable regulatory news) or breakdowns.

- Moving averages: 50-day, 200-day SMAs useful to gauge medium vs long term momentum. Crossover points (golden cross, death cross) can signal change.

- Sentiment indicators: Options activity, short interest, institutional ownership can offer clues to market expectations and risk.

Analyst Consensus & Forecasts

- Earnings guidance: Analysts expect steady growth in net income, but with sensitivity to loan loss provisions, interest expenses, and regulatory costs.

- Price targets: Generally in-line with current valuations, with modest upside unless macro economic conditions improve or TD’s U.S. operations outperform.

- Upgrades / Downgrades: Watch for earnings misses vs expectations; future revisions will have notable impact.

- Macro assumptions: Forecasts assume stable to slowly improving economic growth, contained inflation, and interest rate levels holding or easing slightly in certain jurisdictions.

Investment Case: Pros vs Cons

Pros

- Strong brand and market share in Canada; diversified operations.

- Attractive dividend yield with relatively stable payout history.

- Exposure to rising rate environments, which can improve net interest margins.

- Solid risk management and governance.

Cons

- Vulnerable to economic downturns and credit risks.

- Regulatory and capital requirement pressures.

- Exposure to U.S. economic policy, currency risk.

- Valuation may already price in a lot of “stable bank premium,” limiting upside.

How TD.TO Compares to Peers

Comparative metrics vs other “Big Six” Canadian banks (e.g., RBC, BMO, Scotiabank, CIBC):

| Peer | P/E & P/B Comparisons | Dividend Yield | Growth Leverage (e.g. U.S. exposure) | Risk Profile |

|---|---|---|---|---|

| RBC | Often trades at a premium; sometimes higher P/E due to diversified operations. | Slightly lower yield at times. | Strong wealth management exposure. | Similar regulatory risk. |

| BMO / Scotiabank | Sometimes lower valuations due to particular exposures (e.g. energy, international). | Yields may vary. | Growth dependent on regional exposures. | May have more country/sector risk. |

TD tends to be middle to upper in terms of stability; its U.S. retail exposure is a plus compared to some Canadian-only banks, but also adds complexity and risk.

Conclusion & Recommendation

Based on the above, here’s the likely conclusion for different investor types:

- Dividend / Income Investors: TD.TO remains appealing, provided the dividend is sustainable. The yield is competitive, and the bank has a track record of payouts.

- Growth-Focused Investors: The upside is more limited unless TD can accelerate growth in high-return segments (especially U.S. retail, wealth management), or unless macro conditions improve.

- Value Investors: If valuation multiples slip (e.g. P/B or P/E drops), TD may become more compelling. Watch for any signs of weakness that are priced in too harshly.

- Risk-Averse Investors: TD has many positives — diversification, solid governance, stable operations — but not without exposure to credit and macro risk. It may be a “defensive” bank stock, but expect some volatility tied to interest rates and economic cycles.

Overall Recommendation (as of mid-2025): Likely a Hold for most investors, Buy for those seeking stable income with moderate growth, Avoid / Reduce only in portfolios already overexposed to banking sector or those expecting severe economic downturns.

XAUT-USD

XAUT-USD  AMD

AMD  MARA

MARA  SHOP

SHOP  BULL

BULL  CL=F

CL=F