Tesla (TSLA) is approaching break-even for 2025 after a rough start: deliveries have dropped, margins have tightened, but optimistic catalysts — energy, AI/robotics, regulatory tailwinds — plus recent upside in stock price are bringing it back. For investors, TSLA is becoming less about the promise of EVs alone, and more about execution across diversified verticals (energy, autonomy, robotaxi, recurring revenue). The key is which risks prevail.

What “Break-Even for 2025” Means for Tesla

- Break-even here refers to TSLA returning to or surpassing its performance in 2024—either matching its closing stock price, earnings, or some combination of investor expectations being met. It implies that 2025 will no longer be seeing a net loss in investor confidence or material erosion relative to prior benchmarks.

- For many investors, break‐even isn’t just about price; it’s about stabilizing fundamentals: revenues, margins, cash flows, product pipeline, and regulatory/commercial risks.

Key Drivers of the Recent Stock Rally

Based on current public data, the following have contributed materially to Tesla’s rebound and the sense that break-even is possible in 2025:

- Rate expectations & macro tailwinds: Optimism that the Federal Reserve or central banks will cut rates, lowering borrowing costs and easing pressure on high-growth, high‐investment companies. (Same as in Investopedia’s narrative.)

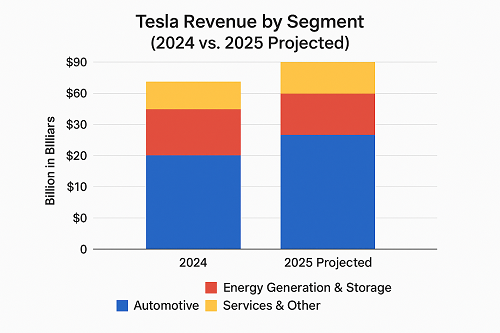

- Investor enthusiasm in non-automotive businesses: Energy storage & generation, robotics (Optimus), autonomous driving (Full Self Driving, robotaxi), and software/recurring revenue streams. Some reports note energy storage growing rapidly YoY.

- Technical/market sentiment factors: Tesla has been holding support levels (e.g. 200-day moving average), showing chart bases, momentum indicators improving.

- Expectations for improved delivery growth: Despite recent delivery declines, analysts still project ~20-30% YoY delivery growth for full year 2025 in several forecasts.

- Non-automotive revenue contribution rising: Tesla’s energy generation & storage segment is growing rapidly (some sources show YoY growth ~60-70% in that segment). Also regulatory credits, carbon credits remain meaningful contributions.

Core Weaknesses & Headwinds to Watch

To understand how solid this break-even path is, we need to examine what’s pulling Tesla down:

- Delivery declines / ASP pressure: Tesla’s automotive revenues have been hurt by falling vehicle deliveries (one source: ~13% YoY drop in Q1 2025) and by incentives/mix shifts which reduce average selling price (ASP).

- Margin compression: Automotive gross margins are under pressure (due to input costs, increased competition, incentives), operating expenses rising, R&D & capex demands increasing, which reduce net margins.

- Revenue flat or declining overall: Some data show year-to-date total revenues down ~2-3% YoY. For example, the trailing twelve months revenue ~US$92.7B vs ~$97.7B for whole 2024.

- Valuation remains high: Tesla still trades with growth / tech multiples, which leaves it vulnerable to even small disappointments. ESG/regulatory risk, supply chain risk, competition (both in EVs and in energy) are nontrivial.

- Execution risk: rolling out new models (lower cost cars, cheaper battery tech), scaling robotaxi or autonomous driving, fulfilling energy storage ramp, production constraints, regulation.

Financials in Focus: Revenue, Margins, Deliveries

| Metric | Latest Data / Trend | Implications |

|---|---|---|

| Deliveries / Vehicle Sales | Q1 2025 deliveries fell ~13% YoY. | Needs to recover to meet full‐year growth targets (20-30%), else break-even may stretch. |

| Overall Revenue (TTM, all segments) | ~$92.7B TTM, down ~2-3% vs 2024’s ~$97.7B. | Indicates automotive decline not yet offset by energy / services / credits enough. |

| Non-Automotive / Energy Storage Growth | Energy Gen & Storage revenue up ~67% YoY in Q1 2025. Also energy storage division projected to grow further. | A growing buffer and pathway to diversified revenue. Important in reaching break-even. |

| Margins / Profitability | Operating margins down vs prior, automotive margins compressed; non-GAAP profits dropping in some segments. | Margin expansion or stabilization is critical for valuation support. |

| Cash Flow / Balance Sheet | Strong cash reserves; free cash flow rising in some quarters; deferred / recurring revenue streams help smoothing. | Gives Tesla flexibility to make investment and absorb shocks. |

Major Catalysts Through 2025 & Beyond

These are the levers that, if pulled successfully, could push Tesla past break-even and into new growth:

- Affordable / Next-Generation EV Models: The lower-cost platform (often called “Next Generation,” “Model Q,” or Model 2 in rumors) may help push new markets, improve margins, volume. Delays or higher costs could undermine this.

- Robotaxi / Autonomy / Full Self Driving (FSD): If FSD revenue grows (subscription/model), robotaxi deployment advances, regulatory hurdles are overcome, these could unlock high margin recurring income.

- Energy Storage / Grid Scale & Powerwall / Megapack: As grid reliability demands increase, energy storage systems (Megapack, Powerwall), solar generation, etc., are likely to see higher demand. Tesla’s capacity in Shanghai and other Gigafactories plays a role.

- Regulatory & Environmental Tailwinds: EV incentives, carbon credits, infrastructure spending globally. Also tighter emissions / regulatory law changes could favor Tesla’s credits business.

- Cost Reductions / Manufacturing Efficiencies: Scaling 4680 battery cells, innovations in casting, supply chain optimization, lower material costs would help margins.

Valuation: Is the Discounted Future Priced In?

Tesla’s stock valuation reflects a mix of current performance and expectations of the future. Key points:

- P/E & P/S Ratios: Tesla still trades at significantly higher multiples than many traditional automakers; investors are pricing in high growth and margin expansion. If Tesla misses targets, valuation could be harshly penalized.

- Comparables: Compared with other EV makers, energy storage companies, and software/AI autonomy plays, TSLA has unique exposure but also unique risks.

- Intrinsic Value Estimates: Analysts have varied views: some bullishly projecting aggressive growth, others warning about margin compression or demand softness. Some forecasts for revenue growth (~15-35%) in non-auto segments are used to justify current price levels.

Scenario Analyses: Best / Base / Worst Case

| Scenario | What Happens | Likely Stock Outcome | Key Risks |

|---|---|---|---|

| Best Case | Delivery growth accelerates toward target (20-30%+ YoY), energy & autonomy segments deliver meaningful revenue with improving margins, rate cuts help capital costs, new affordable EV produces strong demand, regulatory tailwinds strong. | TSLA surpasses break-even comfortably in 2025; stock may push significantly higher, multiple expansion occurs. | Execution risks; supply chain bottlenecks; regulatory delays (esp in autonomy); competition both from legacy and newer players; macro risks (interest rates, inflation). |

| Base Case | Core automotive stays flat or modest growth; energy & FSD segments continue to grow but not yet large; margins stabilize but do not dramatically expand; stock modestly improves. | TSLA reaches or modestly exceeds break-even; stock reflects cautious optimism, moderate upside. | Any slip in deliveries; margin erosion; unexpected cost inflations; competitive share erosion; regulatory or legal setbacks. |

| Worst Case | Delivery declines worsen; ASP falls under sustained competitive pressure; energy / autonomy segments underdeliver; rates stay high; costs (labor, raw materials) bite; regulatory headwinds; market loses confidence. | Stock struggles to reach break-even; possibly underperforms broader market; downward correction likely. | As above amplified; investor sentiment turns negative; capital required for innovation expensive; cash flow declines; valuation contraction. |

What Investors Should Do (Entry, Risk Management, Watch Signals)

If you’re considering TSLA in this transition period, here are practical guidelines:

- Entry Points: Wait for confirmation of improved deliveries or favorable guidance; look for strong performance from energy/AI segments or FSD milestones. Technicals: confirmation above long-term moving averages and support levels.

- Portfolio Allocation: Given high volatility and risk, avoid over-allocating; treat as a growth/speculation positioning rather than stable income/defensive.

- Risk Management: Use stop loss / trailing stops; consider hedging if you’re exposed; monitor cost and margin metrics carefully (input prices, incentive costs).

- Watch Signals / Red Flags: Continued delivery declines; worsening ASPs without offset from non-auto; regulatory setbacks for autonomy or robotaxi; cost overruns in battery, manufacturing; absence of rate cuts when expected.

- Catalyst Events to Monitor Closely: Tesla’s Q2 and Q3 2025 delivery numbers; updates on affordable EV next-gen platform; progress on FSD / robotaxi regulation; energy storage deployment numbers; margin trends in automotive vs non‐automotive segments; macro pressure (rates + inflation).

Conclusion

Tesla appears to be in the late innings of a volatile 2025 where it is moving toward break-even in many senses: stock performance, stabilization of fundamentals. But “break-even” doesn’t mean “safe” — there are still significant headwinds. The upside, however, remains sizable if the company can deliver on its diversified growth strategy: energy, autonomy, recurring revenue.

For investors, TSLA in 2025 is less of a pure EV growth play and more a test of whether Tesla can live up to its vision across multiple verticals, with disciplined execution. If so, break-even may quickly give way to breakout.

XAUT-USD

XAUT-USD  AMD

AMD  MARA

MARA  SHOP

SHOP  BULL

BULL  CL=F

CL=F