Canada’s capital markets often fly under the radar compared to U.S. markets, yet they are deeply intertwined with global resource demand, energy cycles, and financial sector fundamentals. The Toronto Stock Exchange (TSX) and the TSX Venture Exchange (TSXV) house some of the world’s most resource-intensive companies — from mining to oil & gas — making Canada especially sensitive to commodity cycles and global supply-demand shifts.

This guide is designed to be your definitive reference on Canadian markets: explaining structure, recent trends, sector dynamics, trading strategies, and a forward outlook. Whether you’re a domestic investor or an international trader, you’ll find actionable insights to navigate the complexities of the Canadian equity, commodity, and derivative space.

Canada’s Capital Market Architecture

TSX, TSXV & Beyond

- TSX (Toronto Stock Exchange): Canada’s flagship, large-cap equity market. Heavily weighted to financials, energy, materials, and industrials.

- TSXV (TSX Venture Exchange): Hosts early-stage, small to mid-cap issuers — often in mining, exploration, technology. Higher risk, higher volatility.

Beyond these, there is a growing ecosystem of Canadian ETFs, mutual funds, and index funds that allow passive access.

Regulatory Landscape

- Oversight through IIROC (Investment Industry Regulatory Organization of Canada)

- Provincial securities commissions (e.g. Ontario Securities Commission)

- Disclosure requirements, insider rules, continuous disclosure obligations

- Comparisons with U.S. regulation (SEC) can help international traders understand differences

Key Canadian Indices & Sector Dynamics

S&P/TSX Composite & Its Makeup

The S&P/TSX Composite Index is the most followed benchmark. Its sector breakdown often looks like:

| Sector | Weight Estimate* |

|---|---|

| Financials | ~30-35% |

| Energy | ~15-25% |

| Materials & Mining | ~10-20% |

| Industrials, Utilities, etc. | residual |

* (These numbers shift dynamically with commodity cycles and macro rotations.)

Because of this concentration, Canadian equities tend to perform disproportionately to commodity and financial sector trends.

TSX Venture (TSXV)

TSXV is far more volatile. It’s ground zero for exploration stocks, biotech, and junior issuers. Movements here can be amplified — both to the upside and downside.

Sector Rotation Behavior

Canadian markets are especially prone to sector rotation: e.g., when energy outperforms, the broader TSX often benefits dramatically. Conversely, in global risk-off, financials and materials may suffer.

Recent Trends & Market Drivers (2024–2025)

Macro & Commodity Backdrop

- Oil & Gas: Canada is a major exporter of oil and natural gas. Rising oil prices benefit Canadian energy names and related infrastructure.

- Metals & Mining: Gold, copper, rare earths — critical for global decarbonization trends.

- Interest Rates & Inflation: Canadian interest rate policy often lags behind or shadows U.S. Fed moves, influencing yield curves and cost of capital.

- Currency (CAD/USD): A weaker Canadian dollar boosts resource exporters; a strong CAD compresses margins for exporters in USD terms.

Notable Sector Moves & Case Studies

- Energy sector rebound: Names such as Suncor or Canadian Natural Resources have shown resilience amid global oil price volatility.

- Base metals surge: The uptick in copper and lithium has lifted mining juniors in Canada.

- Financial sector stress: Regional bank exposure to commodity cycles, credit conditions impacted performance.

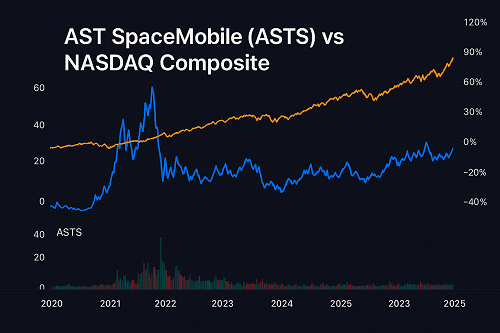

(Embed charts or data snapshots with rolling 1, 3, 5 year performance comparisons.)

Commodities & Futures: The Canadian Connection

Commodity Markets & Canadian Exposure

Canada is a major player in:

- Oil & gas (crude, natural gas)

- Base & precious metals (gold, silver, platinum, nickel, copper)

- Agricultural products (wheat, canola, other grains)

Movements in commodity prices have outsized influence on the valuations of Canadian equities — especially energy and materials firms.

Futures, Derivatives & Hedging Tools

- Commodity futures traded globally (NYMEX, COMEX, etc.)

- Canadian firms often hedge via futures, options, or swaps

- Equity derivatives (options, covered calls) used for managing exposure or yield enhancement

Trading & Investment Strategies for Canadian Markets

Strategy Types

- Value & dividend investing

- Many Canadian companies deliver consistent dividends (e.g. banks, pipelines).

- Screening for high payout ratios, cash flow stability.

- Momentum & sector tilts

- Ride sector rotation (e.g. energy, materials) when momentum confirms.

- Use technical filters (e.g. 50-day / 200-day crossovers) combined with macro signals.

- Pairs & relative value trades

- Long undervalued vs short overvalued within the same sector.

- E.g. long a junior miner and short a more mature peer.

- Hedging & risk control

- CAD/USD hedges using currency futures or options.

- Protective puts, collars, and covered calls on volatile names.

- Diversification across sectors and geographies.

Portfolio Construction Tips

- Cap exposure to volatile small-cap names (e.g. 5–10% max)

- Use sector limits (e.g. no more than 25% in energy)

- Maintain cash buffers or hedges for sudden drawdowns

- Rebalance quarterly, but monitor macro/commodity shifts monthly

Canadian Markets vs Global Exposure

International Diversification

- Canadian equity heavyweights are commodity-linked ≠ technology or health exposure.

- Use cross-listing, U.S. tech ETFs, international stocks to balance.

Currency Hedging

- When holding U.S. or global stocks, use hedged ETFs or forward contracts to neutralize currency drag.

- Evaluate whether to hedge CAD exposure when investing in U.S. equities.

Cross‐Listings & ADRs

Numerous Canadian firms are cross-listed in the U.S. or have ADRs (e.g. in NYSE). That provides alternate access and liquidity.

Risks & Challenges in Canadian Markets

- Commodity Cyclicality: Sharp swings in commodity demand or supply shocks.

- Regulation / Environmental Policy: Carbon taxes, pipeline approvals, resource extraction laws.

- Liquidity Risks: Smaller names on TSXV may suffer from wide spreads, low volume.

- Currency Volatility: Sharp CAD moves can erode gains or exacerbate losses.

- Global Headwinds: U.S. recession, trade disputes, inflation, geopolitical shocks.

Outlook & Tactical Themes Into 2026

Key Themes to Watch

- Energy transition & green mining: Lithium, cobalt, nickel used in batteries will be pivotal.

- Agricultural & food security: Demand for crops like canola, wheat.

- Infrastructure & ESG: Clean energy, carbon capture, pipeline modernization.

- Rate normalization & yield curves: How Canadian rates align with U.S. Fed.

- China & global demand: Major buyer of metals and energy.

Tactical Portfolio Ideas (thematic + balanced)

- Overweight energy & metals names poised to benefit from commodity upcycle

- Core holdings in stable dividend / financial names

- Small allocation to high-beta juniors, with strict stop discipline

- Use hedged instruments or options to manage downside

How to Use This Guide as a Live Reference

- Update commodity/sector trends and index data monthly or quarterly

- Pull live data from sources like TMX, QuoteMedia, Bloomberg, S&P/TMX

- Embed charts (price, volume, sector rotation) to make it visually rich

- Use internal linking (e.g. “see sector rotation” → detailed pages) and external authoritative links (e.g. Canada government, TSX, regulatory bodies)

Conclusion & Call to Action

The Canadian markets offer a unique blend of resource leverage, dividend potential, and opportunities for tactical trading. By combining macro understanding, commodity insights, disciplined strategy, and continuous adaptation, you can navigate TSX and TSXV with confidence.

If you’d like, I can help you translate this into a fully optimized webpage (with schema, meta tags, images, charts) ready to publish — or dig further into specific sectors (energy, mining, tech). Just say the word.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F