“Most Active Stocks” are the beating heart of the stock market.

These are the tickers with the highest trading volume during a given session—often the center of institutional money flow, retail enthusiasm, catalysts, or breaking news.

Most active stocks attract traders because they typically offer:

- Better liquidity

- Tighter bid-ask spreads

- More predictable price movement

- Clearer intraday levels

- Stronger trend behavior

- Meaningful catalysts

Unlike static market-cap lists, the most active list changes every single day, reflecting real-time sentiment, fear, greed, and momentum.

What Defines a “Most Active Stock”?

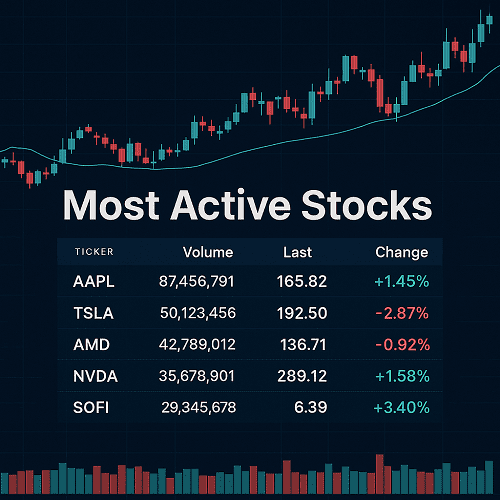

A “Most Active” stock is ranked by trading volume, not by price or market cap.

Volume = the number of shares traded during a session

If AAPL trades 50 million shares today and TSLA trades 40 million, AAPL is more active — regardless of price.

Volume reflects:

- Market participation

- Liquidity

- Institutional interest

- Reactions to news

- Capital rotation between sectors

The most active list is a window into where the money is moving right now.

Why Trading Volume Is One of the Most Important Market Indicators

High volume means:

- More participants

- Strong conviction

- Higher probability of sustained moves

- Predictable breakouts/breakdowns

- Clearer intraday patterns

- Strength behind price

Low volume means:

- Weak interest

- Choppy movement

- False breakouts

- Wide spreads

- Higher slippage

In short: volume confirms validity.

When a stock is on the most active list, you know something is happening—and that’s exactly what traders want to see.

How to Read a Most Active Stocks List

A high-quality most active list shows:

| Metric | Meaning | Why It Matters |

|---|---|---|

| Volume | Shares traded | Identifies liquidity + interest |

| % Change | Price move today | Shows direction of sentiment |

| Price | Current share price | Determines risk and volatility |

| Market Cap | Company size | Helps measure institutional interest |

| Average Volume | Baseline activity | Useful for spotting unusual volume |

| Sector | Industry group | Helps see rotation + hot sectors |

A trader should never look at volume alone — context is key.

Key Metrics Traders Should Analyze

To outperform the average trader, go deeper than the default metrics.

1. Relative Volume (RVOL)

Shows how today’s volume compares to normal.

- RVOL of 1.0 = normal

- RVOL of 3.0 = triple normal activity

- RVOL of 10+ = unusual event (earnings, news, catalysts)

2. Float

Lower float = higher volatility.

- Low float < 20M

- Medium float 20M–100M

- High float > 100M

3. Short Interest

High short interest + high volume can create short squeezes.

4. ATR (Average True Range)

Measures volatility.

Higher ATR = more movement = more opportunities.

5. Institutional Ownership

Institutions dominate volume—institutional spikes = powerful moves.

Types of High-Volume Stocks (With Examples)

1. Megacaps

Example: AAPL, MSFT

- High stability

- Massive liquidity

- Perfect for day trading and scalping

2. News-Driven Movers

Example: A biotech FDA approval

- Extreme intraday volatility

- High RVOL

- Large breakouts

3. Earnings Movers

Example: TSLA on earnings day

- Heavy volume

- Trend-driven behavior

4. Small-cap Surges

Example: Low-float AI, biotech, or EV stocks

- Explosive moves

- High risk/reward

5. Sector Rotation Leaders

Example: Semiconductors, energy, financials

- Institutional rotation drives volume

How Institutions Influence Most Active Stocks

Institutions drive 60–80% of all market volume.

When hedge funds, mutual funds, or pension funds buy or sell, they generate:

- Massive block orders

- Algorithmic execution

- Dark-pool prints

- Intraday breakouts

Most active lists often highlight exactly where institutional flows are concentrated.

Why Retail Traders Love High-Volume Stocks

Retail traders love most active stocks because they provide:

- Clear trends

- Clean technical patterns

- Tight spreads

- Predictable momentum

- High liquidity

- Fast execution

These conditions are ideal for day trading and short-term strategies.

Trading Strategies for Most Active Stocks

Below are professional-grade strategies used by experienced traders.

Intraday Scalping Strategy (Professional Framework)

Indicators:

- VWAP

- Level 2 + Time & Sales

- EMA 9/21

- High-volume nodes

Setup:

- Stock appears in the most active list

- High RVOL (3.0+)

- Trading above VWAP = long bias

- Pullback to EMA9

- Entry on strong tape (T&S confirms buyers)

Profit Targets:

- Previous high

- Intraday resistance levels

Stop Loss:

- VWAP break

- Volume deterioration

Swing Trading High-Volume Stocks

Swing traders look for sustained volume after catalysts.

Checklist:

- Earnings beat

- Analyst upgrades

- Institutional inflows

- Sector strength

- Weekly chart breakout

Volume expansion on multiple timeframes = strong swing potential.

Breakout & Momentum Strategy

Volume confirms breakouts.

Rules:

- Wait for a break of a major level

- Confirm with high volume > 2× average

- Enter on retest or continuation

- Avoid breakout entries with low volume (fakeouts likely)

Mean Reversion in High-Volume Environments

Conditions:

- Parabolic spike

- Extreme deviation from VWAP or EMA21

- Exhaustion volume

- RSI > 80 or < 20

Mean reversion works best after unsustainable moves.

Risk Management Rules for Trading Active Stocks

Golden Rules:

- Risk 1% per trade

- Never chase a parabolic candle

- Respect VWAP

- Avoid low-float stocks unless experienced

- Size down during high volatility

Professional Stop-Loss Techniques:

- Hard stop

- Volatility stop (ATR)

- VWAP stop

Common Mistakes to Avoid

- Trading without a catalyst

- Entering low-volume breakouts

- Ignoring float size

- Oversizing positions

- Holding losers hoping for reversals

- Trading news without preparation

Best Screeners and Tools for Finding Most Active Stocks

Top tools:

- TradingView

- Thinkorswim

- Webull

- Market Chameleon

- Stocktwits (sentiment)

- Benzinga Pro (news + unusual volume)

- Finviz (free + excellent filters)

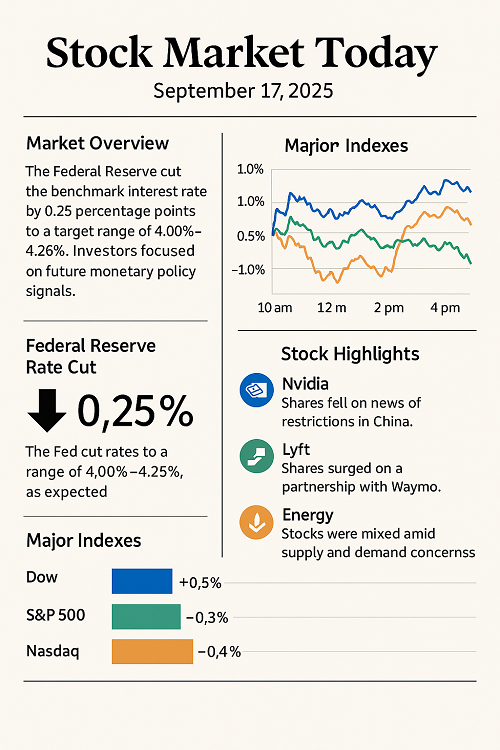

Sector-Specific Insights

Tech:

High volume, strong trends, macro-sensitive.

Energy:

Driven by oil/commodity prices.

Biotech:

Catalyst-heavy, high volatility.

Financials:

Macro-driven volume flows.

Consumer Discretionary:

React strongly to earnings and sentiment.

Case Study: How a Stock Becomes “Most Active”

Let’s break down a typical high-volume move:

Example Flow:

- Pre-market earnings beat

- Algorithmic buying triggers

- Analysts upgrade stock

- Retail crowds pile in

- Stock enters most active list

- Momentum funds rotate in

- Stock trends for the rest of the day

Volume = narrative + conviction + money flow.

How Market Conditions Affect Activity Levels

Bull Markets:

- Higher participation

- Volume follows trends

- More breakouts

Bear Markets:

- Defensive sectors dominate

- High volume in megacaps

- Volatility spikes

Sideways Markets:

- Rotation strategies

- False breakouts

- Choppy movement

FAQs: Most Active Stocks

What time of day has the highest volume?

- First hour (9:30–10:30 AM ET)

- Last hour (3:00–4:00 PM ET)

Are most active stocks good for beginners?

Yes — because liquidity reduces execution risk.

Do high-volume stocks always trend?

No. Some become active due to bearish catalysts (downgrades, disasters, etc.). Always analyze direction + catalyst.

What causes unusual volume?

- Earnings

- Insider buying

- Institutional rebalancing

- M&A activity

- Sector rotation

- Breaking news

Final Thoughts

The “Most Active Stocks” list provides one of the clearest windows into real-time market sentiment and institutional money flow. By understanding volume behavior, catalyst alignment, and price-action structure, traders can identify high-probability setups and avoid low-quality trades.

This guide is designed to help traders outperform the basics offered by typical market-activity pages, delivering deeper insights, actionable strategies, and a professional framework for navigating high-volume stocks with confidence.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F