Why TD Bank Matters

As one of Canada’s “Big Five” banks, Toronto-Dominion Bank (TD) plays a pivotal role in the Canadian and North American banking sector. Its stock, often referred to as stocks TD, is frequently tracked by investors, analysts, and traders alike. Given its cross-border operations—especially in the U.S.—TD is exposed to macroeconomic, regulatory, and interest rate dynamics on both sides of the border.

In 2025, TD is under intensified scrutiny. The bank faces regulatory constraints, significant legal costs, and restructuring needs, while still holding strong fundamentals in retail banking, wealth, and capital markets. For prospective investors and traders, understanding the full picture is essential.

This article offers a deep dive—beyond basic quotes—into what moves TD’s stock, what the risks are, and how an intelligent, strategic participant might approach it.

Primary Keywords (targeted):

- TD Bank stock

- Toronto-Dominion Bank share price

- TD Bank analysis

- TD Bank 2025 outlook

- Canadian bank stock comparison

We’ll also naturally include secondary / LSI keywords like “dividend yield,” “regulatory risks,” “U.S. operations,” “valuation multiples,” “technical analysis,” and “peer banks (RBC, BMO, Scotiabank, CIBC).”

Company Profile & Business Segments

Overview & History

Toronto-Dominion Bank, often referred to as TD, is a leading Canadian bank with a strong presence in the U.S. It resulted from the merger of the Bank of Toronto (founded 1855) and the Dominion Bank (founded 1869) in 1955.

Headquarters: Toronto, Ontario, Canada

CEO (as of 2025): Raymond Chun (appointed early 2025)

Employees: ~100,000+ across multiple divisions and geographies

TD is more than just a Canadian retail bank. Its operations span personal/commercial banking, wealth & asset management, insurance, wholesale banking, and capital markets.

Business Segments & Revenue Streams

TD’s core operating segments typically include:

- Canadian Personal & Commercial Banking – deposit-taking, mortgages, consumer and business loans

- U.S. Retail Banking – cross-border presence in the U.S. retail banking space

- Wealth Management & Insurance – asset management, advisory, insurance products

- Wholesale / Capital Markets – corporate banking, investment banking, institutional services

These segments provide diversified revenue streams, allowing the bank to offset slowdowns in one area with strength in another.

Competitive Landscape

TD competes with other Canadian major banks: Royal Bank of Canada (RBC), Bank of Montreal (BMO), Bank of Nova Scotia (Scotiabank), Canadian Imperial Bank of Commerce (CIBC). In the U.S., it competes with large regional banks and midsize retail banking players.

Key competitive differentiators for TD:

- Cross-border synergies

- Strong deposit base

- Diversification through wealth and capital markets

- Brand and customer loyalty in Canada

However, its U.S. presence also introduces regulatory exposure and compliance risk.

Recent Developments & Catalysts

To understand where TD is heading, we must account for both tailwinds and headwinds that are shaping sentiment.

Regulatory Penalties & Asset Cap

One of the most significant developments is TD’s settlement with U.S. regulators over anti-money laundering (AML) compliance failures. In 2024, the bank agreed to pay $3.09 billion in penalties and pled guilty to criminal charges.

As part of the settlement, TD’s U.S. operations are restricted from expanding new branches or increasing assets beyond a cap (set at ~$434 billion as of September 2024).

This penalty has serious implications: it limits growth in one of TD’s key markets and forces heavy compliance, capital, and remediation costs.

Divestment of Schwab Stake

In early 2025, TD announced it would exit its ~10.1% stake in Charles Schwab (which it acquired via the TD Ameritrade merger). The stake was valued at roughly $15.4 billion.

TD intends to use proceeds (≈ C$8 billion) to fund share buybacks and reinvest into core banking operations.

Removing this investment simplifies TD’s balance sheet and redirects capital towards its core operations.

Leadership Changes & Governance Reform

In response to the regulatory scandal, TD accelerated its CEO transition. Raymond Chun became CEO on Feb 1, 2025, ahead of schedule, replacing longtime CEO Bharat Masrani.

The bank has also restructured its board, imposed stricter governance rules, and trimmed executive compensation to restore investor confidence.

Earnings Volatility & Reserve Charges

In Q3 2024, TD posted a surprise loss after provisioning ~C$2.6 billion against expected fines and compliance remediation.

While its core operations remained solid (e.g. net interest income, revenue), the exceptional charges dented investor sentiment.

Going forward, volatility may persist depending on how regulatory and remediation costs evolve.

Macro & Interest Rate Environment

TD’s profitability is sensitive to interest rates. As central banks shift rates, net interest margins (NIM) are affected. Rising rates can benefit banks by widening spreads (when deposit re-pricing lags), while flattening or inverted yield curves can hurt.

Key macro factors to watch: U.S. Fed policy, Bank of Canada policy, inflation trends, Canadian/U.S. credit cycles, and cross-border regulatory changes.

Financials: Key Metrics, Trends & Ratios

Below is a breakdown of the most critical financial metrics for TD Bank.

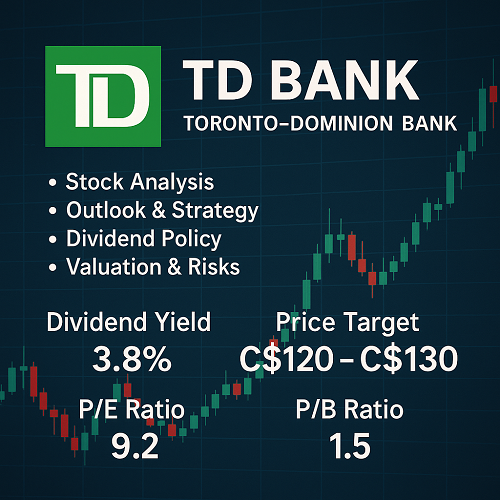

Latest Snapshot

| Metric | Value / Trend | Notes / Interpretation |

|---|---|---|

| Trailing P/E ratio | ~9.2× (TTM) | Reflects depressed valuation due to regulatory overhang |

| Forward P/E | ~12–13× (consensus) | Investors pricing in normalization plus growth |

| Price / Book (P/B) | ~1.5–1.6× | Reasonably conservative compared with peers |

| Net Profit Margin | ~30–33% in recent quarters | Stable for a diversified bank |

| Return on Equity (ROE) | ~16–18% | Strong for the sector |

| Return on Assets (ROA) | ~1% | Typical for large banks |

| Dividend Yield (Forward) | ~3.8%–4.0% | Attractive for income investors |

| Payout Ratio | ~35–40% | Leaves room for reinvestment and buybacks |

| Share Repurchase Activity | Moderate, funded by capital and asset sales | Especially as they divest Schwab stake |

Commentary:

TD’s balance sheet is generally healthy, with solid profitability and capital adequacy (not in table). The depressed valuation multiple largely reflects regulatory overhang. When remediation and compliance burdens fade, TD’s valuation could re-rate positively.

Historical Trends & Growth

- Over the past 5–10 years, TD has delivered consistent earnings growth driven by organic banking and wealth expansion.

- The acquisition of TD Ameritrade in 2020 boosted its U.S. footprint (though now partially unwound via Schwab stake exit).

- Revenue growth has been relatively steady, moderated by periods of regulatory headwinds.

- Expenses have grown, especially compliance, litigation, and remediation costs post-AML settlement.

Sensitivity & Stress Factors

Worst-case stress scenarios involve deeper regulatory fines, capital constraints (due to asset cap), credit loss cycles, or macro recessions. In such cases, ROE would compress, dividend stability becomes questionable, and capital deployment (e.g., buybacks) may be curtailed.

Dividend & Capital Return Policy

For many investors, especially in Canada, dividend yield and sustainability are key.

- Current Yield: ~3.8%–4.0% (forward)

- Payout Ratio: Moderate (≈ 35–40%), leaving flexibility for growth and reserves.

- Policy Philosophy: TD prefers a balance of dividends and buybacks, while maintaining strong capital buffers.

- Share Buybacks: The divestment of Schwab stake provides additional firepower for buybacks.

- Dividend Risks: Extreme regulatory or capital stress may reduce or freeze dividends, but as of now, TD has maintained consistency.

Risks & Regulatory Challenges

No analysis is complete without a clear-eyed view of risks.

Regulatory & Compliance Risk

The AML settlement is a reminder that banking institutions can be penalized severely for compliance lapses. Continued oversight, remediation cost creep, or further litigation could pose downside risk.

The U.S. asset cap constrains TD’s growth in the U.S. and may delay or block future expansion.

Credit / Economic Slowdown

A recession or credit downturn would impact TD’s loan book (unlikely minor banking sectors), increase allowances for loan losses, and compress margins.

Interest Rate / Yield Curve Risk

A flattening yield curve, inverted curve, or declining rates could erode net interest margins. Conversely, aggressive rate hikes might strain borrowers.

Currency & Cross-border Exposure

With operations across Canada and the U.S., TD is exposed to currency risk, regulatory divergence, and cross-border funding or capital constraints.

Strategic Execution Risk

Divesting non-core assets (e.g., Schwab stake) and redeploying capital must be executed well to preserve or enhance value. Missteps could hurt investor confidence.

Valuation & Market Sentiment

Even with strong fundamentals, sentiment can drag multiples. TD may remain undervalued until regulatory overhang recedes.

Valuation & Peer Comparison

Relative Valuation vs Peers

Let’s compare TD to major Canadian banking peers (RBC, BMO, Scotiabank, CIBC) on valuation multiples and earnings metrics.

| Bank | P/E (TTM) | P/B | ROE | Dividend Yield |

|---|---|---|---|---|

| TD | ~9–10× | ~1.5× | ~16–18% | ~3.8–4.0% |

| RBC | Higher multiple (often premium) | ~2× | ~14–17% | ~3.5%–4.0% |

| BMO / Scotiabank / CIBC | Varied, often mid-teens P/E | Lower P/Bs | Lower ROEs | Yield similar or higher |

Because of its regulatory overhang, TD’s valuation is depressed relative to peers, even though its ROE and balance sheet strength remain competitive.

Intrinsic Valuation / Discounted Cash Flow (DCF) Approach

While a full DCF model is beyond this article, the rough approach is:

- Project free cash flows over 5–10 years, factoring in growth, cost of capital, regulatory friction, and capital constraints.

- Discount them by a weighted average cost of capital (WACC), adjusted for banking sector risk.

- Add terminal value (e.g. via Gordon Growth or exit multiple).

- Subtract net debt (if applicable).

Given the regulatory drag and capital constraints, many analysts apply a “regulatory discount” (e.g. 10–20%) to valuation.

Base Case Valuation Estimate

Based on consensus forward earnings and peer multiples, a reasonable valuation target for TD by late 2025–2026 lies in the C$120–130 range (or a ~15–20% upside from current levels), assuming regulatory overhang eases, growth resumes, and multiples re-rate.

Bear-case scenarios (if fines or restrictions deepen) could push the valuation lower (e.g. ~C$90–100 or more downside).

Bull-case scenarios (if regulatory clearance occurs, U.S. growth resumes, capital redeployment yields strong returns) could see valuation re-rating to ~C$140–150+.

Technical / Chart Analysis

Technical analysis should complement fundamental insights, especially for traders.

Price Trends & Patterns

- Over the past year, TD’s stock has shown a strong upward trend (subject to pullbacks).

- Key support zones often lie near previous resistance turned support (e.g. Fibonacci retracements, trendlines).

- Resistance zones near all-time highs or psychological levels (e.g. C$120, C$130, etc.).

Using daily, weekly, and monthly charts, traders can watch for breakouts (volume + momentum), pullbacks to support, and moving average confluences (50, 100, 200-day MA).

Momentum Indicators & Oscillators

- MACD: crossovers provide trend-change signals

- Volume / OBV: ensure breakouts or dips are confirmed by volume

Suggested Trade Setups

- Trend-following entry: Buy on pullback to strong support + bounce

- Breakout trade: Enter when price breaks a resistance level with confirmation

- Trailing stop: Use ATR-based stops or moving average stops

- Options (for advanced traders): Use bullish call spreads or protective puts to manage risk

Important: Because of earnings / regulatory news events, TD may gap, so traders should use caution around event dates and manage risk.

Forecasts, Scenarios & Price Targets

Base Case (45–60% probability)

- Regulatory overhang gradually lifts

- U.S. restrictions soften

- Dividend stays stable, buybacks resume

- EPS growth resumes at ~5–8% annual

- Multiple re-rating from ~9× to ~11–13× forward

- 1–2 year target: C$120–130

Bull Case (20–30% probability)

- TD fully remediates AML issues

- U.S. expansion resumes

- Strong macro tailwinds (rising rates, credit growth)

- Multiple re-rating to ~14–16×

- Upside target: C$140–150+

Bear Case (20–30%)

- New regulatory surprises or fines

- Capital restrictions intensify

- Earnings disappoint

- Market re-rates downward

- Downside risk: C$90–100 or lower

2025 Key Catalysts To Watch

- Progress on compliance / remediation

- U.S. regulatory decisions (permits, relief)

- Quarterly earnings surprises

- Divestment execution (Schwab stake)

- Macro (interest rates, credit conditions)

- Changes in capital allocation (buybacks, dividends)

Trading Strategies & Positioning

Long-Term Investors / Income Focus

- Allocate a core position given strong fundamentals and yield

- Use dollar-cost averaging to ride out volatility

- Monitor key developments: regulatory releases, capital changes

- Maintain a buffer for downside tail risk

Active / Tactical Traders

- Trade around earnings or news events with defined risk

- Trade support-resistance zones and momentum breakouts

- Use options strategies (e.g. covered calls, collar) to leverage or hedge

- Stay attentive to volume, momentum, and trend shifts

Risk Management

- Use stop-loss orders or alerts

- Position size relative to portfolio risk tolerance

- Be cautious near major news events or regulatory pronouncements

- Don’t overleverage—TD can gap on bad news

Conclusion & Takeaways

TD Bank’s stock in 2025 presents a hybrid proposition: strong underlying fundamentals and yield, but burdened by regulatory overhang and risk. If the bank can successfully remediate compliance issues, unlock capital from divestitures (e.g. Schwab stake), and re-establish growth momentum, TD is well-positioned for a valuation re-rating.

For traders and investors, balance optimism with caution:

- Favor entry after confirmation (breakout, support bounce)

- Use risk controls

- Keep a close eye on regulatory developments

In the best case, TD could reclaim its place among Canada’s best-performing bank stocks. In a worst-case scenario, it may lag peers significantly. But with a diversified banking franchise, yield cushion, and capital options, TD remains among the more interesting plays in Canadian financials—provided one watches execution and risk carefully.

Disclosure & Limitations

- This article is for informational and educational purposes only—not financial advice.

- Valuation estimates and forecasts are forward-looking and inherently uncertain.

- Real-world execution involves transaction costs, tax, slippage, and liquidity constraints.

- Always conduct your own due diligence or consult a financial professional before acting.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F