Why Stock Trading Matters

Stock trading is more than just buying shares — it’s an active strategy to extract short- to medium-term gains using volatility, patterns, and market inefficiencies. Unlike long-term investing, trading demands discipline, quick decision-making, and a codified edge.

What you’ll get by mastering this guide:

- Clear, jargon-free foundational knowledge

- Actionable setups, rules, and methods you can test

- Insights from psychology, risk, and systemic thinking

- Tools to reduce drawdowns and enhance consistency

By the time you finish, you’ll have both theory and practical wisdom to execute trades with significantly better odds.

Core Concepts & Terminology

What Is Stock Trading?

Stock trading means buying and selling equity shares with the aim of profiting from price movements over shorter timeframes, often ranging from minutes to months. It differs from buy-and-hold investing in that you’re not banking solely on dividends or long-term growth but rather capitalizing on fluctuations.

Long vs. Short Positions

- Long: You own shares, expecting price to rise.

- Short: You borrow shares and sell them now to repurchase later at a lower price (if correct), profiting from declines.

Order Types

| Order Type | Definition | Use & Risk |

|---|---|---|

| Market Order | Execute immediately at best available price | Simple but may incur slippage |

| Limit Order | Set max price to buy or min price to sell | Precise control, but may not fill |

| Stop Order | Becomes market order when price passes “stop” | For protection / breakout trades |

| Stop-Limit Order | Becomes a limit order after stop is triggered | More control, but risk of non-execution |

Understanding how order types interact with liquidity and volatility is vital.

Bid, Ask, Spread & Liquidity

- Bid: Highest price someone is willing to pay

- Ask (Offer): Lowest price someone is willing to sell

- Spread: Ask minus Bid — a cost to cross the spread

- Liquidity: Depth of buyers/sellers — tighter spreads, better fills

In illiquid stocks, you might face large price slippage or partial fills.

Volume, Market Depth & Order Book

Volume tells you how active a stock is. Order book depth shows how many shares are waiting at various price levels. A price bump through a thick order block is meaningful (support/resistance).

Market Structure & Exchanges

Major Exchanges

The New York Stock Exchange (NYSE) and NASDAQ dominate U.S. cash equities. In Canada, the TSX is central. Each has its rules on settlement (T+2), listing standards, and circuit breakers.

OTC & Dark Pools

Some stocks trade over-the-counter (OTC) outside major exchanges — higher risk, lower transparency. Dark pools are off-exchange venues where large blocks trade away from public order books, sometimes affecting price discovery.

Market Participants

- Retail Traders — individuals

- Institutional Investors — mutual funds, hedge funds, pension, etc.

- Market Makers / Specialists — provide liquidity, narrow spreads

- Proprietary Trading Firms — algorithmic / high-frequency operations

Knowing who you’re competing with helps shape realistic expectations.

Types of Stock Trading Styles

No “one style fits all” — successful traders often pick one or two that match their temperament, capital, and time.

Day Trading

All trades opened and closed within the same day. No overnight exposure. Very fast pace, high cost of mistakes.

Swing Trading

Holding for days to weeks to capture intermediate trends. Requires less constant attention than day trading.

Position Trading

Holding positions for several weeks to months. Intermediate between investing and trading.

Momentum & Trend Trading

Buy when trend is strong, ride it until exhaustion. Use volume and breakout confirmation.

Algorithmic / Quantitative Trading

Rules-based strategies executed automatically — e.g., mean reversion, statistical arbitrage, factor models.

How to Get Started: Setup & Tools

Choosing a Broker & Platform

- Low commissions / fees

- Fast execution & minimal latency

- Access to order types and margin

- Reliable charting tools

- Mobile access & API (for automation)

Check regulatory safety (e.g. in the U.S., FINRA / SIPC; in Canada, IIROC).

Capital Requirements & Position Sizing

You don’t need huge capital initially—but to absorb losing trades, you need room. Many pro traders risk 1–2% of capital per trade (or less).

Charting Software & Tools

Use platforms like TradingView, ThinkOrSwim, NinjaTrader, or broker-native ones. Use multiple timeframes to confirm signals.

Risk Management Basics

Always define your maximum loss per trade, set stop-losses before entry, and pre-calculate drawdown scenarios.

Fundamental vs. Technical Analysis

Fundamentals

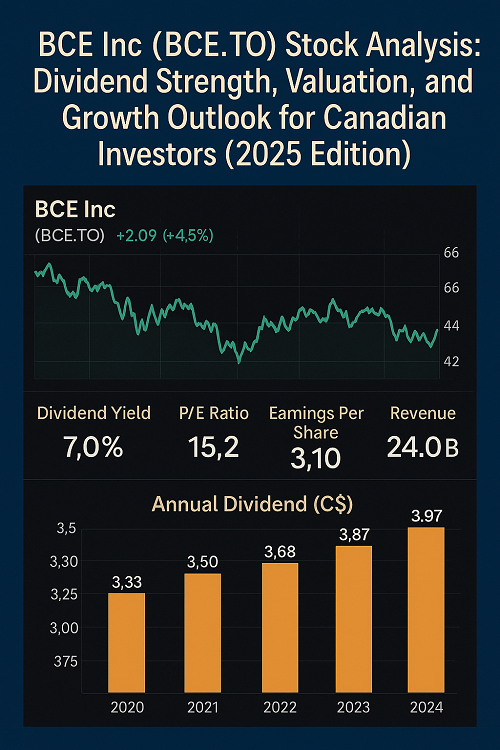

- Earnings per share (EPS), revenue growth

- Price-to-earnings (P/E), Price/Sales (P/S), EV/EBITDA

- Macro factors: interest rates, inflation, geopolitical events

- Catalysts: earnings reports, M&A, sector news

Fundamentals move markets in longer timeframes; traders often use them to filter or avoid risky names.

Technical

- Candlestick patterns, support/resistance

- Indicators (see next section)

- Trend analysis and momentum

Technical analysis is core to timing entry/exit decisions.

Hybrid Approach

Many top traders use fundamental filters (to pick high-probability names) and technical signals for timing.

Technical Indicators & Signals (with Examples)

Moving Averages (SMA, EMA)

- Simple Moving Average (SMA) — average of past N prices

- Exponential Moving Average (EMA) — gives more weight to recent prices

Common crossover signals: e.g., 50-day crossing 200-day indicates trend change.

RSI, MACD, Stochastic

- Relative Strength Index (RSI) — overbought/oversold (generally 70/30)

- MACD — difference between EMAs, with signal line

- Stochastic Oscillator — momentum indicator; crossovers in overbought/oversold zones

Bollinger Bands, ATR, Ichimoku

- Bollinger Bands — volatility envelope — expansion/contraction signals

- Average True Range (ATR) — measures volatility (used for stop placement)

- Ichimoku Cloud — multiple trend and momentum signals

Volume-based Signals

- On-Balance Volume (OBV)

- Volume Rate of Change (VROC)

- Volume Spikes + Price Action — validate breakouts

Price Action Signals

- Support / Resistance zones

- Breakouts / Breakdowns

- Pullbacks / Retests

- Chart Patterns: triangles, head & shoulders, flags

Use confluence — e.g. a breakout that’s confirmed by volume and RSI not being overbought.

Risk & Money Management

Risk / Reward Ratio & Expectancy

- Many traders aim for ≥ 2:1 or 3:1 reward vs risk

- Expectancy = (Win% × Avg Win) – (Loss% × Avg Loss)

Position Sizing & Kelly Criterion

- Basic rule: risk a small percent of capital (1–2%)

- Kelly Criterion gives “optimal fraction” under ideal assumptions — but often too aggressive for real trading, so use a fractional Kelly (e.g. half-Kelly).

Stop Losses, Trailing Stops & Exit Rules

- Always set a stop before entering

- Use trailing stops to lock in profits

- Predefine exit rules so you don’t “let winners turn into losses”

Portfolio Allocation & Diversification

Don’t overconcentrate in one stock even if you “feel good” about it. Spread risk across sectors, styles, and timeframes.

Psychology of Trading

Emotional Discipline

Fear, greed, hesitation, and overconfidence are your greatest adversaries.

Avoiding Overtrading & Revenge Trading

Don’t force trades. If you lose, take deeper breaths, review, and wait for confirmation.

Journaling, Review & Continuous Improvement

Log your setups, outcomes, deviations from plan, emotional state. Review weekly/monthly for patterns of mistakes or edge erosion.

Advanced Techniques & Tools

Leverage & Margin Trading

Borrowing capital amplifies gains and losses. Understand margin calls and maintenance margins.

Short Selling & Hedging

Shorting can offer profit on down moves, but risk is unlimited. Use hedging techniques to reduce downside.

Options as a Supplement

Options allow asymmetric payoff structures:

- Covered calls can generate income

- Protective puts protect downside

- Spreads / Iron condors exploit volatility

Pairs Trading, Stat Arb & Market Neutral

Trade relative performance between correlated stocks. Statistical methods can exploit mean reversion.

Automated Systems, Bots & APIs

Backtest on historical data, simulate, run with strict risk rules. Use frameworks (e.g., Python + Pandas, QuantConnect, MetaTrader).

Stock Trading for Different Markets

U.S. vs Canadian / Global Markets

Understand differences in liquidity, regulation, taxation, settlement, currency risk.

Small-Cap / Micro-Cap / OTC Stocks

These offer bigger volatility but come with high risk — low liquidity, possible manipulation, wider spreads.

Sector Rotation & Thematic Plays

Rotate capital into hot sectors (tech, AI, renewable energy) when macro tailwinds are strong.

Common Pitfalls & How to Avoid Them

- Chasing “hot tips” / rumors

- Excessive leverage / overexposure

- Ignoring slippage, commissions & fees

- Letting losses run

- Trading without a plan

- Ignoring macro shifts (e.g. interest rates, regulation)

Case Studies & Examples

A Day Trade Walkthrough

- Setup: strong momentum stock

- Entry: breakout above resistance with volume confirmation

- Stop: below recent low or ATR-based

- Exit: target or trailing stop

A Swing Trade Setup & Exit

- Identify a consolidation breakout

- Confirm with MACD, rising volume

- Trail stop once trend is established

- Exit on reversal candle or RSI divergence

Mistake Post-mortem

- Example: entering too early, ignoring volume, violation of stop

- What to learn: wait for confirmation, don’t pre-judge

Checklist: Daily & Weekly Routines

Daily

- Pre-market scan for catalysts

- Watchlists & levels (support/resistance)

- Journaling trades in real time

- Post-market review

Weekly

- Review edge metrics (win rate, avg win/ loss, expectancy)

- Adapt watchlists to top sectors

- Check performance vs benchmarks

FAQs on Stock Trading

Q: What’s the minimum capital needed to start?

A: You can begin with a few hundred dollars, though with more capital, you can manage risk better.

Q: Is trading riskier than long-term investing?

A: Yes — higher volatility, shorter timeframes, more frequent decisions, and more exposure to emotional decisions.

Q: Can one survive with part-time trading?

A: Yes, but you need setups with high probability and higher edge, as you’ll have less screen time.

Q: How often should I review my performance?

A: After every trade (in brief), weekly, and monthly deep dives.

Conclusion & Next Steps

Stock trading is a challenging but rewarding discipline. Mastering it requires combining sound risk management, a well-defined edge, psychological control, and continuous adaptation. Use this guide as a foundation; then:

- Pick a style that fits you

- Backtest a few strategies

- Trade small size in real market

- Iterate, refine, and evolve

Consistency over time — not perfection — is the real goal.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F