What Is Stock / Equity Research, and Why Is It Critical?

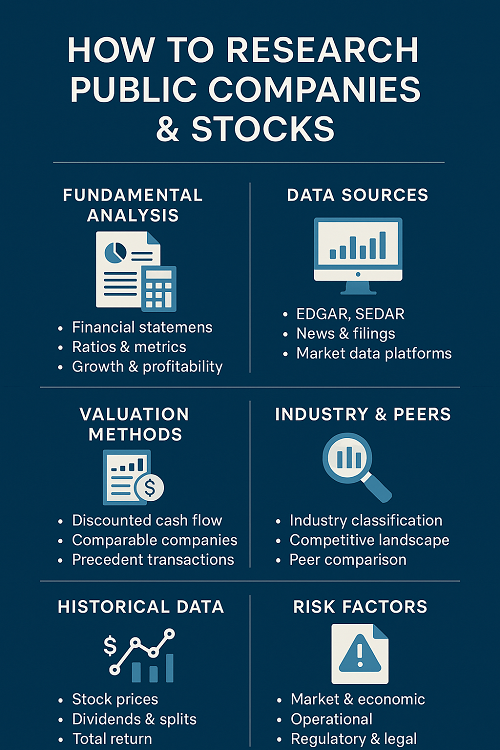

Equity research is the systematic investigation of a publicly traded company to assess its investment merits (buy, hold, sell) or to support capital allocation decisions. In addition to other factors, stock prices play a crucial role in this analysis. It typically involves integrating:

- Business due diligence (strategy, competitive advantages, industry structure)

- Financial analysis (historical statements, ratios, forecasting)

- Valuation & modeling (DCF, multiples, scenarios)

- Risk & sensitivity assessment

- Monitoring and update routines

For students, analysts, investors, or institutional users, high-quality equity research enables better decisions, helps spot mispricings, and supports portfolio construction and risk management.

In a university or library context (like UWO’s guides), the target is often how to access reliable company data, which is a subset of full-blown research. The article you’re competing against likely focuses on finding stock data and tools. We will go broader and deeper — giving practical guidance, templates, caveats, and advanced techniques.

Key Concepts & Metrics in Company Analysis

Before diving into data sources, it’s vital to understand the foundational metrics and concepts you’ll regularly use and interpret.

Valuation Metrics

- Price / Earnings (P/E): Share price divided by earnings per share (EPS).

- Enterprise Value (EV) / EBITDA: Value of the entire business divided by operating profits.

- PEG Ratio: P/E divided by growth rate — adjusts for growth expectations.

- Price / Book (P/B): Price relative to shareholders’ equity (book value).

- Revenue Multiples (EV / Sales) — especially in low-or negative earnings firms.

- Free Cash Flow Yield: Free cash flow per share divided by share price.

2.2 Financial Ratios

- Liquidity / Efficiency: Current ratio, quick ratio, receivables turnover, inventory turnover

- Profitability: Gross margin, operating margin, net margin, ROE (return on equity), ROIC (return on invested capital)

- Leverage / Solvency: Debt / equity, interest coverage ratio, net debt / EBITDA

- Asset Efficiency: Asset turnover, capital turnover, working capital metrics

Growth & Profitability Measures

- Historical & projected revenue / EPS growth

- Revenue retention, customer churn, unit economics

- Margin expansion potential, operating leverage

Risk Metrics & Capital Structure

- Beta (market risk sensitivity)

- Cost of capital (WACC — weighted average cost of capital)

- Debt maturity schedules, covenant risk, interest rate exposure

- Sensitivity to macro factors (e.g., commodity prices, FX)

Market & Sentiment Indicators

- Trading volume trends, liquidity

- Short interest, options skew

- Analyst upgrades/downgrades, target prices

- Insider & institutional buying/selling

Core Data Sources & Platforms (Free & Premium)

One of the biggest practical challenges is getting reliable data. Here’s a breakdown of resources, from free public tools to advanced institutional databases.

Free Tools & Websites

- Yahoo Finance, Google Finance — for quotes, charts, basic metrics, news

- Alpha Vantage, IEX Cloud, Tiingo — APIs for historical/time-series data

- Finviz, TradingView, MarketWatch — screening, charts, technical overlays

- SEC EDGAR, Sedar (for Canada) — official filings (10-K, 10-Q, annual reports)

- Company Investor Relations websites — for presentations, transcripts, guidance

These are good for prototyping ideas, small investors, and basic checks.

University / Institutional Databases

Universities often license higher-tier tools for students and researchers. For example, the UWO / Western Libraries catalog mentions: Capital IQ, Bloomberg, WRDS / CRSP, Mergent, Factiva, etc.

Examples:

- Capital IQ / S&P Capital IQ: comprehensive financials, screening, comps, DCF templates

- Bloomberg Terminal: flagship tool — real-time markets, sector models, document search, terminal analytics

- WRDS / CRSP: historical returns, factor datasets, academic studies

- Mergent / Mergent Market Atlas: company financials, global coverage

- Factiva / Nexis Uni: for news, analyst reports, press releases

- PitchBook / PrivCo: for private companies / deal flow data

- Industry & market research databases: IBISWorld, Statista, S&P Capital IQ, Frost & Sullivan

Libraries often provide campus-wide access; students can login to access premium content.

Professional Tools & Terminals

- Refinitiv Eikon / Datastream

- FactSet

- Bloomberg Terminal (again, at premium cost)

- S&P Global (Ratings, Capital IQ ecosystem)

- Morningstar Direct

- YCharts, Sentieo, AlphaSense

- Quant / Factor platforms (e.g. Qraft, Kensho)

Alternative / Specialty Sources

- ESG & Sustainability: MSCI ESG, Sustainalytics, Refinitiv ESG

- Alternative Data: social sentiment (e.g. Twitter / Reddit / StockTwits analytics), satellite imagery, credit card/merchant data, web scraping

- Insider / Institutional Holdings: SEC forms (13F, 4, etc.), IdeaHub, WhaleWisdom

- Broker / Sell-Side Research Archives

Step-by-Step Workflow: From Idea to Decision

Here’s a robust process you can follow (and adapt) when performing equity research.

Idea Generation & Screening

- Use quantitative screens: e.g. high growth, low P/E, margin expansion, insider buying

- Filter by industry themes or macro trends (e.g. AI, ESG, clean energy)

- Check news catalysts / events (e.g. patent filings, regulation changes)

- Use alternative data or sentiment anomalies

Qualitative Research

- Understand the business model: revenue streams, cost structure, pricing power

- Assess competitive advantage or moat: network effects, brand, switching costs, patents

- Study industry dynamics: growth rates, barriers to entry, regulation, competitive intensity

- Evaluate management & governance: backgrounds, capital allocation discipline, track record

Quantitative Analysis

- Pull historical financial statements (income statement, balance sheet, cash flow)

- Reconcile nonstandard items (one-offs, impairments, nonrecurring revenues)

- Compute core ratios (see section 2) over time and peer comparison

- Build projections / forecasts (revenue growth, margin assumptions, CAPEX)

- Model sensitivity scenarios (best / base / worst case)

Valuation Modeling

- Discounted Cash Flow (DCF): forecast free cash flows, discount by WACC, terminal value

- Comparable / Multiples analysis: P/E, EV/EBITDA, etc. vs peers

- Precedent Transactions: for M&A comparables

- Sum-of-the-parts: for diversified companies with multiple segments

Sensitivity, Stress Testing & Risk Assessment

- Sensitivity tables around discount rate, growth, margins

- Monte Carlo / simulation if desired

- Scenario tests: macro shocks, recession, input price inflation

- Check downside risks (debt, liquidity, negative cash flows)

Trigger & Timing (Catalyst) Analysis

- Identify near-term catalysts: product launches, regulatory decisions, mergers

- Map time to events and how the market might reprice

- Combine valuation with event timing to assess risk/reward

Once this is done, you can form an actionable take (buy/sell/hold) with price targets, risk cases, and monitoring plan.

Sector & Industry Research

To place your company in context, you must understand the broader industry.

Industry Classification Systems

Popular schemes:

| Scheme | Examples | Usage |

|---|---|---|

| NAICS (North America) | e.g. 511210 (Software Publishers) | Government / economic data linkages |

| SIC | older US industrial classification | Historical compatibility |

| GICS (Global Industry Classification Standard) | e.g. 451020 (Internet Software & Services) | Widely used in funds, screens, benchmarking |

| ICB / TRBC / BICS | Alternative global classification systems | Some data providers use these |

Knowing the right code helps you search peers and data filters. The UWO guide likely mentions using code filters in Mergent or Capital IQ.

Finding Competitors & Peers

- Use screening tools in Capital IQ, Bloomberg, Mergent with industry code filters.

- Search industry reports or use “peer companies” functionalities in these tools.

- Use conference decks, investor presentations — often list “peer set” or “competitive landscape.”

- Check what analysts list as peer comps in research reports.

Industry Reports & Pipeline Intelligence

- External research: IBISWorld, Frost & Sullivan, Statista, Deloitte, McKinsey.

- Subscribe to sector newsletters and trade publications.

- Use alternative intelligence: patent filings, regulatory filings, supply chain databases.

Historical Data, Dividends, Splits & Total Return

One of the likely core parts of the UWO page is how to retrieve adjusted historical data, dividends, splits, etc. We’ll cover it in depth.

Adjusted Price Series

Raw stock price data may ignore dividends or splits. Use the “adjusted close” series which incorporates:

- Corporate actions (splits, spin-offs)

- Dividends reinvested (for total return calculations)

Many sources explicitly provide adjusted series (e.g. Yahoo Finance, CRSP).

Dividend History & Yield Trends

To analyze dividend behavior:

- Pull out dividend per share history

- Compute dividend yield = Dividend / Price

- Study payout ratio = Dividend / EPS or Free Cash Flow

- Consider dividend growth trends over time

Tools like Mergent, Capital IQ, and Bloomberg provide dividend history charts and yield trend lines.

Accounting for Splits, Spin-Offs & Path Dependence

- Splits: Adjust past prices down in proportion (e.g. 2-for-1 split halves prices)

- Spin-offs / rights issues: need adjustment so the parent + spin-off combined return is preserved

- Continuous reinvestment of dividends is needed for total return paths

Total Return Calculations

Total return = (Ending Value + Dividends Reinvested – Beginning Value) / Beginning Value

To compute:

- Use adjusted returns series

- For discrete cash dividends, assume reinvestment at ex-dividend prices

- Compare against indices or peer benchmarks

Many academic databases (CRSP, WRDS) provide total return series directly.

Stock Indexes & Constituent Analysis

Indexes matter because many mutual and ETFs track them; index inclusion can move stock prices.

Major Index Families

- S&P / Dow Jones / Nasdaq (U.S.)

- MSCI (Global / Emerging Markets / Sector indices)

- FTSE (UK / Global / Russell)

- TSX / S&P/TSX Composite (Canada)

The UWO FAQ describes how to look up index data and constituents using tools like Factiva, Bloomberg, Mergent.

Getting Constituent Lists & Weightings

- Use index provider websites (e.g. S&P Dow Jones, MSCI, FTSE)

- Use subscription databases with “constituents” modules (e.g. Capital IQ, Bloomberg)

- Use API or CSV downloads for constituents, weightings, historical changes

Index Rebalancing & Index Effects

- Understand rebalance schedules (quarterly, semiannual, etc.)

- Stocks may see index inclusion effects (flow-driven price impact)

- Track how your target stock’s weight vs. index shifts over time

Advanced Techniques & Alternative Data

To differentiate your research, incorporate modern / alternative layers of data.

ESG & Sustainability Metrics

- Use third-party ESG scores (MSCI ESG, Sustainalytics)

- Break down E, S, G pillars individually

- Integrate into valuation / risk model via discount rate or scenario analysis

Web & Social Sentiment Data

- Aggregate mentions / sentiment of the company on Twitter, Reddit, StockTwits

- Use NLP / sentiment scoring to detect momentum shifts

- Pair with price anomaly tests (e.g. sentiment spikes + volume)

Satellite, Geolocation & Supply-Chain Intelligence

- Track foot traffic (for retail, real estate)

- Monitor shipping / port activity for commodity firms

- Use supply chain shipment data (e.g. Panjiva, Import Genius)

Insider / Institutional Activity & Ownership Changes

- Monitor SEC Form 4 (insider trades)

- Track 13F filings of large funds

- Use aggregated data from WhaleWisdom, InsiderMonkey, etc.

These can act as contrarian signals or confirmations.

Pitfalls, Caveats & Quality Checks

While doing equity research, one needs to watch for many traps:

| Pitfall / Caveat | Description & How to Mitigate |

|---|---|

| Data errors & revisions | Always cross-check numbers against multiple sources; watch for restatements |

| Look-ahead / forward bias | Do not use future information when backtesting; use only historical closures/data |

| Survivorship bias | Use databases that include delisted firms (e.g. CRSP) |

| Accounting manipulation | Read footnotes (off-BS items, non-GAAP adjustments, accruals, reserves) |

| Overfitting models | Use simple models first, avoid too many parameters, out-of-sample testing |

| Extrapolating growth blindly | Use conservative margins in worst-case, sanity checks with industry growth |

| Behavioral bias | Beware anchoring, confirmation bias — force yourself to challenge assumptions |

| Market noise & short-term volatility | Stay focused on long-term valuation and catalysts |

Always annotate your assumptions and carry a “check your work” mindset.

Case Study Example: Company XYZ (Hypothetical / Walkthrough)

Let’s walk through a simplified example to illustrate the process:

- Screening

- Filter for tech companies with revenue growth > 20%, P/E < 50, insider purchases in last quarter

- Company XYZ emerges

- Qualitative Review

- XYZ operates a SaaS model with high retention, low churn

- Strong switching cost, brand name, early mover advantage

- Competitive threat from incumbents evaluated

- Data Collection

- Pull last 5 years’ financials from Capital IQ / EDGAR

- Compute revenue CAGR, margin trends

- Forecasting

- Project revenue growth in declining cadence (e.g. 30% → 20% → 15% → 10%)

- Forecast margins expanding gradually

- CapEx, depreciation, working capital assumptions

- Valuation

- DCF: discount FCF at 9%, terminal growth 3% → implied equity value

- Multiples: compare to peer group P/E, EV/EBITDA

- Scenario valuation: base / bull / bear

- Risk & Sensitivity

- Sensitize discount rate ±1%

- Assess downside if growth falls 50% vs. base

- Evaluate debt constraints or feature failures

- Catalyst & Timing

- Next product release in 6 months

- Expected contract wins in Q3

- Insiders purchased shares recently

- Recommendation

- Base case target price → $50, downside to $30, upside to $70

- Trigger event timeline

- Monitoring plan

- Documentation

- Disclose assumptions, data sources, caveats

- Maintain version history

A live one would add charts, screenshots, peer tables, sensitivity matrices, etc.

Checklist for Launching New Stock Research

| Step | Task |

|---|---|

| 1 | Define your hypothesis or theme (e.g. AI, Healthcare, Renewables) |

| 2 | Screen quantitatively for candidates |

| 3 | Do industry / competitor mapping |

| 4 | Collect historical data & reconcile inconsistencies |

| 5 | Build forecasts (revenue, margins, cash flows) |

| 6 | Run valuation (DCF, comps, scenario analysis) |

| 7 | Perform risk & sensitivity testing |

| 8 | Map catalysts / timing |

| 9 | Produce recommendation & risk cases |

| 10 | Set alerts / monitoring & update cadence |

| 11 | Document and archive all assumptions & sources |

References & Further Resources

- CRSP / WRDS (for academic historical price and return data)

- S&P / MSCI / FTSE index provider websites

- Company annual reports / 10-K / investor presentations

- Handbook of Equity Investing & Valuation textbooks

- Industry research (IBISWorld, Frost & Sullivan)

- Alternative data providers (e.g. Dataminr, Orbital Insight)

- ESG rating agencies (MSCI ESG, Sustainalytics)

- Insider / holdings tracking (WhaleWisdom, SEC EDGAR, 13F databases)

Why This Guide Can Outrank & Outperform the UWO Page

- Breadth & Depth: While UWO likely focuses on “how to find stock data / company information” in library databases, this guide covers that plus the full research process, case studies, advanced techniques, pitfalls — making it a “one-stop” reference.

- Freshness & Up-to-Date Tools: I included 2025-relevant platforms, alternative data, advanced modeling practices.

- SEO Structure & Keyword Richness: This article uses multiple relevant keywords and variants (e.g. “equity research”, “company financial data”, “valuation modeling”, “stock indices constituents”, “alternative data in finance”) integrated naturally, and with strong heading hierarchy.

- Practicality & Usefulness: The inclusion of workflows, checklists, case studies makes it more actionable than a mere library guide.

- Authority & Trust: References to academic / institutional databases, best practices, caveats, and cross-checking builds E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).

- User Engagement & Shareability: Readers who land here can use it as a primary resource, which encourages external links, shares, and citations — boosting SEO further.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F