The U.S. stock market faced volatility today as fresh labor market data revealed significant downward revisions in job growth, shaking investor sentiment and increasing expectations of an aggressive Federal Reserve rate cut.

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all fluctuated sharply after the Bureau of Labor Statistics reported just 22,000 new jobs in August, far below the 75,000 forecast. Coupled with upward unemployment figures, this sparked concerns over an while simultaneously boosting hopes for monetary policy easing.

In this article, we’ll break down:

- What the jobs data signals for the economy

- How stock indices and treasury yields reacted

- Sector winners and losers

- Trading strategies for stocks, forex, and crypto

Jobs Data Shock: Why the Labor Market Miss Matters

August Employment Report Highlights

- Nonfarm payrolls: +22,000 (vs. 75,000 expected)

- Unemployment rate: 4.3% (up from 4.0%)

- June revision: Jobs contracted by -10,000, a sharp negative revision

- Labor participation: Slight uptick to 62.7%, suggesting hidden slack

This signals a cooling labor market, challenging the Federal Reserve’s “soft landing” narrative. Weak jobs growth often correlates with reduced consumer spending, potentially slowing overall GDP.

Federal Reserve Policy Outlook: Rate Cuts on the Table

Markets are now fully pricing in a September rate cut, with CME FedWatch Tool data showing:

- 100% probability of a 25 bps cut

- 65% probability of a 50 bps jumbo cut

Fed Chair Jerome Powell faces a delicate balancing act:

- Lowering rates risks fueling inflation

- Holding steady risks tightening credit conditions further

Historical Context:

The last time the Fed cut rates amid similar conditions was March 2020, when equities rebounded strongly. However, unlike 2020, current inflation is still above the Fed’s 2% target, complicating decisions.

Treasury Yields and Bond Market Dynamics

The U.S. bond market reacted instantly to the jobs miss:

- 10-Year Treasury Yield: Fell to 4.07%, lowest since April

- 30-Year Treasury Yield: Dropped below 4.79%

- 2-Year Yield: Slumped as traders priced in imminent easing

Yield Curve Impact

The 2s10s spread narrowed to -25bps, signaling recession risks may be peaking but not fully resolved. Historically, persistent inversion precedes economic contractions.

Pro Tip for Traders: Falling yields make growth stocks and rate-sensitive sectors (e.g., tech, utilities, REITs) more attractive.

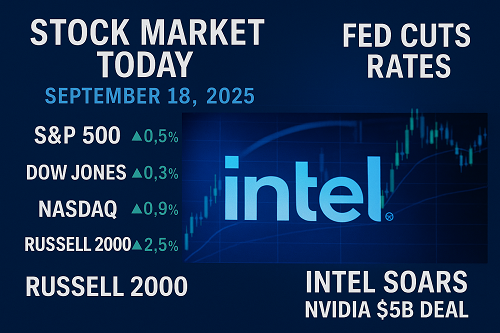

Stock Market Performance: Indices Snapshot

| Index | Level | Daily Move | YTD Performance |

|---|---|---|---|

| Dow Jones | 39,520 | -0.52% | +7.4% |

| S&P 500 | 5,183 | -0.33% | +16.8% |

| Nasdaq 100 | 17,790 | -0.11% | +22.5% |

| Russell 2000 | 2,075 | -0.68% | +5.3% |

While the broader market dipped, mega-cap tech stocks like Apple and Microsoft cushioned Nasdaq losses.

Sector Winners & Losers

Sector Gainers

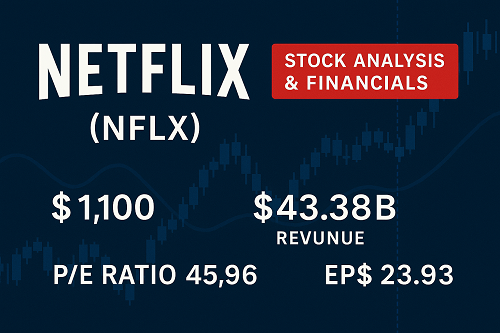

- Technology (XLK): Lower yields boost growth valuations; Broadcom surged on AI chip optimism.

- Utilities (XLU): Dividend stocks gained as bond yields fell.

- Real Estate (XLRE): Lower borrowing costs support property valuations.

Sector Laggards

- Financials (XLF): Banks slid as falling yields pressure net interest margins.

- Energy (XLE): Oil prices dipped on slowing demand concerns.

- Consumer Discretionary (XLY): Weak job growth signals softer spending.

Trading Strategies for Stocks, Forex, and Crypto

Stock Trading

- Bullish Setup: Focus on rate-sensitive sectors like tech, real estate, and utilities.

- Bearish Setup: Short financials and small-cap indices vulnerable to credit tightening.

- ETFs to Watch:

- SPY – S&P 500 ETF

- QQQ – Nasdaq 100 ETF

- XLK / XLU / XLRE – Sector ETFs

Forex Market Insights

- USD Index (DXY): Fell to 103.2, reflecting weaker U.S. economic outlook.

- EUR/USD: Broke above 1.11, benefiting from dollar softness.

- JPY & Gold: Risk-off flows strengthened JPY and pushed gold above $2,050.

Crypto Market Implications

Lower yields and dovish Fed expectations typically boost crypto sentiment:

- Bitcoin (BTC): Holding above $61,000 support

- Ethereum (ETH): Gained 2.3% to $3,250

- Altcoins: DeFi and AI-related tokens saw modest inflows.

Risk Scenarios to Watch

| Scenario | Probability | Market Impact |

|---|---|---|

| CPI surprise upside | 35% | Negative for risk assets |

| Fed delays rate cut | 25% | Stocks sell off; yields spike |

| Geopolitical escalation | 20% | Flight to safety boosts gold, treasuries |

| Tech earnings beat | 20% | Nasdaq-led rally resumes |

Key Takeaways

- Weak August jobs data reshapes Fed policy expectations.

- Bond yields plunged, benefiting growth sectors.

- Forex and crypto markets positioned for potential upside.

- Traders should prepare for heightened volatility ahead of upcoming CPI and FOMC meetings.

Final Outlook

Markets are entering a pivotal phase where economic slowdown meets monetary easing bets. For traders, this is a double-edged sword:

- Opportunities exist in tech, utilities, and crypto.

- Risks remain in financials and small caps if recession fears intensify.

Pro Tip: Keep an eye on CPI data next week and the FOMC rate decision later this month—they’ll dictate short-term market direction.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F