What Is a Stock?

A stock is a financial security representing partial ownership in a company. When you buy a stock, you buy a “share” — a unit of ownership that gives you a claim on the company’s assets, earnings, and voting rights.

In other words:

If the company grows and becomes more valuable, so does your share.

Key characteristics of a stock:

- Represents partial ownership of a corporation

- Trades on public stock exchanges

- Gives shareholders the potential to profit from price increases

- May provide income through dividends

- Typically includes voting rights on major corporate decisions

A stock is not a loan to a company — that would be a bond. A stock is a slice of ownership.

How Stocks Work: Ownership, Rights & Corporate Structure

Owning stock usually gives you:

✔ Voting rights

Most common shareholders can vote on:

- Board of directors appointments

- Corporate policies

- Mergers or acquisitions

- Executive compensation proposals

Votes may occur annually or during special meetings.

✔ A share of earnings (dividends)

If the company distributes profits, shareholders receive dividends according to the number of shares they own.

✔ Residual claim on assets

If a company liquidates, shareholders get what’s left after creditors and bondholders are paid.

✔ Capital appreciation

As the business grows, its stock price may rise — increasing the value of your investment.

✔ Transferability

You can sell your shares anytime through an exchange.

Why Companies Issue Stock

Companies go public through an Initial Public Offering (IPO) to raise capital for growth.

Companies issue stock to:

- Expand operations

- Develop new products

- Pay off debt

- Acquire other companies

- Strengthen financial stability

- Improve public visibility and credibility

Selling stock allows businesses to raise money without taking on debt or paying interest.

How Stock Prices Are Determined

Stock prices change constantly due to supply and demand.

Major factors influencing stock prices include:

1. Company performance

- Revenue growth

- Profitability

- Market share

- Earnings reports

2. Investor sentiment

- Fear and greed

- News events

- Social media buzz

- Industry announcements

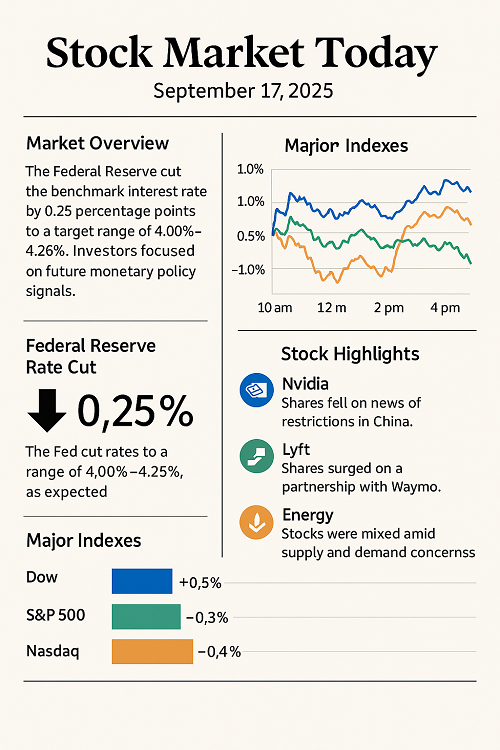

3. Economic conditions

- Interest rates

- Inflation

- GDP growth

- Employment data

4. Market liquidity

Higher trading volume usually reduces volatility.

5. Technical trading

Prices also react to:

- Chart patterns

- Support and resistance levels

- Algorithmic trading

- Momentum strategies

Ultimately, price = what buyers will pay and sellers will accept.

How Investors Make Money from Stocks

Investors can profit in two primary ways:

1. Capital Gains

When the price of your shares increases, you can sell them at a profit.

Example:

Buy at $50 → Sell at $80 = $30 profit per share

2. Dividends

Some companies pay regular cash distributions to shareholders, typically quarterly.

Additional profit sources include:

- Stock buybacks, which can boost share prices

- Dividend reinvestment, compounding returns over time

- Covered-call strategies for income investors

Types of Stocks Explained

A well-rounded investor should understand the major stock categories:

By Company Size (Market Capitalization)

- Large-cap (e.g., Apple, Microsoft)

Stable, blue-chip companies with global presence - Mid-cap

Growing companies with strong potential - Small-cap

High growth potential but higher risk

By Growth Characteristics

- Growth stocks

High-potential companies reinvesting profits (e.g., tech firms) - Value stocks

Stocks trading below perceived intrinsic value - Income stocks

High-dividend, stable businesses

By Sector

Examples include:

- Technology

- Healthcare

- Energy

- Consumer goods

- Industrials

- Finance

Diversifying across sectors helps lower risk.

Common vs. Preferred Stock

| Feature | Common Stock | Preferred Stock |

|---|---|---|

| Ownership | Yes | Yes |

| Voting rights | Usually | Rare |

| Dividend payments | Variable | Fixed or priority |

| Price volatility | Higher | Lower |

| Liquidation priority | Lowest | Higher than common |

Preferred stock behaves somewhat like a hybrid between stock and bond.

Stock Market Structure: Exchanges, Indexes & Trading Venues

Major U.S. Stock Exchanges

- NYSE (New York Stock Exchange)

- NASDAQ

- CBOE (Chicago Board Options Exchange)

Other regions include:

- LSE (London)

- TSE (Tokyo)

- HKEX (Hong Kong)

Key Stock Indexes

Indexes measure market performance:

- S&P 500

- Dow Jones Industrial Average (DJIA)

- NASDAQ Composite

- Russell 2000

Index performance often serves as the benchmark for portfolios.

Risks of Owning Stocks

Stocks offer high long-term returns but come with risks:

1. Market risk (volatility)

Prices can rise or fall quickly.

2. Business risk

Poor management or failing products can hurt a company.

3. Economic risk

Recessions, inflation, and high interest rates impact stock performance.

4. Liquidity risk

Some stocks are harder to sell at a fair price.

5. Emotional risk

Investors often damage their returns by reacting emotionally.

How to Evaluate a Stock

To make informed decisions, investors analyze stocks using two approaches.

Fundamental Analysis

This method studies the company’s financial health.

Key metrics include:

- Revenue & earnings growth

- Profit margins

- P/E ratio (price-to-earnings)

- Debt levels

- Free cash flow

- Return on equity (ROE)

Technical Analysis

This method studies chart patterns and price behavior.

Tools include:

- Trendlines

- Support/resistance

- Moving averages

- RSI and MACD

- Volume analysis

Technical analysis helps with timing buy/sell decisions.

Strategies for Investing in Stocks

1. Buy-and-hold investing

Best for long-term wealth creation.

2. Value investing

Buying undervalued companies.

3. Growth investing

Targeting high-expansion firms.

4. Dividend investing

Focusing on steady income generators.

5. Index investing

Buying an index fund to mirror a market’s performance.

6. Dollar-cost averaging

Investing a fixed amount regularly to smooth volatility.

7. Active trading (advanced)

Day trading, swing trading, and options strategies — higher risk, specialized skill required.

How to Buy and Sell Stocks

Investing in stocks is simple:

- Open a brokerage account

- Deposit funds

- Choose the stock you want

- Select the order type (market, limit, stop)

- Make the purchase

- Monitor your investment or set long-term strategies

Always maintain a diversified portfolio to reduce risk.

Frequently Asked Questions

Are stocks risky?

Yes — stocks fluctuate in value. However, historically they provide the highest long-term returns of major asset classes.

Do all stocks pay dividends?

No. Some companies reinvest profits into growth.

How many stocks should I own?

Most experts recommend 15–30 stocks across sectors — or a diversified index fund.

How long should I hold stocks?

Long-term investing (5+ years) historically produces the most reliable returns.

Final Thoughts

Stocks are powerful tools for building wealth, but understanding how they work is essential. By learning the fundamentals — from ownership rights and price dynamics to evaluation methods and investment strategies — you position yourself to make confident, informed decisions.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F