Warner Bros. Discovery (WBD) is a major player in global media, combining the publishing, studio, streaming, and network assets from the former WarnerMedia and Discovery. Investors interested in the performance of Warner Bros. Discovery can follow its progress under the NASDAQ ticker symbol nasdaq wbd.

- Formation: The merger of WarnerMedia (spun off from AT&T) and Discovery, Inc. officially closed in April 2022.

- Core brands: HBO / HBO Max (rebranded), Warner Bros., Discovery Channels, CNN, TBS, TNT, HGTV, etc.

- Rebranding & streaming emphasis: In 2025, WBD announced that its streaming service “Max” would revert to “HBO Max” to reinforce the premium content brand.

- Restructuring: WBD is reorganizing into two units — Streaming & Studios versus Global Linear Networks — to segregate growth vs. legacy assets.

This dual-structure aims to (a) isolate underperforming linear/cable networks from growth engines, and (b) unlock value via flexibility or eventual spin-offs.

usiness Divisions & Strategic Moves

To understand WBD’s future, you need to break down its business lines and how they are evolving.

Streaming & Direct-to-Consumer (DTC)

This is the growth engine:

- Subscriber growth: WBD targets ~150 million global DTC subscribers by end of 2026.

- Monetization levers: subscription pricing increases, premium tiers, ad-supported revenue, bundling, tackling password sharing.

- Content & IP: leveraging HBO, Warner Bros. content, DC franchises, and Discovery content for exclusive content.

- Geographic expansion & partnerships: licensing deals, joint ventures in emerging markets, minority investments (e.g., 30% stake in OSN streaming).

Studios & Production

Warner Bros. film & television production, licensing, catalog monetization, and content creation. This division is critical for IP leverage and content amortization.

Linear Networks & Legacy Cable / TV

Includes traditional channels (Discovery Channel, HGTV, TNT, TBS, etc.) which have been under pressure amid cord-cutting. WBD plans to segregate these legacy businesses to avoid dragging down the growth units.

2.4 Strategic Moves & M&A Speculation

- Potential buyout interest: There’s market speculation that Paramount / Skydance (backed by Larry Ellison / David Ellison) may bid for WBD.

- Spin-offs: The intention is to spin off or separate the linear networks arm as a standalone public entity.

- Brand pivot: Reverting to “HBO Max” branding to strengthen premium identity.

All of these moves are intended to unlock hidden value and simplify the corporate narrative for investors.

Recent Developments & Catalysts (2024–2025)

Below are the key recent events shaping WBD’s risk/reward:

| Date / Period | Development | Impact / Significance |

|---|---|---|

| Dec 2024 | Announced restructuring into two units | Signals strategic pivot, isolates underperformers |

| May 2025 | Rebranding “Max” → “HBO Max” | Enhances premium brand alignment |

| 2025 QX | Earnings & guidance for strong DTC growth | Bolsters optimism in streaming trajectory |

| 2025 | Speculated acquisition talk (Paramount / Skydance) | Could create M&A premium or increase volatility |

| 2025 | Analyst rating adjustments (downgrades, target revisions) | Reflects market reassessment of execution risk |

These recent developments are central to any forward-looking model: they either validate strategic intent or raise execution risks.

Fundamental Analysis

To understand value, we must dig into financials.

Revenue & Profit Trends

- WBD’s revenue is diversified across streaming, licensing, networks & distribution, and advertising.

- Some quarters show net losses (especially after content write-downs or integration costs).

- However, adjusted EBITDA and segment-level operating profit metrics are more relevant for investor focus.

Balance Sheet & Cash Flow

- Debt levels: WBD holds significant debt from the merger and previous acquisitions—managing leverage and interest cost is critical.

- Free cash flow (FCF): Generation of stable FCF from content licensing, studio profit, and streaming monetization is needed to support growth investments.

Margins & Segment Performance

- Streaming margins tend to be lower initially, due to content costs (amortization, production, marketing). Over time, they should improve with scale.

- Legacy network margins are declining due to cord-cutting and advertising compression.

- Studios / licensing provide good margin and high returns on IP.

Putting it all together, WBD is in a transition — some parts are mature and pressured, others are high growth but capital intensive.

Valuation & Analyst Outlook

Analyst Sentiment & Price Targets

- Some bullish views: Analysts see upside as streaming and spin-out strategies unlock value.

- But caution exists: TD Cowen downgraded WBD from “Buy” to “Hold,” citing that some of the recent run-up is speculative.

- Some target prices are well below current levels (e.g. $14) to reflect downside risk in case execution falters.

- Others raise targets to $22 or more if streaming outcomes and M&A potential materialize.

Valuation Metrics & Peer Comparison

- P/EBITDA, EV/EBITDA, PEG ratio (adjusted for growth) are relevant metrics.

- Compare WBD to peers: Disney, Netflix, Comcast, Viacom (Paramount) — each has different risk profiles in streaming, content library, and network exposure.

- Discounted cash flow (DCF) models may hinge heavily on assumptions about subscriber growth, churn, content amortization, and margin expansion.

Given the transformation underway, valuation is high-variance: if streaming and spin-out succeed, upside is meaningful; if not, downside is significant.

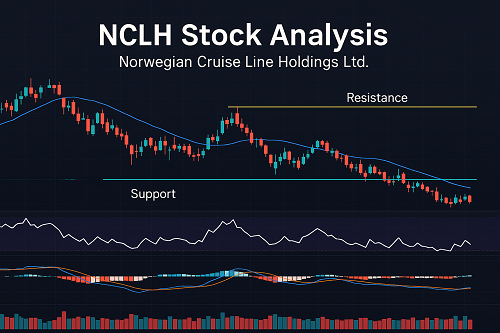

Technical / Chart & Price Patterns

While the Yahoo page offers a basic chart, a deeper technical look is necessary (preferably with interactive charts). Some key observations:

- Support / resistance zones: Look at historical levels in the $17–$20 range as critical zones.

- Trend lines & channels: Determine whether WBD is in an uptrend, consolidation, or potential reversal.

- Volume confirmation: Spikes in volume often accompany earnings, news, or restructuring announcements — those validate technical moves.

- Moving averages (50-day, 200-day), RSI, MACD: Use these indicators to gauge momentum and overbought/oversold conditions.

Without embedding the live chart here, the key is: combine fundamentals and technicals — if the price breaks above key resistance on strong volume, it could spur continuation; if it fails, downside risk increases.

Risks & Challenges

No analysis is complete without acknowledging what can go wrong. Key risks for WBD:

- Execution risk: Streaming scaling, content cost overruns, or underperforming content may erode investor confidence.

- Regulatory / antitrust: If acquisition or merger discussions proceed, regulators might impose constraints or block deals.

- Legacy businesses drag: The linear network side, if not properly separated, may weigh down valuation and earnings.

- Debt burden & interest rates: High debt and rising interest rates could stress leverage.

- Competition: Netflix, Disney+, Amazon, Paramount, Apple — the streaming & content battle is fierce.

- Subscriber churn / saturation: If user growth plateaus or churn accelerates, monetization assumptions may fail.

- M&A speculation backlash: If acquisition rumors do not materialize, investor sentiment may turn negative.

SWOT Summary

| Strengths | Weaknesses |

|---|---|

| Strong IP library (HBO, Warner Bros.) | High leverage and integration complexity |

| Ambitious streaming growth plan | Legacy cable/networks under pressure |

| Strategic restructuring could unlock value | Execution & content cost risk |

| M&A interest could deliver takeover premium | Highly competitive media landscape |

| Opportunities | Threats |

|---|---|

| Spin-offs or breakups to unlock value | Regulatory barriers or failed deals |

| Monetization via advertising, bundling, international growth | Streaming saturation or consumer fatigue |

| Strategic partnerships & content licensing | Content cost inflation or poor hits |

Price Forecasts & Scenarios

We can establish three broad scenarios:

- Base Case (“Execution Success”)

- Assumes streaming growth meets targets, margins improve, spin-off plan yields valuation uplift.

- WBD trades toward premium valuations — target range: $22–$25+

- Bear Case (“Underperformance / Execution Fail”)

- Streaming growth disappoints, legacy drag remains, debt weighs.

- Multiple compression and negative sentiment — target range: $12–$16

- Bull Case (“Acquisition / Break-up Premium”)

- A buyout or bidding war (e.g. Paramount / Skydance) triggers premium valuation.

- Could push toward $24–$28+, depending on deal terms.

These forecasts depend heavily on assumption inputs: growth rates, margins, discount rates, risk premiums, and success of restructuring.

How to Trade or Invest WBD

Long-Term Investors

- Use WBD as a speculative growth / turnaround play, expecting multi-year value realization.

- Dollar-cost average to manage volatility.

- Monitor streaming metrics, spin-out progress, and M&A signals.

Medium-Term / Swing Traders

- Trade around news catalysts (earnings, announcements, deal rumors).

- Watch technical breakouts or breakdowns around support/resistance.

- Use options for directional plays (calls/puts) depending on conviction.

Risk Management

- Limit exposure (single-position sizing).

- Use stop-loss orders—especially given volatility.

- Be cautious on hype-driven moves (like acquisition speculation) that reverse if rumors don’t materialize.

Frequently Asked Questions (FAQ)

Q: Is WBD a “good buy” now?

A: It depends on your risk appetite. WBD has potential upside via streaming and restructuring, but has execution and legacy risks. Entry should be based on comfort with volatility and long time horizons.

Q: When will the spin-off / separation of linear networks happen?

A: Management aims for a mid-2025 to mid-2026 timeline for reorganization and potential spin-off.

Q: Could WBD be acquired?

A: Yes, there is active speculation that Paramount / Skydance may bid. But nothing is confirmed, so this is a risk/opportunity variable.

Q: How does WBD compare to Netflix or Disney?

A: WBD is more leveraged to legacy networks and restructuring risk; Netflix is pure streaming, while Disney has hybrid assets. Each has different risk/reward profiles.

Q: What metrics should I watch quarterly?

A: Subscriber growth (net adds, churn), average revenue per user (ARPU), content amortization expenses, free cash flow, EBITDA margins, and debt servicing.

Conclusion & Investment Thesis

Warner Bros. Discovery (WBD) is currently in the midst of a highly strategic transformation. The key question for investors is whether its streaming and content ambitions can outpace the drag from legacy networks and the burden of debt.

- If execution succeeds, streaming and spin-out strategies can unlock meaningful value and drive the stock upward.

- If execution falters, that could compress multiples and lead to downside scenarios.

- The M&A speculation adds a layer of optionality — but also volatility.

For risk-tolerant investors with a multi-year horizon, WBD represents a high-upside gamble on media’s future. For more conservative players, waiting for clearer signs of execution or strategic clarity may be prudent.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F