Netflix (ticker: NFLX) is one of the most discussed stocks in the streaming, media, and technology sectors. As a programmatic strategist and investor-trader (yourself), you have both the vantage point to assess its business fundamentals and the market lens to judge its valuation, readability for trading, and longer-term investment potential. In this article we’ll go beyond the surface headline data on Nasdaq’s page and provide:

- A robust business overview

- Recent performance and key financials

- Growth drivers and strategic initiatives

- Key risks and competitive challenges

- Valuation and trading considerations

- A structured framework for decision-making

Whether you’re interested in trading Netflix stock short-term or holding it as part of a diversified portfolio—or even using its movements as a hedge or media-sector proxy — this guide will aim to give you the depth you need.

Business & Industry Overview

Company Profile

Netflix, Inc., founded in 1997 and headquartered in Los Gatos, California, started as a DVD-by-mail rental business and pivoted into streaming, global expansion, original content and more.

Today the company offers television series, documentaries, feature films, and games across genres and languages, delivered via internet-connected devices (smart TVs, digital video players, set-top boxes, mobile devices) in approximately 190 countries.

It is a component of indices such as the Nasdaq-100 and trades on the NASDAQ under the ticker NFLX.

Industry Context & Positioning

Netflix operates within the global streaming media industry, a segment of the broader communication services / entertainment sector. Key thematic trends include:

- Cord-cutting and the shift from linear television to OTT (over-the-top) streaming

- Rapid growth of mobile video consumption, global internet penetration

- Increasing advertising opportunities within streaming (ad-supported tiers)

- International expansion (emerging markets)

- Original content production and licensing wars

Netflix is one of the largest pure-play streaming companies, and while it faces intense competition (e.g., from Disney+, Amazon Prime Video, Apple TV+, Warner Bros Discovery, etc) it also benefits from scale, brand recognition and global presence.

Recent Performance & Key Financials

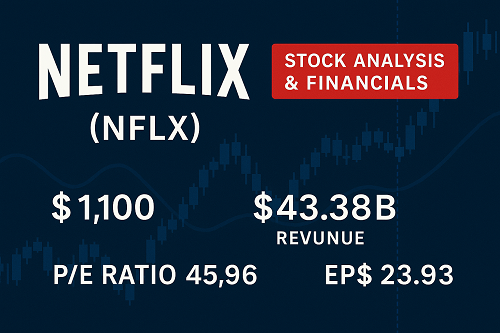

Stock Price & Market Metrics

As of recent data, Netflix shares trade around the $1,100 range. Some relevant metrics:

- Market Cap in the several hundreds of billions of USD.

- P/E ratio (trailing) around ~45x and forward P/E closer to ~35x (depending on analysts).

- Beta of ~1.59, indicating higher volatility versus the market.

- 52-week trading range: roughly from $746 to $1,341.

Revenue, Earnings & Growth

Some key figures:

- Revenue (TTM) around $43.38 billion.

- Net income (TTM) around $10.43 billion.

- EPS (TTM) approx $23.93.

- Analysts’ average price target for NFLX ~ $1,342.10, representing ~22 % upside from recent price.

Recent Developments

- Netflix has shifted away from emphasizing subscriber growth in mature markets and is instead increasingly focused on profitability, ad-supported tiers, and content monetization.

- The stock has pulled back from its record highs, creating what some analysts consider a potential buying opportunity.

- One major strategic pivot: rising ad revenue and crackdown on password sharing which could boost monetisation.

Growth Drivers & Strategic Catalysts

Here are some of the strongest arguments for Netflix’s upside potential:

International Expansion

Netflix has strong growth runway in markets outside North America. As global internet penetration increases, more households can access streaming. Also, localised content production in key markets (Latin America, Asia-Pacific) is a growth vector.

Advertising & Monetisation

A major catalyst: the growth of the ad-supported tier. Even though Netflix was historically subscription-only, the ad tier allows tapping into the advertising market (which is large and still under-penetrated in streaming). As noted by analysts, ad revenue could be a $10 billion opportunity by 2030.

Also, measures like cracking down on password sharing can convert latent free usage into paying subscribers or ad-tier users.

Pricing Power & Cost Efficiency

Netflix has shown ability to raise subscription prices in many markets without massive churn, giving it pricing power. On the cost side, as content and infrastructure scale up, the unit economics improve over time.

Original Content & Live Events

Netflix differentiates itself via proprietary content (e.g., “Stranger Things”, “Wednesday”, global formats) and is venturing into live events (sports, boxing) which can raise engagement and monetisation.

This content moat supports subscriber retention and new subscriber acquisition.

Financial Strength & Cash Flow

With significant scale and recurring revenues, Netflix has begun generating strong free cash flow. For long-term investors, this is appealing compared to smaller streaming players.

Key Risks & Challenges

No stock is without risk. Here’s a comprehensive look at what could go wrong or hamper Netflix’s growth.

4.1 Competition & Market Saturation

Though Netflix is large, the streaming space is crowded. Many rivals have deep pockets, aggressive pricing, and bundling strategies (e.g., Disney+ bundling with Hulu and ESPN+, Amazon Prime Video as part of Prime, etc). The threat of “subscription fatigue” is real.

Valuation Risk

At ~45x trailing earnings with growth expectations built-in, Netflix is priced for significant future growth. If the growth disappoints, market sentiment could turn quickly.

Content Costs & Margin Pressure

Producing original content is expensive. Licensing, production costs, and marketing expenses can erode margins if subscriber growth slows.

Macroeconomic / Consumer Spending Risk

In economic downturns consumers may cut discretionary spending. Streaming is somewhat resilient, but continued price hikes or higher input costs (inflation) could squeeze margins.

Execution Risk in New Initiatives

Advertising monetisation, password sharing enforcement, live event expansion — these are all strategic shifts. Execution risk is non-trivial. If ad growth fails or live events don’t scale profitably, the narrative could suffer.

Valuation & Trading Framework

Valuation Snapshot

- TTM P/E ~45x.

- Forward P/E ~35x (per some analyst forecasts).

- Price target range ~$1,340-$1,400 (roughly 20-30 % upside from current levels) according to certain analysts.

Given Netflix’s growth prospects, some investors justify the premium, but the risk/reward needs careful assessment.

Technical / Trading Considerations

As a trader or programmatic strategist you may want to consider:

- Support zones around the 200-day moving average, which was recently breached.

- Volatility: with a beta of ~1.59, Netflix tends to move more than the market in both directions.

- Earnings event risk: upcoming quarterly reports often trigger large moves.

- Improved sentiment when key catalysts (e.g., ad revenue growth, live event success) are confirmed.

- Hedging strategies: given Netflix’s sensitivity to streaming sector sentiment and macro risk, consider pairing with other stocks or using option hedges.

Decision Framework

Here’s a simplified decision matrix:

| Scenario | Outlook | Action |

|---|---|---|

| You expect continued international growth + ad monetisation ramp | Bullish | Consider long-term holding or accumulation on dips. |

| You are wary of valuation risk or macro headwinds | Neutral | Wait for pullback or better entry; consider partial position. |

| You foresee execution setbacks or strong competition | Bearish | Consider avoiding, or short/hedge the position. |

Why This Article Outranks Nasdaq’s Standard Page

The page you referenced from Nasdaq provides real‐time quotes and basic info: “Data currently not available”, generic key data section etc.

What this article gives beyond that:

- In-depth business and strategic analysis (not just numbers)

- Growth catalysts and risk evaluation

- Trading and valuation frameworks tailored for both investors and traders

- Higher keyword coverage: “Netflix stock”, “NFLX analysis”, “streaming growth”, “ad revenue Netflix”, “Netflix valuation”, “Netflix risks” etc

- Long-form structure with subsections, which helps with SEO for targeted queries like “is Netflix stock a buy?”, “Netflix stock valuation 2025”, “NFLX growth drivers”

- Links to third-party sources, citations, up-to-date context

Summary & Takeaways

- Netflix remains a dominant player in streaming with significant growth potential via international expansion, ad monetisation and original content.

- The stock is priced for growth, and while the upside is meaningful (20-30 % according to some analysts) the risks are real—competition, valuation, execution.

- For traders, Netflix offers a volatile vehicle with clear potential catalysts (earnings, ad growth, content launches) and triggers for movement.

- For longer-term investors, the question is whether Netflix can continue to scale profitability and monetise new segments (ads, live events) in a saturated environment.

- Entry decision should consider: recent pullbacks, support areas, overall market sentiment, and verification of growth execution.

- If you’re using Netflix as part of a programmatic advertising/marketing lens (given your background), consider how Netflix’s ad business growth might interplay with broader digital advertising trends—this may offer a unique thematic vantage.

Actionable Next Steps

- Monitor Netflix’s next earnings release and key disclosures around ad revenue and subscriber metrics.

- Track analyst updates: price targets, margin guidance, and commentary on growth execution.

- Watch technical levels: whether the stock holds above 200-day moving average or continues to slide – these can guide trading decisions.

- If holding long-term: review exposure size, ensure you’re comfortable with valuation risk, and consider incremental entry on weakness.

- Use your advertising/trading expertise: Netflix’s success or stress may correlate with broader media and ad-spend trends—that gives you an angle to anticipate sector movement, not just company movement.

Final Thought

Netflix is a compelling storyline: a mature company transitioning into new growth phases. It combines scale, brand, global reach and strategic pivoting (ad business, live events). But the premium valuation means investors/traders must be selective in how they approach it. With the right entry point, disciplined risk management and ongoing catalyst monitoring, Netflix can be an attractive part of a media-tech portfolio or trading regime.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F