Executive Summary & Key Takeaways

- Marvell Technology (MRVL), listed on the Nasdaq, is a semiconductor / data infrastructure company positioned at the intersection of cloud, AI, networking, and storage.

- The stock has seen significant upside in recent quarters thanks to AI-driven demand, but faces valuation and margin risk given competitive and macro pressures.

- Based on current fundamentals, a base case fair value lies in a range below the recent highs, with potential upside depending on execution and secular tailwinds.

- From a trading standpoint, MRVL offers volatile opportunities, ideal for swing or momentum strategies with well-defined risk controls.

- Key risks include cyclicality of semiconductors, supply chain constraints, geopolitical exposure (especially China), and margin compression.

These takeaways will be unpacked and supported through deeper sections below.

Company Overview & Business Segments

Business Model & Positioning

Marvell (NASDAQ: MRVL) is a fabless semiconductor company that designs, develops, and sells high-performance chips and systems for data infrastructure. Its product suite covers:

- Ethernet controllers, switches, transceivers, and network interface devices

- Storage controllers (HDD / SSD controllers, NVMe, NVMe over Fabrics)

- Interconnect & optical technologies (e.g. silicon photonics, DSPs, laser drivers)

- Custom ASIC / SoC solutions for cloud, AI, telecom, and edge workloads

It operates globally, with customers across cloud service providers, hyperscale data centers, enterprise networking, and communications infrastructure.

Recent Strategic Moves & Acquisitions

Marvell has grown via both organic development and strategic acquisitions (e.g. Cavium, Inphi, Aquantia, Innovium). These moves help it broaden into high-growth domains such as AI acceleration, coherent optics, and next-generation networking interconnects.

By stacking multiple technology layers—digital, analog, mixed-signal, DSP, optics—Marvell aims to offer vertically integrated platforms rather than standalone chips, thus capturing more margin along the stack.

Revenue Breakdown & Margin Profile

Exact breakdowns vary quarter to quarter, but key metrics to monitor:

- Revenue by End Market: Data Center / Cloud, Enterprise Networking, Storage

- Gross Margin Trends: Reflects product mix, scaling, and cost of goods

- Operating Margin / R&D Investments: Reflects investment in next-gen architectures and competition

In the latest trailing-12-month period, Marvell reports revenue of ≈ USD 7.23 billion and a net loss (–USD 103 million) primarily due to elevated costs or write-downs.

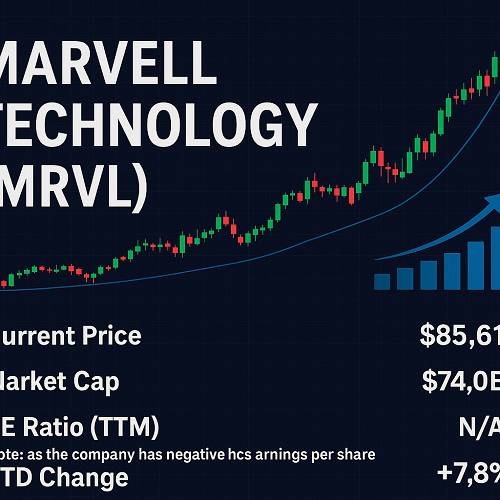

MRVL Stock at a Glance (Fundamentals & Valuation)

Key Metrics

Here’s a snapshot of MRVL’s relevant financial and valuation metrics (as of latest reporting):

| Metric | Value | Notes / Interpretation |

|---|---|---|

| Share Price | ~$85.61 (as of Oct 10, 2025) | Volatile swings possible around earnings or guidance |

| Market Capitalization | ≈ USD 73.8–74 billion | Large-cap in semiconductor space |

| PE Ratio (TTM) | Negative / not meaningful (due to net loss) | Watch forward P/E instead |

| Forward P/E | ~ 25–30× (analyst consensus) | Depends heavily on margin recovery |

| Price / Book | ~5.5× | Indicates premium over book value |

| Price / Sales | ~8–11× (varies by source) | Reflects high expectations |

| Debt / Equity | Moderate (e.g. ~0.35x to 0.5x) | Leverage manageable |

| Cash / Liquidity | ~$1.2 billion in cash / equivalents (mrq) | Cushion for investments or downturns |

| Beta / Volatility | ~ 1.9 – 2.0 (5-yr monthly) | High volatility, reactive to macro / semiconductor cycles |

Interpretation

- MRVL trades at premium multiples (P/B, P/S) relative to many traditional semiconductor names, reflecting its growth expectations and involvement in high-growth domains (AI, optical).

- The negative trailing P/E is a red flag; investors must lean on forward earnings estimates, margin recovery, and guidance.

- The substantial cash balance gives the company flexibility to invest, buy back shares, or weather downturns, but it must avoid overleveraging.

Growth Drivers & Risk Factors

Growth Drivers (Bull Case)

- AI / Data Center Boom

As AI workloads scale, demand for high-throughput interconnects, optical switching, retimers, and custom ASICs increases. Marvell stands to benefit if it can secure design wins. - Interconnect / Optical Innovation

Its push into coherent optics, silicon photonics, DSP-driven optical modules, and retimer technologies could unlock higher-margin growth. - Vertical Integration & Custom Solutions

Clients may prefer end-to-end stacks (digital + analog + optics). If Marvell continues to integrate more layers, it captures more margin and value. - Aggressive Buyback / Capital Return

The company has authorized large share repurchase programs, which, if deployed smartly, can boost EPS and provide shareholder value. - M&A & Strategic Acquisitions

Smart acquisitions can fill gaps and accelerate entry into adjacent growth segments.

Risk Factors & Bearish Considerations

- Cyclicality & Macro Downturns

The semiconductor sector is notoriously cyclical. A downturn in cloud spending, capex cuts, or macro recession can hurt revenues. - Margin Compression

Rising component, wafer, or logistics costs could squeeze margins if product mix shifts or competition intensifies. - Supply Chain & Geopolitical Exposure

Dependency on advanced foundries, China / Taiwan exposure, export controls, trade policy shifts, and chip sanctions pose material risks. - Execution Risk & Design Win Delays

If Marvell fails to deliver or its roadmap lags, clients may switch or delay purchases. - Valuation Sensitivity

Given high multiples baked in, any negative surprise (earnings miss or guidance cut) may lead to sharp downside.

Technical / Price Analysis & Trading Strategy

Price Behavior & Volatility

MRVL tends to exhibit strong intra-quarter volatility, especially around earnings or guidance announcements. A high beta (≈ 1.9–2.0) suggests it often overshoots on both sides.

It also exhibits momentum characteristics: when locked into an uptrend, it can run sharply, but equally liable to overcorrect.

Key Technical Levels (Hypothetical Example)

(These are illustrative; for live trading use charting tools.)

- Support Zones: Historically around $70, $50

- Resistance Zones: 52-week high near ~$127 (strong resistance)

- Moving Averages: 50-day MA, 200-day MA intersections

- Trendlines & Channels: Use high-low pivots to draw channels

- Volume Profile / Breakout Confirmation: Watch for volume confirmation on breakouts or breakdowns

Suggested Trading Approaches

- Momentum / Swing Trades

- Enter near pullbacks within a confirmed uptrend

- Use tight stop losses (e.g., 3–5%)

- Target partial profits near resistance or trendline breaks

- Event-Driven Plays (Earnings / Guidance)

- Trade straddle or directional bias leading into earnings

- Be wary of implied volatility crush post-earnings

- Range / Mean-Reversion

- In sideways or choppy markets, fade extreme moves toward support or resistance bands

- Use oscillators (RSI, MACD) for entry confirmation

- Tactical Hedging / Covered Calls

- If holding long-term, sell out-of-the-money calls to generate income or downsize risk

Risk controls are essential given the stock’s volatility: always size position relative to risk (e.g. max 1–2% of portfolio loss per trade).

Institutional, Insider, and Ownership Trends

Institutional Ownership

Institutional investors (mutual funds, hedge funds) hold significant stakes in MRVL. Changes in their allocations can drive substantial flows. Watch for:

- 13F filings

- Dark pool activity

- ETF inclusion / exclusion events

Insider Activity

Executive and board member buying or selling can signal confidence (or concern). Monitor:

- Open market purchases

- Stock option exercises

- Sales following major announcements

A string of insider buys, especially before product launches or earnings, can be a positive signal; conversely, heavy selling before guidance cuts is a red flag.

Comparative Peer & Sector Context

To assess MRVL’s relative strength and valuation, compare against peers such as NVIDIA (NVDA), Broadcom (AVGO), Micron (MU), Intel (INTC), Qualcomm (QCOM).

Peer Metrics Snapshot

| Ticker | Domain / Specialty | Forward P/E | Price / Book | Growth Prospects / Weakness |

|---|---|---|---|---|

| NVDA | AI GPUs / AI infrastructure | High premium | Premium | Strong AI moat, but high valuation risk |

| AVGO | Communications / infrastructure | Moderate | High | Balanced mix; stable dividends |

| MU | Memory / storage | Cyclical | Lower | Sensitive to memory cycles |

| INTC | CPUs / chips | Low to moderate | Moderate | Legacy challenges, process delays |

| QCOM | Mobile / chips / licensing | Premium | Premium | Licensing risk, but stable cash flows |

In such context, MRVL’s valuation appears aggressive. Its success hinges on delivering above-average growth, margin expansion, and defensibility in AI / data infrastructure.

If MRVL can sustain 20–30% revenue growth for several years and gradually improve margins, it can justify its multiples. But relative underperformance or execution missteps may lead to a gap-down relative to peers.

Scenario Forecasts & Valuation Models

Base Case (Moderate Growth)

- Revenue growth: 15–25% CAGR next 3–5 years

- Operating margins: expand from negative to low double digits

- Discount rate (WACC): ~8–10%

- Terminal growth: ~3%

Under this, discounted cash flow (DCF) yields a fair value in the $65–$95 range (depending on assumptions).

Bull Case (Aggressive AI Upside)

- Strong AI / data center wins

- High-margin products scale faster

- Margin expansion > 15%

- Multiple expansion (P/E 30–35×)

In this scenario, MRVL could re-test or exceed prior highs (e.g. ~$120+).

Bear Case (Execution / Macro Downturn)

- Slower revenue growth

- Margin erosion

- Multiple contraction

Fair value might fall into the $40–$60 zone (or lower) if tails unravel.

It’s wise to run different valuation models (DCF, multiples, comparables) under varying assumptions to create a valuation band, not a single point.

Catalysts & What to Watch

Upcoming Catalysts

- Earnings releases & guidance revisions — watch for margin outlook and bookings

- Major design wins or AI data center contracts

- New product announcements in optics / AI accelerators

- Share buyback or dividend policy changes

- Macro or policy changes affecting semiconductors, export controls, or capex cycles

Key Metrics to Monitor

- Bookings backlog / revenue visibility

- Gross margins & product mix

- R&D efficiency (R&D to revenue)

- Capex / capital structure

- Client concentration & risk

- Insider / institutional buying activity

Conclusion & Investment Thesis

Marvell Technology (MRVL) is a high-potential, high-risk play in the semiconductor / data infrastructure space. It is well positioned to ride secular trends in AI, cloud, and interconnect technologies, but must execute flawlessly in a competitive and cyclical sector.

- For growth-oriented investors / traders: MRVL can be a compelling vehicle for upside, especially if one times exposure around catalysts. But volatility demands discipline and risk control.

- For cautious or income investors: The valuation remains aggressive, and downside risk is nontrivial—so position sizing and hedging are key.

- For long-term holders: If Marvell executes its roadmap, margins expand, and multiple expansion remains favorable, it could deliver 2x+ from current levels over multiple years.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F