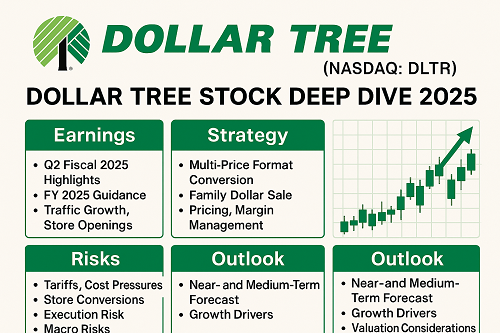

Dollar Tree’s Crucial Moment in 2025

Dollar Tree, Inc. (NASDAQ: DLTR) stands at a pivotal point in 2025. Once known for its iconic $1 pricing model, the discount retailer has evolved into a multi-price powerhouse adapting to modern inflationary realities. As consumers increasingly seek value in a high-cost economy, Dollar Tree’s transformation into a more flexible “3.0” store format has reshaped its growth trajectory — and caught Wall Street’s attention.

With over 16,000 stores across North America, the company competes directly with Walmart, Dollar General, and other value-retail heavyweights. Yet, as inflation pressures ease and tariffs return to the headlines, investors are re-evaluating whether DLTR remains a defensive play or if headwinds could limit its rebound potential.

This analysis delivers a comprehensive, data-driven view of Dollar Tree’s financial performance, valuation, strategic direction, and 2025-2026 outlook for both long-term investors and active traders.

Company Overview: From $1 Stores to Multi-Price Growth

Founded in 1986 and headquartered in Chesapeake, Virginia, Dollar Tree built its reputation as a single-price retailer. The brand’s simplicity — every item for one dollar — made it a favorite among price-conscious shoppers. However, persistent cost inflation and supply-chain disruptions forced a strategic shift.

Today, Dollar Tree operates under two major banners:

- Dollar Tree: Transitioned to a multi-price model (typically $1.25–$5.00) offering higher-margin products and brand-name goods.

- Family Dollar: Targets low-income urban and rural markets with a broader grocery and household goods assortment.

Together, these brands reach more than 150 million shoppers annually across the U.S. and Canada.

Key competitive advantages include:

- A strong private-label portfolio (especially in consumables).

- Dense store footprint near urban and rural populations.

- Efficient logistics supported by 25+ distribution centers.

- Loyal customer base driven by perceived value.

Recent Financial Performance: Revenue Growth Amid Cost Pressure

Second-Quarter FY 2025 Results (Reported Sept 2025)

Dollar Tree’s Q2 FY 2025 results showcased both strength and vulnerability:

| Metric | Result | YoY Change | Commentary |

|---|---|---|---|

| Revenue | $7.7 billion | +6.5% | Driven by same-store sales growth and store expansion. |

| Comparable Sales | +6.3% | ↑ from +4.8% last year | Customer traffic up 3%, average ticket +2%. |

| EPS (Adjusted) | $1.46 | −4% | Margin compression from tariffs and wage increases. |

| Gross Margin | 31.4% | −120 bps YoY | Reflects multi-price rollout costs. |

| Operating Income | $710 million | −2% | Despite sales growth, costs offset gains. |

Management reaffirmed FY 2025 revenue guidance of $31.5 – $32.0 billion and adjusted EPS of $6.40 – $6.70.

Strategic Transformation: The “3.0” Era and Portfolio Streamlining

1. Multi-Price Conversion (Store 3.0 Program)

Dollar Tree’s most critical initiative is the conversion of all stores to a multi-price format, allowing prices above $1.25 for premium or bulky items. By Q2 2025, over 70% of U.S. locations had adopted the model.

Benefits include:

- Expanded merchandise mix (food, home décor, health & beauty).

- Improved average transaction value.

- Better cost flexibility and sourcing efficiency.

2. Family Dollar Divestiture

In early 2025, Dollar Tree announced plans to sell Family Dollar — a move long urged by investors frustrated with underperformance. The sale, expected to fetch over $1 billion, allows management to refocus capital on higher-margin core operations.

3. E-Commerce & Private Label Focus

The company continues expanding its online bulk ordering platform and exclusive private-label lines to boost repeat sales and margins.

4. Supply-Chain Investments

Upgrades to automated distribution centers aim to reduce shrinkage and logistics costs, enhancing profitability over the next 24 months.

Investment Thesis: Why DLTR Still Appeals to Value-Oriented Investors

Despite margin pressures, Dollar Tree remains one of the most resilient retailers in an uncertain economy.

Key Bull Points

- Defensive Business Model: Discount retail thrives in downturns as consumers “trade down.”

- Earnings Recovery Potential: Margin expansion expected as tariff effects fade.

- Operational Simplification: Family Dollar divestiture may unlock shareholder value.

- Cash Flow Strength: Consistent operating cash flows support repurchases and capital upgrades.

Financial Snapshot (FY 2025 E)

| Metric | Value |

|---|---|

| Revenue | $31.8 B |

| EPS (Adj.) | $6.55 |

| Operating Margin | 7.8% |

| Store Count | 16,300+ |

| Cash on Hand | $1.6 B |

| Debt/Equity | 0.55 |

At a forward P/E of ~17×, DLTR trades below its 5-year average (≈ 21×), implying potential multiple expansion if earnings stabilize.

Risks & Headwinds: What Could Go Wrong

- Tariffs & Cost Inflation:

Renewed import tariffs on Chinese goods in 2025 could squeeze margins, especially for seasonal and household categories. - Execution Risk on Store Conversions:

Rolling out new formats across thousands of stores increases operational complexity and capex. - Wage & Occupancy Inflation:

Rising labor costs and real estate expenses may offset top-line growth. - Consumer Spending Slowdown:

A cooling economy or improved job market could shift shoppers back to mid-tier retailers. - Competition:

Dollar General and Walmart aggressively expand small-format stores targeting the same demographic.

Technical and Market Sentiment Analysis

DLTR stock has traded between $98 – $156 over the past 12 months. As of October 2025, shares hover near $122, roughly 15% below their 200-day moving average — suggesting value accumulation territory for contrarian investors.

Key technical levels:

- Support: $115 – $118

- Resistance: $135 – $140

- RSI: 42 (bullish divergence potential)

Analyst consensus remains “Moderate Buy” with an average price target around $152, implying ~25% upside. Institutional ownership remains high at 95%, reflecting continued long-term confidence.

Peer Comparison: Discount Retail Landscape

| Company | Ticker | FY 2025 Revenue (B) | Gross Margin | Forward P/E | YTD Perf |

|---|---|---|---|---|---|

| Dollar Tree | DLTR | $31.8 | 31% | 17× | −8% |

| Dollar General | DG | $39.2 | 30% | 18× | −4% |

| Five Below | FIVE | $3.9 | 36% | 22× | +6% |

| Walmart | WMT | $660 | 25% | 23× | +12% |

Dollar Tree’s valuation remains compelling relative to peers given its restructuring and efficiency upside.

2025–2026 Outlook: Rebound Potential and Catalysts

- Store Conversion Completion: Expected by late 2026, driving revenue per store higher.

- Margin Expansion: Management targets a +150 bps margin improvement post-tariffs.

- EPS Growth Forecast: Analysts project +12–15% CAGR through 2028.

- Capital Allocation: Share repurchases expected to resume in 2026 once divestiture proceeds are realized.

- Macro Tailwinds: Persistent consumer focus on affordability amid sticky inflation supports demand.

Valuation and Trading Perspective

| Metric | Value | Comment |

|---|---|---|

| Current Price (Oct 2025) | ≈ $122 | Near 52-week midpoint |

| Fair Value (DCF Estimate) | $150–$155 | Assuming 8% WACC, 3% LT growth |

| Upside Potential | ≈ 25% – 30% | If EPS > $6.70 and margins recover |

| Dividend Yield | None | Company prioritizes reinvestment and buybacks |

Investor takeaway: DLTR offers a reasonable entry point for medium-term investors seeking exposure to the value retail sector without overpaying for growth.

Conclusion: Dollar Tree’s Transition May Define Its Next Decade

Dollar Tree’s 2025 transformation is more than a reaction to inflation — it’s a complete redefinition of its brand promise. The company’s shift to multi-price formats, coupled with the potential Family Dollar exit, sets the stage for higher profitability and operational focus.

While near-term volatility remains likely due to tariffs and macro noise, the longer-term fundamentals — efficient scale, loyal customers, and disciplined capital use — support a constructive outlook.

For investors comfortable with short-term swings, DLTR offers an attractive mix of defensive resilience and strategic growth heading into 2026 and beyond.

FAQs About Dollar Tree (DLTR)

Q1: What is Dollar Tree’s next earnings date?

Expected in December 2025 (Q3 FY 2025 results).

Q2: How many stores does Dollar Tree operate?

As of Q3 2025, approximately 16,340 stores across the U.S. and Canada.

Q3: What is the “Store 3.0” format?

It allows flexible price points ($1.25 – $5.00+) and expanded assortments for seasonal, household, and consumable items.

Q4: Does Dollar Tree pay a dividend?

No. The company focuses on share buybacks and debt reduction instead.

Q5: How does Dollar Tree compare to Dollar General?

Dollar Tree’s multi-price approach offers slightly higher gross margins but lower comps stability than Dollar General’s broader grocery model.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F