In a market crowded with technology names, Apple Inc. remains one of the most relentlessly watched stocks. With a market capitalization exceeding $4 trillion and a presence across smartphones, wearables, services and now artificial intelligence, Apple is both a legacy tech powerhouse and a key play in emerging trends.

For investors and traders alike, understanding Apple requires bridging its established ecosystem with its next-wave opportunities — from iPhone upgrades to AI, services monetization and global expansion.

This article offers a deep dive into Apple’s current status, the upside potential, the risks, and how to approach it in your portfolio or trading plan.

Primary keyword / focus phrase: Apple Inc. stock analysis 2025

Secondary keywords: AAPL stock price, Apple growth drivers, Apple valuation, best tech stocks to buy, Apple vs competitors.

Company Overview & Business Model

Corporate Profile

- Apple Inc., founded in 1976 by Steve Jobs, Steve Wozniak and Ronald Wayne, is now headquartered in Cupertino, California.

- The company trades under the ticker AAPL on the NASDAQ.

- It is a multinational technology company with hardware (iPhone, iPad, Mac, Apple Watch, AirPods), software (iOS, macOS), and services (App Store, Apple Music, Apple TV+, iCloud).

Business Segments & Revenue Sources

- Devices: The iPhone remains the core — contributing roughly half of total revenue in recent years.

- Wearables, Home & Accessories: Apple Watch, AirPods, HomePod add diversification and margin stability.

- Services: The fastest-growing segment — App Store, Apple Care, Apple TV+, Apple Pay. Recurring revenue model helps stabilize growth.

- Ecosystem strength: The stickiness of Apple’s devices + services creates high switching costs, defensible business model.

Competitive Positioning

- Apple competes with the likes of Samsung Electronics (in smartphones), Microsoft Corporation (in services/OS), Alphabet Inc./Google (in AI & mobile), and myriad others in wearables/accessories.

- Strengths: Brand loyalty, integration of hardware + software + services, global supply chain.

- Weaknesses: Margins dependent on device cycle, supply-chain exposures (e.g., China production), heavy reliance on iPhone.

Financial Snapshot & Valuation Metrics

Key Financials (recent)

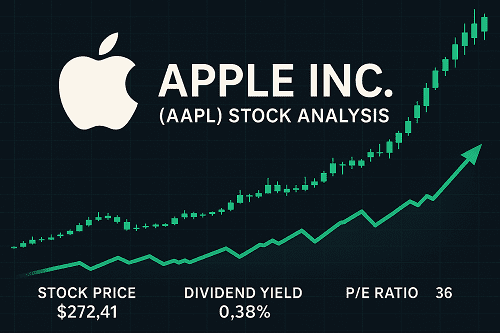

- Market Cap: ~$4.03 trillion.

- 52-Week Range: ~$169.21 – ~$277.32.

- Dividend Yield: ~0.38%.

- Consensus Analyst Price Target: ~$275.87 average, with a “Buy” consensus.

Valuation Metrics

- Trailing P/E: ~36–41× depending on source.

- Forward growth: EPS forecast growth ~10-12% in near term.

- PEG Ratio: ~2.6 (indicating the stock may be trading at a premium to growth).

Interpretation

- Apple trades at a premium relative to many peers, reflecting its growth expectations and strong brand/market position.

- With limited near-term upside according to some analysts (average price target close to current price), much of the growth may already be priced in. investors need to ensure catalysts line up.

- The modest dividend yield suggests this is a growth/tech play more than an income play.

Growth Catalysts: What’s Driving Apple Now

Next iPhone Upgrade Cycle

Apple’s hardware cycle remains a primary driver. With each major iPhone release there is potential for device-sales uplift, and given Apple’s ecosystem, incremental services revenue.

Analysts believe an AI-driven upgrade cycle may be underestimated.

Services & Recurring Revenue Growth

- The higher-margin services segment (App Store, Apple Music, iCloud) is expanding, helping stabilize earnings when hardware sales flatten.

- As more users adopt Apple devices, services penetration may increase, boosting lifetime value per customer.

AI and Future Technologies

- Apple is increasingly investing in AI, machine learning, and new platforms (e.g., AR/VR, Apple Vision) which may unlock future growth beyond the device cycle.

- With competitors accelerating in AI, Apple’s ability to embed advanced features into its ecosystem could become a differentiator.

Global Expansion & Emerging Markets

- Growth opportunities remain in markets like India, Southeast Asia, Latin America – where premium smartphone penetration is still relatively low.

- Localization of services + manufacturing investments may also boost margins long-term.

Capital Return & Share Buybacks

- Apple has one of the largest share-repurchase programs in tech, which can support the share price and return cash to shareholders.

Key Risks & Headwinds

Hardware Dependency & Cycle Risk

- A large portion of revenue still comes from iPhone sales, making Apple vulnerable to device-cycle slowdowns or disappointing launches.

Supply Chain & Geopolitical Exposure

- Manufacturing heavily tied to China & other Asia-based suppliers; trade tensions, tariffs, component shortages or lockdowns can impact margins.

Competitive Pressures & Innovation Risk

- The pace of innovation in smartphones and wearables is intense; competitors may erode Apple’s market share or force margin compression.

Valuation Risk

- When growth expectations are already baked in, anything less than strong results or growth disappointment can lead to downside risk.

- As one article noted: “Apple’s stock sees worst day since 2022… here are 2 major worries for investors.”

Regulatory & Privacy Challenges

- Being a large tech company, Apple faces regulatory scrutiny (antitrust, app-store practices), which could impose constraints or fines in future.

Technical Analysis & Price Action

6Chart Setup

- Recent trading range shows AAPL oscillating between ~$269–$277 on a 52-week high of ~$277.32.

- Volume has averaged ~47 million shares recently.

Support & Resistance

- Support: Near ~$250 (psychological round number), and likely near previous breakout levels.

- Resistance: ~$277–$280 zone is key — a breakout above could trigger next leg higher.

- Momentum traders will watch for moving-average crossovers (50-day vs 200-day) and RSI/ MACD divergences.

Trade Setups

- For momentum/traders: A breakout above ~$280 with high volume could signal a long entry.

- For swing/investors: A pull-back toward the ~$250–$260 zone may offer a more attractive risk/reward entry.

- Risk management: Stop-losses below recent swing low; protective puts if investing.

Investment & Trading Strategies for AAPL

Long-Term Investor Approach

- If you’re buying AAPL for the next 3–5 years: Focus on Apple’s ecosystem growth, services margin expansion, and global penetration.

- Use dollar-cost averaging if worried about valuation or near-term volatility.

- Rebalance periodically, especially if Apple becomes a large portion of your portfolio.

Income/Dividend Strategy

- Although Apple pays a dividend (~0.38% yield), this is modest. If your objective is income, Apple may play more as a growth hybrid than dividend staple.

- Reinvest dividends into higher-growth parts of the business (services, AI) if you believe in long-term opportunity.

Trading / Short-Term Approach

- Use technical triggers: breakouts, pull-backs, volume spikes.

- Keep an eye on earnings announcements — surprises (positive or negative) can generate large intraday moves.

- Manage risk tightly; big tech stocks like Apple often move on market sentiment.

Portfolio Role & Allocation

- Apple can serve as a core large-cap growth holding, especially for tech-tilted portfolios.

- Ensure diversification: don’t overweight Apple if you’re already exposed to high-tech, FAANGs, or large-cap growth.

- Consider pairing Apple with a commensurate hedge (e.g., global diversification, small-cap exposure) in case of tech-sector rotation.

AAPL in the Portfolio: Suitability, Alternatives & Comparisons

Suitability

- Suitable for: growth-oriented investors, tech-savvy traders, those bullish on device/AI ecosystem.

- Less suitable for: pure income investors (low yield), ultra-value investors (premium valuation), those seeking high-beta speculative plays.

Alternatives & Peer Comparison

- Microsoft (MSFT): Broader enterprise software exposure.

- Alphabet (GOOGL): More pure-AI and advertising growth.

- Samsung Electronics: Hardware diversification, slower service growth.

- Amazon (AMZN): Services + hardware + cloud, but different business mix.

Comparing valuation, growth prospects and risks across the set helps validate Apple’s relative attractiveness.

Relative Strength & Market Leadership

- Apple remains one of the largest components of major indices (S&P 500, Nasdaq-100), making it both a growth engine and a source of systematic risk.

- Because it’s so widely held, broad market moves impact Apple heavily — watch macro cues.

FAQs (for Featured Snippet Potential)

Q1: What is Apple’s current stock price?

As of recent data, Apple stock traded around ~$272.41.

Q2: What is Apple’s dividend yield?

Roughly 0.38%, making it a low-yield but growth-oriented dividend stock.

Q3: What are Apple’s main growth drivers in 2025?

Key drivers: iPhone upgrade cycle, services expansion, AI/ML integration, wearables growth, global markets. (See Section 4 above)

Q4: What are the major risks for Apple stock?

Major risks: hardware cycle slowdowns, valuation premium, supply-chain/China exposure, regulatory headwinds, innovation risk. (See Section 5 above)

Q5: Is Apple a buy now?

It depends on your time horizon and risk tolerance. Valuation is elevated, so either a pull-back or compelling catalyst may offer better entry. Consider your allocation, or use a staggered entry.

Conclusion

In summary, Apple Inc. (AAPL) remains a cornerstone of the tech universe — with a massive ecosystem, broad product base, and increasingly important services and AI ambitions. For long-term investors, it offers stability, brand strength and moderate growth. For traders, it offers liquidity and volatility to exploit.

However — the valuation is already high, meaning the margin for error is thinner. Without strong catalysts, upside may be limited and risk of disappointment greater. For this reason, timing your entry (or scaling in) could be more important than ever.

Whether your focus is trading horizons of days/weeks or investing over years, Apple deserves a place in your watch-list — but it also demands respect and disciplined execution.

Actionable Next Steps

- Monitor upcoming catalysts: hardware announcements (next iPhone), services growth reports, AI/ML product launches.

- Watch technical levels: key support ~$250–$260, resistance ~$280+.

- Set risk parameters: stop losses, position sizing given premium valuation.

- Consider portfolio fit: ensure you’re not over-concentrated and match your risk profile.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F