In today’s financial markets, investors are constantly looking for efficient, flexible vehicles to obtain exposure to niche strategies, alternative asset classes, or leveraged themes — without necessarily owning the underlying physical assets. One such vehicle is the Exchange-Traded Note (ETN). While the concept may seem similar to an Exchange-Traded Fund (ETF), ETNs come with a unique structure, risk profile, and set of advantages that make them an intriguing tool for both long-term investors and active traders.

This guide offers a deep dive into ETNs: what they are, how they work, how they differ from ETFs and other exchange-traded products, and how you can evaluate, select, and use them within a diversified portfolio. Given my background as a trader covering stocks, forex and crypto, I’ll also highlight advanced considerations relevant to high-performance portfolios.

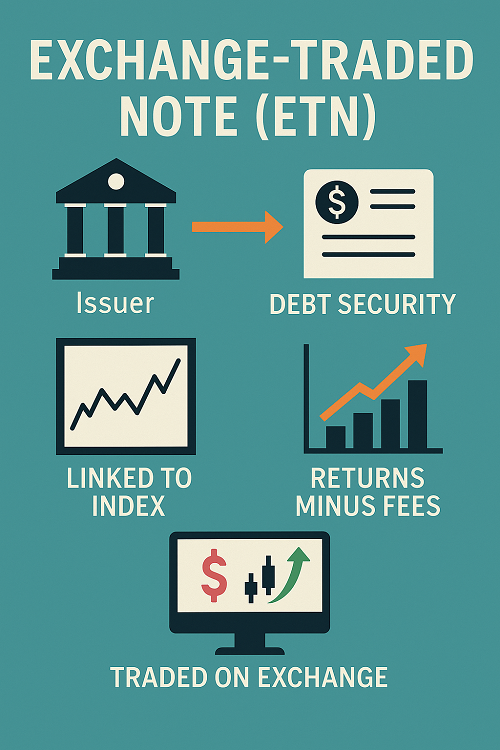

What Is an Exchange-Traded Note (ETN)?

An Exchange-Traded Note (ETN) is a debt instrument issued by a bank or special-purpose entity that promises to pay the holder a return linked to the performance of a specified benchmark, index, commodity, currency, or strategy, minus fees and expenses. Unlike ETFs, which typically own a basket of assets, ETNs do not generally hold the underlying assets. Instead, they act like senior, unsecured debt of the issuer: you are exposed not only to the benchmark’s performance but also to the issuer’s credit quality.

Historical origin & evolution

The first documented ETN appeared in Israel in May 2000 — the “Tali-25” ETN, issued by Ofek Leumi Financial Instruments, tracking a basket of securities on the Tel Aviv Stock Exchange. Since then, ETNs have proliferated globally, particularly in the U.S. and Europe, offering exposure to commodities, currencies, leveraged strategies, and other innovative indexes.

Structure & Mechanics of ETNs

Issuer and debt-note nature

When you buy an ETN, you essentially become a creditor of the issuer for the return that the note promises. Because an ETN is senior, unsecured, unsubordinated debt, if the issuer were to default or suffer credit deterioration, the ETN holder is exposed to loss — even if the underlying benchmark has performed well.

How pricing and returns work

- The issuer links the note to a benchmark or strategy (for example, the performance of a commodity index or currency basket).

- On maturity (for a finite-term ETN) or upon sale in the secondary market (for a perpetual ETN), the holder receives cash based on the benchmark’s performance, net of fees.

- Many ETNs trade on an exchange like stocks or ETFs during market hours, providing liquidity and intraday price transparency.

- The “indicative value” (IV) of the ETN reflects what the note should be worth given its underlying index, accrued fees and time to maturity. Deviations from IV can create trading opportunities — but they also reflect liquidity or structural risk.

Creation and redemption mechanisms

Some ETNs allow large institutional investors to redeem directly with the issuer (not just trade on the secondary market). This mechanism helps keep the ETN’s market price close to its theoretical value. However, unlike many ETFs, the redemption may not be continuous or may require large minimums, which can reduce liquidity for smaller investors.

Maturity vs perpetual

ETNs may be issued with a defined maturity date, at which the issuer will redeem the note and pay the performance-linked cash amount. Others are perpetual, meaning they remain outstanding indefinitely until the issuer calls them or the investor sells them in the market. Principally, perpetual ETNs behave like perpetual debt.

ETNs vs ETFs and Other Exchange-Traded Products

Understanding the differences between ETNs and ETFs (and other ETPs) is critical for proper risk assessment.

| Feature | ETN | ETF |

|---|---|---|

| Underlying asset ownership | Typically none; you hold debt of issuer | Usually owns underlying securities or assets |

| Issuer credit risk | Yes – you are exposed to issuer default or credit downgrade | Minimal direct issuer credit risk (except for counterparty risk in certain structures) |

| Tracking error | Very low (issuer promises index return minus fees) | Subject to tracking error due to asset management, costs, cash flows |

| Fee transparency | Fees embedded and reduce final payout | Fees visible via expense ratio; tracking error may add implicit cost |

| Tax treatment | Often treated as prepaid contract or debt instrument (varies by jurisdiction) | Tax treatment more straightforward; may distribute dividends/capital gains |

| Liquidity | Depends heavily on trading volume and creation/redemption mechanics | Generally high liquidity for major ETFs |

| Complexity | Can be more complex (leverage, niche indices, currency overlays) | Varies but many simple index-based ETFs exist |

In short: ETNs offer precise exposure with minimal tracking error, but they come with credit risk and structural complexity that many ETF investors may not fully appreciate.

Why Investors Use ETNs: Advantages

Access to niche asset classes and strategies

ETNs can provide exposure to markets or strategies that are difficult to access via traditional instruments — for instance:

- Commodity futures (gold, oil, agriculture) without owning futures contracts directly.

- Currency baskets or volatility indices.

- Leveraged themes (2× or −1× exposure).

Very low-to-no tracking error

Because the issuer promises the index return (minus fees), ETNs theoretically offer near-perfect replication of the benchmark — avoiding the slippage, rebalancing cost or diversification constraints some ETFs face.

Tax efficiency (in some jurisdictions)

In the U.S., ETNs are often treated as prepaid contracts rather than interest-bearing debt or dividend-paying instruments. That means you may not receive annual taxable distributions; instead, capital gains are realized when you sell or the note matures.

For certain investors, this deferred tax treatment is advantageous.

Intraday liquidity and structured-product access

ETNs trade on exchanges like stocks, enabling intraday access, shorting, margin trading, etc. They combine structured product exposure with exchange-trading convenience.

Risks & Disadvantages: What to Watch Out For

Credit/issuer risk

Because ETNs are unsecured debt obligations of the issuer, you are subject to default risk or credit downgrade risk — even if the benchmark does well. For example, if the issuing bank’s credit rating falls, the ETN’s value might suffer independent of the index performance.

Liquidity risk & wide bid-ask spreads

Many ETNs trade thinly compared to large ETFs. Illiquidity can result in wider bid-ask spreads, greater slippage, and challenges when exiting a large position.

Benchmark structure risks (especially commodities)

For commodity-linked ETNs, issues like contango (futures price higher than spot) or backwardation can dramatically erode returns over time — sometimes contrary to investor expectations.

Tax treatment uncertainty

Although ETNs promise tax efficiency, actual tax treatment may depend on issuer, local jurisdiction and investor status. Some benefits may not be realized, or tax rules may change, reducing the expected advantage.

Complexity & leverage risk

Leveraged ETNs (2×, 3×) and those tracking volatile strategies (momentum, volatility indices) can amplify losses. These are generally suited only for sophisticated investors who understand the mechanics and risks.

Real-World Examples & Use Cases

Example 1: Commodities exposure via ETN

Suppose an investor wants to gain gold exposure without owning bullion or an ETF backed by physical gold. A gold-linked ETN allows tracking of a gold futures index, trades on the exchange, and provides intraday liquidity. The investor gets the return of the gold futures benchmark minus fees — but must accept issuer credit risk and futures-roll cost risk.

Example 2: Currency or volatility strategy

An ETN may track a volatility index (such as VIX futures) or a basket of emerging-market currencies. A trader could use this as a tactical allocation — e.g., expecting a spike in volatility or currency depreciation. Because the ETN trades like a stock, it can be used in a broader multi-asset trading strategy including stocks, forex and crypto exposures.

Portfolio context

With your background in stocks, forex and crypto trading, ETNs can serve as satellite allocations — for example:

- Using a volatility-linked ETN as a hedge against equity risk.

- Employing a currency-basket ETN to complement your forex trades.

- Adding a commodity-ETN exposure to diversify beyond stocks and crypto, where correlations may drop.

However, treat ETNs as tools rather than core holdings unless you thoroughly understand their structure.

How to Evaluate and Select ETNs

Here’s a checklist when you’re researching an ETN:

- Issuer creditworthiness: Review the bank or entity issuing the ETN. Find its credit rating, financial strength, debt obligations.

- Underlying benchmark/strategy: Understand what index the ETN tracks. Is it simple (e.g., broad commodity index) or complex (leveraged, volatility, niche theme)?

- Fee structure: What is the annual management/expense fee? How is it accrued? Does it significantly drag performance?

- Liquidity and trading volume: Check average daily trading volume, bid-ask spreads, and how easy it is to enter/exit large positions.

- Tracking vs actual return: While ETNs promise low tracking error, in practice check historical performance vs benchmark, especially for complex or commodity-linked ones.

- Tax treatment for your jurisdiction: Confirm how the ETN is treated for tax purposes where you are investing (USA, Canada, etc.).

- Maturity, redemption features, leverage: Is the ETN perpetual or mature at a fixed date? Can you redeem with issuer or just trade on market? Is there leverage?

- Collateral or structuring: Certain ETNs may have collateral backing or be backed by a portfolio of assets; others are purely unsecured.

- Correlation and portfolio fit: How does the ETN correlate with your existing portfolio? Does it add diversification or simply add risk?

By systematically evaluating these factors, you’ll be better positioned to select ETNs that fit your risk profile and trading/investment strategy.

Regulatory, Tax & Accounting Considerations

United States

In the U.S., ETNs are regulated as debt securities by the Securities and Exchange Commission (SEC) and traded on exchanges under the oversight of regulators such as the Financial Industry Regulatory Authority (FINRA). The SEC’s “Investor Bulletin: Exchange-Traded Notes (ETNs)” warns investors about issuer credit risk and structural complexity.

For tax purposes, many ETNs are treated as prepaid contracts rather than debt paying interest, meaning taxable gain is often deferred until sale/maturity rather than periodic income.

Canada

Canadian investors should carefully examine whether an ETN issued in the U.S. is eligible for RRSP/TFSA, how the Canada Revenue Agency (CRA) treats it (capital gains vs income), and whether withholding taxes apply if the issuer is foreign. Given your location in Toronto, this is a relevant consideration.

Accounting and reporting

- ETNs often don’t distribute dividends or interest—so investors are less likely to receive a K-1 or 1099-INT, but may receive 1099-B upon sale or maturity (in the U.S.).

- Some ETNs may generate phantom taxable income; always check the prospectus.

- For leveraged or commodity-based ETNs, tax treatment may differ substantially, particularly for active traders.

Emerging Trends & The Future of ETNs

Thematic & niche ETNs

ETNs are increasingly used to provide exposure to themes such as ESG (environmental-social-governance), blockchain/crypto indices, artificial-intelligence indices, and other non-traditional assets. Traders and investors looking for differentiated exposures may find ETNs especially compelling.

Integration with multi-asset / digital-asset portfolios

As digital assets (cryptocurrencies) and FX strategies become more intertwined with equity and commodity allocations, ETNs can bridge traditional and alternative markets. For example, a crypto-focussed investment may be complemented by a commodity-linked ETN as a hedge or diversification tool.

Structural evolution & regulatory scrutiny

Because ETNs carry issuer-credit risk and complexities, regulators globally are scrutinizing how they are marketed and whether retail investors fully understand their risk profile. Expect increased transparency, improved disclosures, and possibly new issuance structures (collateralised, insured, or hybrid) that mitigate credit risk.

Technology innovation

Blockchain and tokenization may enable entirely new types of exchange-traded debt-linked notes, perhaps with fractional exposures, automated creation/redemption or decentralized clearing. While still emerging, such innovation may further change how ETNs are deployed in portfolios.

Summary & Key Takeaways

- ETNs are exchange-traded debt notes linked to a benchmark’s performance — offering targeted exposure but carrying issuer credit risk.

- They differ from ETFs in meaningful ways (debt vs asset ownership, tracking error, liquidity, tax treatment).

- They are powerful tools for disciplined investors and traders, especially for niche strategies (commodities, currencies, volatility) — but only with careful due diligence.

- Smart selection of ETNs involves checking issuer credit rating, benchmark structure, fees, liquidity, tax status, and fit within your overall portfolio.

- With the rise of thematic investing and alternative assets, ETNs remain a relevant piece of the toolkit — but as complexity increases, so does the need for sophisticated evaluation.

- For investors in Canada (or elsewhere outside the U.S.), pay special attention to tax and regulatory implications in your jurisdiction.

- As a trader with exposure to stocks, forex and crypto, ETNs can act as tactical or strategic additions — but should not be treated as generic plug-and-play products without understanding their entire structure.

Frequently Asked Questions (FAQ)

Q1: Can I buy ETNs in a regular brokerage account?

Yes — most ETNs trade on major exchanges just like ETFs or stocks. You’ll need to ensure your broker supports the specific product.

Q2: Are ETNs safe?

“Safe” is relative. ETNs do carry credit (issuer) risk in addition to market risk. Safety depends on the issuer’s creditworthiness, underlying benchmark, and your holding period.

Q3: How do taxes work on ETNs for Canadian investors?

It depends on the product and issuer. Some ETNs may be treated as capital gains when sold; others may have withholding implications if foreign-issued. Consult a Canadian tax advisor for your specific case.

Q4: Are ETNs better than ETFs?

“Better” depends on your objective. ETNs have advantages (low tracking error, niche access) and disadvantages (issuer credit risk, complexity). If you value simplicity and asset ownership, ETFs may be preferable; if you seek precise benchmark exposure and accept the risks, ETNs can be compelling.

Q5: How does leverage in ETNs work?

Leveraged ETNs aim to deliver a multiple (e.g., 2× or −1×) of the benchmark’s daily return. Because of daily resetting and compounding, long-term returns may deviate significantly from the simple multiple of the benchmark — making them more suited for short-term tactical trades.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F