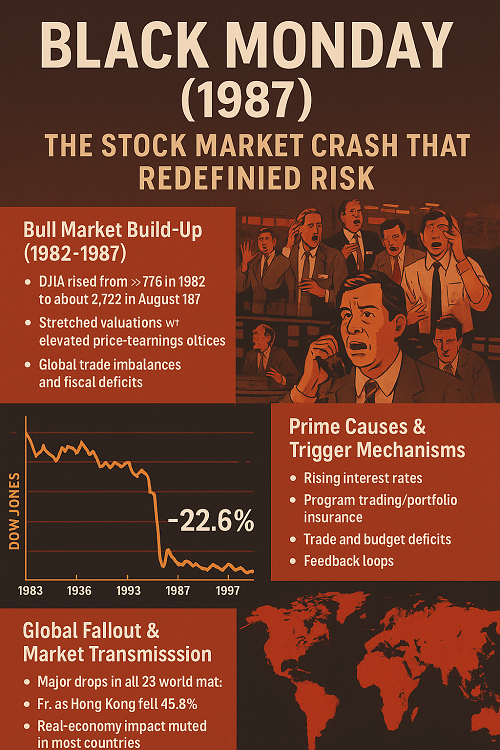

On October 19 1987, financial markets around the world were shaken to their core. This day—commonly known as Black Monday—marked the largest one-day percentage drop in the history of the Dow Jones Industrial Average (DJIA): a fall of approximately 22.6 %. For investors, regulators and risk managers alike, the event became a defining moment: a dramatic illustration of how market structure, technology, macro factors and behavioural dynamics can combine to produce a sudden crash.

The Bull Market Build-Up (1982-1987)

In the years leading up to October 1987, stock markets enjoyed a prolonged and vigorous bull run.

- The DJIA rose from roughly 776 in August 1982 to about 2,722 in August 1987.

- Stock indices globally similarly soared: the nineteen largest markets rose in aggregate by ~296 % during that period.

- Investor sentiment was exuberant: rising corporate earnings, declining inflation (for the era), and favourable interest‐rate environments created a sense of optimism.

However, beneath the surface the foundations were asking for closer scrutiny:

- Valuations had become stretched, with price/earnings multiples at elevated levels relative to historical norms.

- Global trade imbalances and fiscal deficits (especially in the U.S) were widening; the U.S. dollar faced downward pressure.

- Technological and institutional changes (such as increased derivatives trading, computerised hedging) were altering market structure—raising the possibility that new vulnerabilities were building, albeit obscured by the on‐going bull market.

In short: the calm of the bull market masked structural risk.

Anatomy of the Crash (October 19)

What occurred

On Monday 19 October 1987:

- The Dow plunged from about 2,246.74 to 1,738.74, a drop of ~22.6 %.

- Trading volume spiked, order imbalances dominated many stocks, and at many points the systems were overwhelmed.

- In the United States, the futures market opened while many stocks in the cash market were delayed because of specialist overload—leading to a dislocation between futures and cash prices.

Market mechanics: what made it so severe

- Specialists at the New York Stock Exchange (NYSE) were inundated: on that day, 195 stocks on the S&P 500 had trading delays or halts.

- Futures markets and options markets were operating normally while cash markets had delays: this decoupling created arbitrage opportunities, added confusion, and triggered further selling.

- Program trading strategies (like so‐called portfolio insurance) kicked into high gear, which caused automatic sell orders to cascade.

Timeline highlights

- The day opened under pressure: pent-up sell orders from previous days plus poor economic/trade signals.

- As the day progressed, the imbalance between sell and buy orders increased dramatically.

- In the final 90 minutes of trading, steep declines accelerated. Some computer systems and communications were overloaded.

- Markets elsewhere (Europe, Asia) followed the lead, often opening to heavy losses.

Prime Causes & Trigger Mechanisms

There is no single cause of Black Monday, but rather a confluence of factors. Many analysts categorise them broadly as either exogenous triggers (outside the market) or endogenous dynamics (within the market’s structure).

Exogenous / Macro triggers

- Rising interest‐rates: Investors were sensitive to the expectation that interest rates would move higher, squeezing valuations.

- Trade and budget deficits: In the U.S., deficits bred concerns about currency/monetary instability and fed investor anxiety.

- Currency policy and the dollar: The Louvre Accord (February 1987) attempted to stabilise exchange rates and support the dollar, yet doubts grew about its durability. This fed into a loss of confidence.

- Valuation concerns / bubble psychology: Many market participants believed the markets were over‐stretched and that a correction was inevitable. I

Endogenous / Market‐structure triggers

- Program trading / portfolio insurance: Portfolio insurance strategies meant that when markets fell, algorithms triggered further futures selling to hedge exposure—and that selling itself pushed the market down more.

- Derivatives-cash decoupling: Because futures markets opened ahead of cash markets, stale cash prices and cheaper futures created arbitrage flows that amplified selling.

- Feedback loops: Once selling began, further declines triggered more selling—margin calls, risk management rules, stop‐losses—all creating a cascade.

- Global contagion: In an increasingly interconnected market world, pressure in one region quickly spread to others.

3.3 What triggered the trigger?

While macro signals were present, many analysts argue that the actual “spark” was relatively minor—and the real damage came from market mechanics that amplified it.

Global Fallout & Market Transmission

The crash was not confined to Wall Street: it was a global event.

Global market drops

- All 23 major world markets experienced sharp declines; 19 of them lost more than 20 %.

- For example, in Hong Kong the market fell 45.8 % in U.S. dollar terms.

- Japan’s market fell ~14.9 % in one day.

Regional differences in recovery & structural resilience

- Japan recovered its losses in about five months.

- In contrast, New Zealand’s crash triggered a long recession because its central bank did not loosen monetary policy.

- The speed and effectiveness of monetary policy and market regulation determined how deep and long the downturn lasted in each country.

Real‐economy impact

Although the crash was dramatic, the broader real-economy impact in many countries was relatively muted, thanks to swift central‐bank intervention (in the U.S., Germany and Japan) that prevented systemic collapse.That said:

- Some sectors (brokerage, derivative clearing, margin lending) felt acute stress.

- Confidence damage, wealth losses and tightening credit in some markets took more time to heal.

Regulatory & Market Structure Responses

In the wake of Black Monday, regulators and exchanges globally implemented changes to reduce the risk of a similar event.

Trading curbs / circuit breakers

- The idea: halt trading temporarily if a major index falls by a specified percentage, giving markets time to cool down and preventing runaway selling.

- In the U.S., the Securities and Exchange Commission (SEC), NYSE and other bodies adopted new rules for trading halts.

Improvements in clearing and settlement

- Clearing-house backstops were enhanced to manage extreme flows.

- Increased attention to risk management of broker‐dealers, margining, segregation of client assets.

Structural reforms & oversight

- Enhanced monitoring of program trading, index arbitrage and derivative exposures.

- Greater coordination between monetary policy and market stability (central banks became more aware of systemic implications).

- Emphasis on transparency and stress-testing of markets and institutions for ‘what if’ scenarios.

Implications for Traders, Investors & Risk Managers

For you as a trader, investor or risk manager, Black Monday offers enduring insights.

On trading & investing strategy

- Don’t rely solely on fundamentals: Even when macro fundamentals appear sound, structural risk and market sentiment can override them.

- Manage leverage: The crash illustrated how margin, derivatives and automated hedging can accelerate losses.

- Liquidity matters: In stressed markets, liquidity evaporates quickly; position sizing and exit-planning are vital.

- Global market awareness: The crash showed how global contagion works—so consider cross-market risk (equities, futures, FX).

On risk management

- Scenario planning: Have plans for extreme moves—even those past historical precedent.

- Circuit-breaker awareness: Know how markets behave when halts/trading curbs trigger.

- Mind the structural risks: Automated systems, algorithmic trading, inter‐market linkages—all are potential amplifiers.

- Behavioural discipline: Investor psychology—fear, herd behaviour, panic—can dominate rational fundamentals.

Key Lessons for Today’s Markets

As we move further into an era of high-frequency trading, algorithmic strategies, and interconnected global markets, the lessons from Black Monday remain highly relevant.

- Market structure evolves—but vulnerabilities persist: New tools (HFT, ETFs, dark pools) add complexity; the “weak link” may simply shift, not disappear.

- Automatic hedging can create unintended feedback loops: As in 1987, algorithmic responses to market moves can amplify volatility.

- Global linkages are stronger: A shock in one major market can cascade globally in hours.

- Regulation matters—but so does vigilance: Circuit breakers help, but cannot eliminate risk; structural oversight and transparency are still essential.

- Investing discipline wins: During a panic, the well-prepared investor with clarity on risk, sound allocation and exit strategies is at a clear advantage.

Conclusion

The crash of October 19 1987—Black Monday—was more than a dramatic market event. It was a wake-up call: for investors, institutions and regulators alike. While the one-day drop of ~22.6 % is the headline statistic, the enduring importance lies in the lessons learned about market vulnerability, structural risk and behavioral dynamics.

For traders, investors and risk managers operating today—and especially in a world of algorithmic strategies, global connectedness, and ever-faster information flows—Black Monday remains a benchmark for what can happen, and a guide for how to prepare, respond, and survive.

Whether you’re managing ad ops revenue, running programmatic trading strategies, or simply investing capital: the themes of leverage, liquidity, structure and behaviour that defined 1987 continue to matter.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F