BCE Inc. (TSX: BCE), parent company of Bell Canada, remains one of the most influential and stable forces in the Canadian telecommunications landscape. For investors, keeping an eye on BCE stock on the TSX is crucial. With a legacy spanning nearly a century and a half, BCE has built a reputation for reliability, market dominance, and most notably — its generous dividend.

In a world where technology is evolving at breakneck speed and interest rates remain elevated, BCE’s ability to preserve cash flow and sustain one of the most consistent dividends in the country has made it a mainstay for income-oriented investors.

But with BCE’s stock price under pressure in recent quarters — weighed down by heavy capital expenditures, slow revenue growth, and debt concerns — investors are asking:

Is BCE.TO still worth holding in 2025? Or is it time to look elsewhere in Canadian telecom?

This in-depth analysis examines BCE’s business fundamentals, dividend strength, valuation metrics, growth outlook, and risks — helping Canadian investors make an informed decision in 2025 and beyond.

BCE Inc Overview: The Foundation of Canada’s Telecom Industry

Company Profile

BCE Inc. is Canada’s largest telecommunications and media company, operating under the Bell brand. Its reach extends into virtually every corner of the nation, with operations across three major business units:

| Segment | Description | Revenue Contribution |

|---|---|---|

| Bell Communications | Wireless, Internet, and Wireline phone services | ~75% |

| Bell Media | TV, radio, streaming, and advertising | ~20% |

| Other Investments | Data centers, satellite, and corporate ventures | ~5% |

BCE’s integrated structure gives it a diversified revenue base and considerable pricing power — though the same vertical integration also makes it capital intensive.

The Competitive Landscape

BCE operates within a highly concentrated market dominated by the “Big Three” — BCE, Rogers Communications (RCI.TO), and Telus (T.TO). This oligopolistic structure protects margins but also subjects these companies to intense regulatory scrutiny.

Key differentiators:

- Rogers: Aggressive in wireless growth, now bolstered by its Shaw merger.

- Telus: Strong in Western Canada, with a diversified tech-health vertical.

- BCE: Leads in eastern Canada with unmatched network reach and brand strength.

The CRTC’s push for greater competition (e.g., MVNO access rules) poses moderate long-term challenges to BCE’s pricing flexibility.

Market Position and Network Investments

BCE has continued its multi-billion-dollar investments in fiber-to-the-home (FTTH) and 5G expansion, giving it a network advantage, particularly in Ontario and Quebec.

In 2024, BCE reported that over 90% of its footprint now had access to either fiber or high-speed wireless connectivity — a key driver of ARPU (Average Revenue Per User) stability.

BCE’s Financial Performance: Strength in Stability

While BCE’s share price performance has lagged peers recently, its core financial stability remains solid.

| Financial Metric (FY2024) | BCE Inc | Rogers | Telus |

|---|---|---|---|

| Revenue (C$ billions) | 24.0 | 20.5 | 18.7 |

| EBITDA Margin | 42% | 39% | 37% |

| Free Cash Flow | C$3.6B | C$3.0B | C$2.1B |

| Net Debt / EBITDA | ~3.5x | ~4.0x | ~3.8x |

BCE continues to maintain robust EBITDA margins — among the best in the Canadian telecom sector — driven by cost discipline and premium pricing on broadband and wireless plans.

Revenue Trends

Revenue growth has averaged roughly 1.5% to 2% annually over the past five years, with modest gains in wireless offsetting declines in legacy wireline and media.

Wireless remains the growth engine, driven by subscriber additions and ARPU expansion. Meanwhile, Bell Media faces structural headwinds from cord-cutting and a shift toward streaming.

Profitability and Free Cash Flow

BCE’s operating profit margins remain strong, but its free cash flow has been pressured by high capital expenditures — particularly its 5G rollout and fiber expansion.

CapEx intensity remains around 20–22% of revenues, higher than the industry average. However, these investments are expected to ease slightly by 2026, unlocking higher FCF conversion.

Debt and Leverage

BCE’s total debt hovers near C$30 billion, resulting in a net debt-to-EBITDA ratio around 3.5x. While this appears high, BCE’s stable cash flow and predictable earnings make it manageable.

Nonetheless, higher interest rates in 2023–2025 have increased financing costs, slightly dampening profitability.

Dividend Strength: BCE’s Crown Jewel

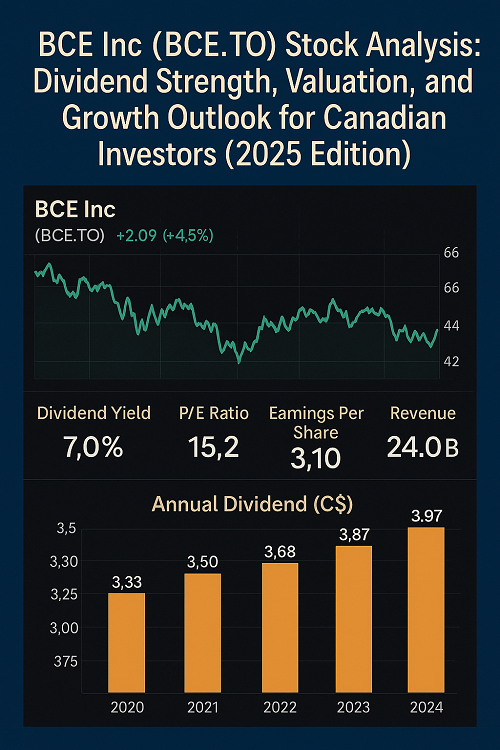

Dividend History and Yield

Few Canadian stocks rival BCE’s dividend track record.

| Year | Annual Dividend (C$) | Growth Rate | Yield (%) |

|---|---|---|---|

| 2020 | 3.33 | +5.0% | 5.4% |

| 2021 | 3.50 | +5.1% | 5.8% |

| 2022 | 3.68 | +5.1% | 6.2% |

| 2023 | 3.87 | +5.2% | 6.8% |

| 2024 | 3.97 | +2.6% | ~7.0% |

As of early 2025, BCE’s dividend yield sits near 7%, placing it among the highest in the TSX 60. The company has raised dividends for 15 consecutive years, reinforcing its appeal to income investors.

Dividend Sustainability

While the yield is attractive, the payout ratio is elevated — hovering near 95% of free cash flow.

BCE’s management has reaffirmed its commitment to dividend stability, but investors should recognize that future increases will likely be modest (1–3%) until free cash flow improves post-2026.

Bottom Line: BCE’s dividend is sustainable, though future growth will be slower.

Comparison with Peers

| Company | Dividend Yield | Payout Ratio | Dividend Growth (5yr CAGR) |

|---|---|---|---|

| BCE (BCE.TO) | ~7.0% | 95% | 4.8% |

| Telus (T.TO) | ~6.5% | 105% | 7.2% |

| Rogers (RCI.TO) | ~3.3% | 70% | 2.0% |

BCE’s dividend yield clearly leads, though its payout ratio is the highest — leaving less room for aggressive increases.

Valuation: Has BCE Become Undervalued?

Market Multiples

| Metric | BCE | Rogers | Telus | Sector Avg |

|---|---|---|---|---|

| P/E (forward) | 15.2x | 17.5x | 16.8x | 17.0x |

| EV/EBITDA | 8.3x | 9.0x | 8.8x | 8.7x |

| Dividend Yield | 7.0% | 3.3% | 6.5% | 4.8% |

BCE currently trades below sector averages on most valuation metrics — suggesting it’s slightly undervalued relative to peers.

Discounted Cash Flow (DCF) Valuation

Using conservative assumptions:

- WACC: 7.0%

- Terminal growth: 1.5%

- FCF 2025E: C$3.8B

Fair value estimate:

≈ C$53–C$58 per share.

At a current trading price near C$47 (as of early 2025), BCE appears 10–20% undervalued, assuming steady FCF recovery and stable dividends.

Analyst Consensus

| Rating | Count |

|---|---|

| Buy / Outperform | 6 |

| Hold | 11 |

| Underperform / Sell | 3 |

Consensus Target Price: ~C$54

Consensus View: “Hold with mild upside potential.”

Growth Outlook: Catalysts for the Next 3 Years

5G Monetization and Network Expansion

BCE continues to invest heavily in 5G and fiber connectivity, positioning itself for scalable long-term growth. As 5G adoption matures, expect improved ARPU and enterprise opportunities in IoT and fixed wireless access.

The company’s 5G coverage surpassed 85% of Canadians in 2024, and monetization is expected to accelerate from 2025 onward.

Fiber-to-the-Home (FTTH) Penetration

BCE’s FTTH footprint now covers millions of households. The company’s goal: to make fiber internet the default across its urban and suburban markets.

This strategic push enhances customer retention, supports premium pricing, and lowers maintenance costs long term.

Media Division & Streaming Initiatives

While traditional TV advertising is in decline, BCE’s Crave streaming platform continues to grow modestly, supported by exclusive content partnerships.

Expect BCE to increasingly emphasize digital media monetization as it rationalizes its broadcasting portfolio.

Cost Efficiency and Digital Transformation

BCE aims to streamline operations through automation and network simplification, targeting C$250–300 million in annual savings by 2026.

If successful, these savings could provide further FCF flexibility to sustain dividends and modest buybacks.

Key Risks: What Investors Should Watch

Rising Interest Rates and Debt Costs

With roughly C$30B in long-term debt, every 1% rise in interest rates could add C$300M in annual interest expense over time.

This is BCE’s most immediate macro risk.

Regulatory Pressures

The CRTC’s push for affordability and wholesale access could compress margins. Any forced reduction in wholesale pricing for smaller ISPs could weigh on BCE’s broadband profitability.

Media Headwinds

Advertising revenues have softened amid declining viewership for traditional TV. BCE’s media assets may continue to shrink in profitability unless offset by streaming growth.

Execution Risk on Fiber & 5G CapEx

If BCE’s heavy capital spending fails to translate into meaningful subscriber growth or ARPU gains, its leverage metrics could come under pressure.

Outlook: What’s Next for BCE in 2025–2027

Base Case Scenario (70% probability):

- EPS grows 2–3% annually.

- Dividend yield remains near 6.8–7.0%.

- FCF coverage improves gradually post-2025.

- Fair value: ~C$55/share (10–15% upside).

Bull Case (20% probability):

- Strong ARPU gains and cost savings accelerate FCF.

- Stock rerates to P/E 17x → price ~C$60+.

Bear Case (10% probability):

- Interest costs rise, regulatory changes cut margins.

- Dividend growth stalls → price could drift near C$42–C$45.

Final Verdict: BCE in 2025 — A Defensive Income Play with Moderate Upside

Despite market pessimism, BCE remains one of the most defensive dividend plays in Canada. While not a high-growth stock, its combination of predictable cash flows, unmatched infrastructure assets, and consistent dividends make it appealing for income-focused investors.

Recommendation:

🔹 Hold / Accumulate on weakness.

🔹 Fair value range: C$53–C$58 per share.

🔹 Dividend remains secure with minor growth potential.

BCE may not deliver explosive capital gains, but for investors seeking steady income and long-term stability, BCE.TO continues to justify its place in a diversified Canadian portfolio.

Summary Table: BCE Investment Snapshot (2025)

| Category | Key Takeaway |

|---|---|

| Dividend Yield | ~7.0% |

| Dividend Growth | Slowing, but sustainable |

| Valuation | 10–20% undervalued |

| Leverage | High but manageable |

| Risk | Regulatory, interest rates |

| Outlook | Stable income, moderate upside |

| Investment Verdict | Hold / Accumulate |

Conclusion: BCE’s Legacy and Future

BCE is not just a telecom stock — it’s part of Canada’s economic backbone. While challenges persist, its disciplined operations and long-standing dividend culture anchor its value.

For 2025 and beyond, BCE Inc. remains an attractive choice for investors prioritizing income stability over growth, offering one of the most compelling dividend yields in North America backed by resilient infrastructure.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F