What is AST SpaceMobile?

AST SpaceMobile, Inc. (Ticker: ASTS) is a communications technology company focused on building a broadband cellular network in space that directly connects to standard, unmodified mobile devices. If you’re considering investing in AST SpaceMobile, you’ll want to keep an eye on ASTS stock.

- Founded: 2017 by Abel Avellan, headquartered in Midland, Texas.

- Industry: Specialty telecommunications / space tech.

- Mission: Allow mobile coverage anywhere on Earth (including remote or under-served areas) without need for special hardware on user side.

Key Financial Metrics & Business Model

Understanding ASTS requires recognizing both its opportunity and the financial strain typical in early-stage, cap-intensive tech.

| Metric | Value | Interpretation |

|---|---|---|

| Revenue (FY) | ~$4.42 million USD | Very small compared to its costs; early stage. |

| Net Income (FY) | −$300.08 million USD | Large losses; high cash burn. |

| EPS (TTM) | −$1.90 USD per share | Negative profitability. |

| Shares Float | ~204.5 million shares | Medium float; awareness of potential volatility. |

| Beta (1Y) | ~1.08 | Slightly more volatile than market. |

| Employees | ~578 | Staffing consistent with growth / R&D phases. |

Business Model Highlights:

- Generate bandwidth via satellites in low-earth orbit (or similar), then sell access or lease capacity to telecom partners and/or directly to consumers.

- Heavy R&D, regulatory, infrastructure, and capital expenditure upfront.

- Potential for recurring revenue once network is built and operating.

Recent Performance & Chart Analysis

Stock Performance

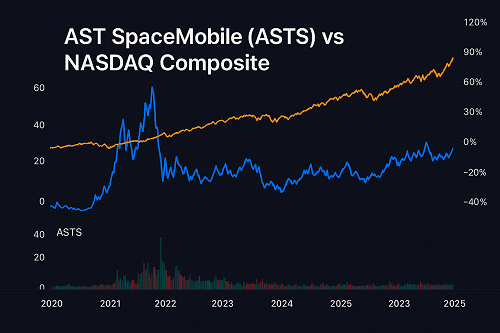

- Year-to-date (YTD): up ~93.8%

- Over 1 year: up ~52.93%

- Over 5 years: up ~308.5%+

- Recent monthly drop: −16.25% in the past month

So while long-term growth has been strong, there’s been notable pullback recently.

Key Levels & Technical Patterns

- All-time high: ~$60.95

- Current levels in the low-$40s (circa TradingView snapshot)

- Possible resistance around ~$50-$60, where prior highs or moving averages cluster.

- Support zones: Prior lows, perhaps around ~$40 and below.

Patterns observed:

- Head & Shoulders top forming — signals potential reversal if neckline breaks.

- Some technical analysts watching for “cup-and-handle” patterns.

- MACD / RSI indicators showing possible divergence (depending on timeframe).

Competitive Landscape & Market Opportunity

Competitive Players

- SpaceX (Starlink): Though focused mostly on broadband and internet, not specifically mobile direct-to-device service, but overlapping in “coverage everywhere.”

- OneWeb, Amazon’s Kuiper Project, T-Mobile, Verizon: Each with their own satellites, cell towers, or hybrid models. ASTS aims for direct coverage, which is different but competitive space can reduce margins.

- Traditional telecoms (AT&T, T-Mobile, Vodafone, etc.): May partner or compete depending on geographic or regulatory constraints.

Market Opportunity

- Underserved or unserved areas: Remote, rural areas with limited infrastructure. Huge population in developing countries.

- Disaster recovery / emergency services: Areas where terrestrial networks go down.

- IoT / connected devices: Potential for devices/sensors that may benefit from wide coverage.

Estimated addressable market ranges in tens of billions annually once service is mature, but costs are massive to build and maintain space infrastructure, regulatory approvals, spectrum licensing, etc.

Analyst Forecasts & Valuation Multiples

Analyst Sentiment

- Some analysts express concern over valuations given limited revenue and high losses.

- Price estimates tend to vary widely: some optimistic (>$60), others much more conservative (in the $30s).

Valuation Issues

- Price/Sales (P/S): Extremely high if using current revenue — suggests the market is pricing huge future growth. Probably not meaningful until recurring revenues are high.

- Profitability metrics (P/E, P/EBITDA): Not meaningful yet (negative values).

Valuations right now are speculative: much depends on execution (satellite deployment, partnerships, regulatory, cost control).

Risks & Challenges

Understanding potential downsides is critical.

- Execution risk: Manufacturing and launching satellites is complex, expensive, and prone to delays.

- Regulatory & licensing risk: Spectrum rights, permits, international agreements can slow deployment.

- Funding and cash burn: Needs significant capital to continue development until revenue scales.

- Competition: Other players with deeper pockets or earlier deployment could erode market share.

- Technology risk: Reliability of space-hardware, latency, weather interference, etc.

- Market acceptance & adoption rate: Users/telecom partners must be willing to adopt service; pricing must be viable.

Price Catalysts & Upcoming Events

Be on the lookout for events that might move the stock significantly:

- Satellite launches or successful deployment announcements.

- Partnerships with telecom carriers or mobile device manufacturers.

- Regulatory approvals (e.g. spectrum, FCC, international).

- Quarterly earnings reports with user / revenue growth numbers.

- Milestones in service availability (commercial service launch).

Investment Strategies & Portfolio Fit

Depending on risk tolerance, here are possible ways to approach ASTS:

| Strategy | Description | Suitable For… |

|---|---|---|

| Speculative growth play | Small – to moderate position, expecting big upside if everything goes well. | Investors who can accept high volatility. |

| Long-term hold | Assume heavy cash burn now, but potential 5-10× returns if network becomes operational and adopted. | Long horizon investors (5+ years). |

| Swing trading / technical | Trade on shorter-term patterns (support/resistance, breakouts) while monitoring news catalysts. | More active traders. |

| Hedge / paired trades | Pair position with a competitor or hedge via options to reduce downside risk. | More experienced investors. |

Technical Analysis & Levels to Watch

Here are key technical levels and signals (assuming price is in the ~$40-50 region, adapt as current):

- Support zones:

- ~$40: recent lows or psychological support.

- ~$30-35: deeper support if breakdown occurs.

- Resistance zones:

- ~$50-55: prior highs and possibly moving averages.

- ~$60: all-time high; strong resistance.

- Indicators to watch:

- RSI / MACD for momentum shifts.

- Volume spikes on upward moves for confirmation.

- Watch for break of downtrend lines (trendline from recent highs).

- Moving average crossovers (e.g. 50-day over 200-day).

- Patterns: Cup-and-handle, head-and-shoulders, wedge-breakouts.

FAQs

Q: Is ASTS a good buy right now?

A: It depends on your risk tolerance. If you believe AST SpaceMobile will successfully deploy its satellite network, secure partners, and start generating revenues, then current valuation may present upside. But there’s substantial execution and cash flow risk.

Q: When is ASTS expected to become profitable?

A: There’s no public, guaranteed timeline. Profitability likely hinges upon reaching scale in service adoption, which may be several years away.

Q: What is the price target for ASTS?

A: Analyst targets vary widely: some project $50-$60+ if key milestones are met; others suggest $30-$40 or lower if headwinds persist.

Q: Does ASTS pay dividends?

A: No. The company is currently not paying dividends.

Q: What’s the revenue growth outlook?

A: Growth is expected but from a very low base. Investors should look for quarter-over-quarter progress and partnerships/launches as earliest signals.

Q: What are competitors to watch?

A: Starlink (SpaceX), OneWeb, Amazon Project Kuiper, terrestrial mobile carriers expanding into satellite/space coverage.

Conclusion

AST SpaceMobile (ASTS) represents a high-risk, high-potential play in the convergence of satellite communications and mobile broadband. For investors interested in frontier tech, connectivity in remote areas, and “moonshot” growth, it may be compelling — but only as part of a diversified portfolio.

To outperform peers and justify current valuation, ASTS must deliver on satellite deployment, regulatory compliance, partner adoption, and margin improvement. Until then, the stock will likely see high volatility, swings based on news, and high downside if milestones are missed.

XAUT-USD

XAUT-USD AMD

AMD MARA

MARA SHOP

SHOP BULL

BULL CL=F

CL=F