Market Overview: Wall Street Soars to Fresh Highs

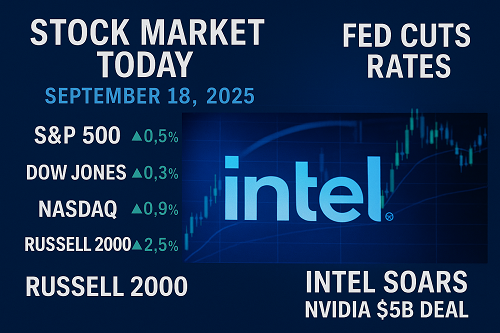

- Date: Thursday, September 18, 2025 – An update on the US stock market today reveals new trends and movements.

- Indexes:

- S&P 500 +0.5% → record close

- Nasdaq Composite +0.9% → record close

- Dow Jones +0.3% → record close

- Russell 2000 +2.5% → first record since Nov 2021

Takeaway: Investors cheered the Fed’s first rate cut of the year, while Intel’s rally fueled a tech-led breakout.

Federal Reserve Policy: First Cut of 2025

- The Federal Reserve cut rates by 25 basis points, citing a “risk-management” approach.

- Chair Jerome Powell suggested further cuts in October and December remain possible, but data-dependent.

- Treasury yields climbed: the 10-year rose toward 4.10%, showing bond markets still cautious.

Economic Data:

- Jobless claims: 231,000 (better than forecast, down from 263,000)

- Philadelphia Fed Index: +23.2 (vs. −0.3 in August)

Intel’s Biggest One-Day Gain Since 1987

- Nvidia invested $5 billion in Intel, co-developing chips for data centers and PCs.

- Intel stock soared ~23%, its strongest rally in nearly 40 years.

- Nvidia also gained ~3-4%, rebounding from China tech restrictions.

- The Philadelphia Semiconductor Index jumped 3.6%, reinforcing chip-sector leadership.

Sectoral Leadership

- Semiconductors & AI tech led the rally (Intel, Nvidia, ASML, Synopsys).

- Small caps (Russell 2000, S&P SmallCap 600) surged, highlighting risk-on appetite.

- Laggards: Consumer discretionary & staples saw muted or negative performance.

Notable Movers

| Stock | Move | Catalyst |

|---|---|---|

| Intel (INTC) | +23% | Nvidia partnership, optimism on chip turnaround |

| Nvidia (NVDA) | +3-4% | $5B Intel investment, AI momentum |

| CrowdStrike (CRWD) | +10-13% | Analyst upgrades, cybersecurity strength |

| Darden Restaurants (DRI) | −7.7% | Weak outlook, soft sales |

| Cracker Barrel | −7% | Mixed results, traffic concerns |

Technical breakouts: TTM Technologies cleared a 51.15 buy point, signaling growth stock momentum.

What to Watch Next

- Fed trajectory – Will October/December cuts materialize?

- Labor market trends – Cooling jobs data could ease inflation pressure.

- AI & semiconductor policy – U.S.-China chip tensions remain a wildcard.

- Earnings season – Guidance from mega-caps and consumer names critical.

- Valuation risks – Indices are extended; pullbacks likely before next leg higher.

Risks for Investors

- Overvaluation in tech could trigger short-term corrections.

- Inflation shocks may force Fed to pause cuts.

- Geopolitical instability (China trade, energy prices, Middle East risks).

- Earnings misses (as seen with Darden & Cracker Barrel) can sink sentiment.

Strategy Takeaways

- Follow leadership sectors: semis, AI, cybersecurity, and small caps.

- Wait for dips: Avoid chasing highs; use pullbacks for entries.

- Hedge with defensives: Utilities, healthcare, and dividend payers as balance.

- Stay data-driven: Jobless claims, inflation reports, Fed minutes will drive moves.

Conclusion

September 18, 2025 marked a historic trading session: record highs across major U.S. indexes, Intel’s biggest rally since 1987, and a decisive Fed pivot toward easing. While opportunities abound in AI-linked semis and growth stocks, elevated valuations and macro risks mean disciplined strategies are essential for traders and investors alike.

XAUT-USD

XAUT-USD  AMD

AMD  MARA

MARA  SHOP

SHOP  BULL

BULL  CL=F

CL=F