NVIDIA Corporation (Nasdaq: NVDA) remains a dominant force in AI-hardware, data center infrastructure, and high-performance computing. Its Q2 FY2026 earnings continued to set records: revenues rose significantly year-over-year, margins stayed healthy, and forward guidance underscores strong demand, though regulatory and geopolitical headwinds are becoming more visible. Meanwhile, tech enthusiasts are closely watching Nasdaq Google trends as these giants continue to shape the tech landscape.

Major takeaways:

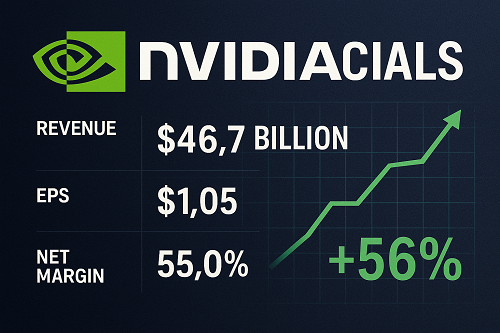

- Revenue growth: ~56% YoY in Q2 FY2026.

- Core driver: Data Center revenues, especially from Blackwell architecture, are powering much of the increase.

- Valuation: High multiples (P/E, P/S) reflect growth expectations, near-term GUIDANCE.

- Challenges: China export restrictions (notably on H20 chips), concentration risk among large customers, potential margin pressure.

We will unpack all of these in detail.

Recent Financial Performance: Q2 FY2026 Highlights

| Metric | Q2 FY2026 | Growth vs Prior Year | Key Notes |

|---|---|---|---|

| Total Revenue | $46.7 billion | +56% YoY | Exceeded guidance range. |

| Sequential Growth | +6% from Q1 FY2026 | – | Driven largely by Data Center (incl. Blackwell) revenue gains. |

| EPS (non-GAAP diluted) | ~$1.05/share | up from ~$0.68 in Q2 FY2025 | Strong bottom-line growth. |

| Gross Margins | GAAP ~72.4%; non-GAAP ~72.7% | relatively stable YoY | Slight adjustments when excluding certain reserved H20 inventory release. |

| Segment Strength | Data Center revenue $41.1B, +56% YoY; Blackwell DC sequential growth ~17% | – | Data center remains majority contributor. |

Key Context & Events

- H20 chip sales to China: In Q2, there were no H20 sales to Chinese customers. Some revenue (~$180 million) came from a release of previously reserved H20 inventory sold outside China.

- Guidance for Q3 FY2026: Revenue expected around $54 billion, excluding uncertain China H20 revenue.

Revenue Segments & Geography Breakdown

To really understand what’s moving the top line and what might move it in the future, it helps to drill down.

By Business Segment

- Data Center

The workhorse of NVIDIA’s recent growth. Composed of AI infrastructure, server GPUs, networking, etc. Data Center revenue was $41.1B in Q2 FY2026, rising ~56% YoY and increasing sequentially.

The Blackwell architecture is a major lever here: it has been adopted widely for models requiring large compute, training, inference etc. - Professional Visualization & Other Segments

These are much smaller in dollar terms but showing growth: e.g., Professional Visualization revenue in Q2 FY2026 was ~$601 million, up ~18% QoQ and ~32% YoY.

Gaming, automotive, & edge/embedded contribute, but are not (yet) as large or fast-growing as data center infrastructure.

By Geography

While detailed geographic split is less frequently disclosed in fine detail, key geographic factors include:

- Strong demand in United States and possibly Western markets for AI/data center infrastructure.

- China: Currently constrained by U.S. export restrictions. No H20 sales to China in Q2, which could meaningfully affect some future revenue streams. Regulatory/licensing uncertainty is significant.

- Others (Asia excluding China, EMEA) likely contribute, but public sources place the major growth and risk centers in throughput into China.

Profitability & Margins

NVIDIA’s profitability remains a strong point. Margins are high for the space, due to product mix, scale, and premium positioning.

- Gross Margin: ~72.4% GAAP, ~72.7% non-GAAP in Q2 FY2026. The slight difference caused by inventory releases etc.

- Operating Margin & Net Margin: These are somewhat less often fully detailed in public summaries, but net margin remains strong, boosted by high gross margins plus operating leverage. (Sources like FinanceCharts and Macrotrends show net margin around ~55%+.

- Other Profitability Metrics: Return on Assets (ROA), Return on Equity (ROE), ROIC are all very high, as seen in long-term ratio data. For example, Macrotrends shows ROE well over 100% in recent periods.

- Tax Rate & Other Income/Expense: Q2 FY2026 expected tax rate ~16.5%, plus or minus 1%, excluding discrete items. Other income/expense was an income ~$500 million.

Cash Flow, Balance Sheet & Capital Allocation

NVIDIA is not only growing revenue and profit; it’s generating plenty of cash and allocating it in ways investors watch.

- Operating Cash Flow / Free Cash Flow: Free cash flow remains robust though capex is also meaningful (especially for R&D, new architecture development, and supply chain). Sources like WSJ Financial Statements show substantial FCF.

- Capital Expenditures & R&D: NVIDIA continues to invest heavily in its next-generation GPU architecture (Rubin, successor to Blackwell), as well as in software, AI framework infrastructure, etc. These investments may pressure margins in future periods but are necessary for sustaining competitive advantage. Publicly disclosed R&D spend is large and increasing.

- Share Buybacks & Capital Return: The company has approved large share repurchase programs in recent periods (e.g., ~$60B announced around Q2 2026) per some reports.

- Debt & Liquidity: Debt levels are modest relative to equity; liquidity remains strong. The balance sheet is viewed as healthy. NVIDIA holds cash, marketable securities; limited exposure to high leverage risk.

Valuation Metrics & Comparison to Peers

High growth comes with high multiples. Whether NVIDIA is overvalued or fairly valued depends largely on whether future growth matches expectations, and how risks are perceived.

| Metric | Value / Approx | Commentary |

|---|---|---|

| Trailing-12-month (TTM) P/E | ~ 50-55× | Reflects investors pricing in strong growth; high relative to many but not unusual for high growth tech / AI names. |

| Price/Sales (P/S) | Mid-20s (20-30x) | Again high; the high revenue growth justifies some premium but this still implies expectations of continued hyper-growth. |

| Price/Book (P/B) | Very elevated (30-40×) | Book value small relative to market cap, due to significant intangible asset value, earnings retention, etc. |

| EV/EBITDA | Very high (30-40×+) | Given high margins and growth, the EBITDA base is strong but valuation is stretched. |

Peer Comparison

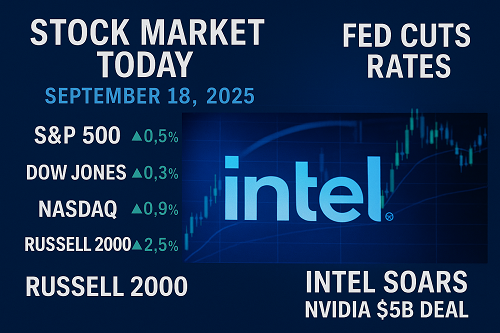

Comparing NVIDIA with companies in similar or adjacent spaces (e.g., AMD, Intel, Broadcom, or even cloud service providers) shows:

- Many of these have lower revenue growth or lower margins, which justifies lower multiples.

- The gap in expected growth and competitive positioning favors NVIDIA: dominance in data center GPU, early mover advantage in AI infrastructure, strong software/hardware ecosystem (CUDA, etc.).

- However, the high multiples leave less margin for error: growth misses, regulatory risk, competition matter more.

Forward Guidance & Growth Drivers

What is NVIDIA expecting, and what are the main levers that could make or break future performance?

Guidance

- Q3 FY2026: Revenue guidance of approximately $54B, excluding potential China H20 shipments. This implies sequential growth of ~15-16%.

- Margins are expected to remain strong, though subject to headwinds (inventory write downs, supply chain, regulatory compliance costs).

Key Growth Drivers

- Data Center / AI Infrastructure Demand

The demand for training large AI models, inference, and AI systems (Blackwell, Rubin) remains a major tailwind. - Product Roadmap Innovation

NVIDIA’s release of new architectures (Blackwell, forthcoming Rubin) and continuing evolution in GPU and AI chips, as well as system & networking stack improvements, is critical. - Software Ecosystem & Partnerships

NVIDIA’s CUDA ecosystem, software tools for AI (both training/inference), partnerships with cloud providers (AWS, Microsoft, etc.), OEMs, etc. - Edge / Automotive / Robotics

While small relative to Data Center, segments like automotive (self-driving, ADAS), robotics (Jetson, etc.) are beginning to contribute and may accelerate. - Global AI Infrastructure Spending

Analysts estimate trillions of dollars over coming years being committed globally to data center & AI infrastructure. NVIDIA stands to benefit significantly.

Risks & Challenges

High upside potential usually comes with significant risks. For NVIDIA, some key risk vectors include:

- Regulatory / Geopolitical Risks

The biggest is U.S. export restrictions to China (especially on H20 chip shipments). If licensing fails, or rules become more restrictive, revenue and margin could suffer. - Customer Concentration

A large share of revenue comes from a few hyperscale customers (cloud providers, AI firms). If they slow spending, or build in-house alternatives, or change procurement behavior (for cost or regulatory reasons), the revenue could be affected. - Competition & Technology Risk

AMD, Intel, Broadcom, and others are all pushing aggressively into AI compute. In addition, possible alternative architectures (GPUs vs. TPUs vs. custom AI ASICs) may put long-term pressure on margins. - Supply Chain & Scaling

Hardware scaling (fabrication, assembly, yield, logistics), chip packaging and cooling are complex; shortages or delays in advanced nodes could limit ability to meet demand. - Valuation Risk & Market Sentiment

With high valuation multiples, any signs of slowing growth (especially revenue growth less than expected) or negative surprises in guidance could lead to sharp declines. - Margin Compression

As more competition enters, or as hardware cost inputs (wafer costs, energy, shipping, labor) increase, or if discounts are needed, margins could shrink.

Investment Thesis: What’s Priced In?

When considering whether NVDA is a good buy now, one must weigh what is already reflected in its current price:

- The market appears to have baked in continued very strong growth in Data Center / AI for at least the next few quarters.

- Also baked in are expectations for new product launches (Blackwell, Rubin) and continuing leadership in hardware + software stack.

- Some risks (like China curbs) are known and partially priced in; but there remains uncertainty in how much they could hurt.

If NVIDIA meets or beats expectations on revenue growth, manages its margins well, and continues scaling new products, upside may persist. But the margin for error is shrinking. Even small misses in guidance or revenue from China could trigger outsized negative reactions.

Conclusion

NVIDIA’s recent financials are impressive: revenue growth above 50% YoY, robust margins, strong cash flow, and a solid roadmap. For growth-oriented investors, the company holds great promise—especially given its leadership in AI infrastructure.

However, high expectations come with high risk. Regulatory pressures, especially around China, competitive threats, and the challenge of sustaining growth rates will be critical. Valuations are high; thus discipline in forward guidance and execution will be rewarded (or punished) significantly by markets.

XAUT-USD

XAUT-USD  AMD

AMD  MARA

MARA  SHOP

SHOP  BULL

BULL  CL=F

CL=F