What Is Alphabet (GOOG)?

Alphabet Inc. is the parent company of Google, created in 2015 as part of a corporate restructuring. Its business spans various sectors, and is often represented on the Nasdaq as NASDAQ: GOOG due to its significant market presence.

- Google Search & Advertising

- YouTube

- Cloud computing (Google Cloud Platform, GCP)

- Android / Mobile OS

- Other Bets (Waymo, Verily, etc.)

Ticker “GOOG” refers to Alphabet’s Class C common shares, which typically don’t carry voting rights (versus GOOGL shares which do). Understanding which class you hold matters for governance, though performance is usually very similar.

Alphabet is one of the largest publicly traded tech companies by market cap, with wide influence in search, digital ads, cloud, and increasingly in AI and autonomous systems.

Current Stock Snapshot

| Metric | Value |

|---|---|

| Ticker | GOOG |

| Exchange | NASDAQ |

| Market Cap | ~$2.9–3.0 trillion USD (as of last close) |

| 52-Week Range | Approx. $142.66 – $242.57 USD |

| Average Daily Volume | ~14.5 million shares |

| Recent Price / % Change | ~$241.38 USD; +0.25% (approx.) |

Note: Stock prices are volatile; always check real-time data from your brokerage or market data provider.

Fundamental Analysis

Revenue & Profitability

- Revenue Streams: Advertising remains the lion’s share of revenue; Cloud is the fastest-growing segment; “Other Bets” still in investment mode.

- Profit Margins: Historically strong in search/ad business. Cloud dampens margins somewhat, but scale is improving.

Balance Sheet & Cash Flow

- Alphabet holds large cash reserves and generates robust free cash flow (FCF).

- Low debt relative to assets, good liquidity.

Executive & Governance

- CEO: Sundar Pichai

- Alphabet emphasizes R&D heavily (AI, infrastructure, autonomous systems).

- Share classes: Voting power skewed toward founders/executives via Class B shares; Class C (GOOG) mostly non-voting.

Valuation Metrics

Comparative and historical valuation help you judge whether GOOG is cheap, rich, or “fair.”

| Metric | GOOG (Recent) | Ex-Tech Peers* |

|---|---|---|

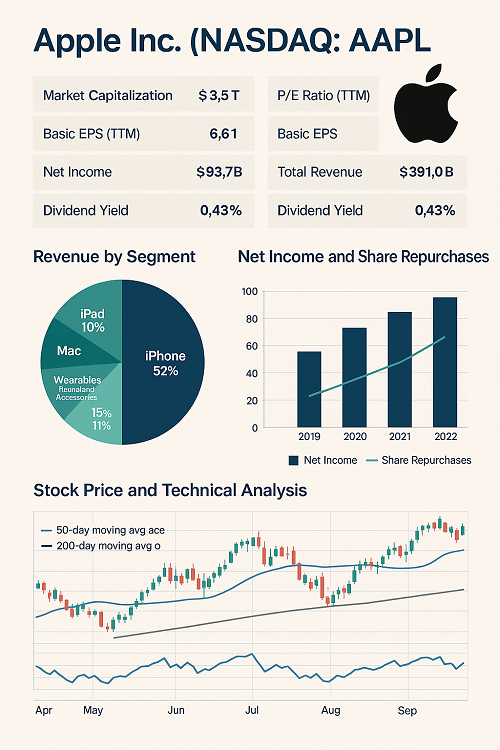

| P/E Ratio (Trailing / Forward) | (Estimate based on recent earnings) — often in the mid-20s to 30s forward P/E | Apple, Microsoft, Amazon often similar or higher for high growth; some cloud/AI peers even more expensive |

| Price / Sales (P/S) | Moderate given scale and margins | Cloud peers often higher P/S; ad revenue companies somewhat comparable |

| PEG (Growth-adjusted P/E) | Depends on growth in Cloud + advertising; growth remains strong, so PEG often more favorable than simple P/E | Many high‐growth techs have worse PEGs unless expecting blow-out growth |

Ex-Tech Peers include Microsoft (MSFT), Amazon (AMZN), Meta (META), etc.

Other key metrics:

- Beta: Reflects GOOG’s volatility relative to the market. Historically moderate; reacts to ad-spend cycles.

- Dividend Yield: Alphabet does not currently pay a dividend; returns are via growth and share repurchases (if any).

- Return on Equity / Assets: Strong ROE, especially in ad/search business; Cloud is capital intensive but improving.

Recent Financial Performance

- Alphabet’s most recent quarterly revenue growth: strong growth in Cloud & YouTube offsetting some ad-dollar softening.

- Margins: Slight compression in ad business when macro is weak; Cloud margin still improving.

- Operating Expenses: Heavy investment in AI infrastructure, data centers; “Other Bets” continue to lose money but could have big upside.

- Earnings: Generally beating consensus in recent quarters (depending on ad demand cycle); forward guidance is often scrutinized.

Growth Drivers & Business Segments

Here are what might drive GOOG forward:

- Digital Advertising Resilience

Search, YouTube ads, programmatic ad markets bounce back with macro recovery and e-commerce demand. - Cloud Computing

Google Cloud is number three globally; margin expansion as scale and efficiency improve. - AI & Machine Learning

Generative AI, LLMs, infrastructure; OpenAI (partnered), internally built models; expanding enterprise AI adoption. - Other Bets and Innovation

Waymo (autonomous vehicles), health sciences, quantum computing, etc. High risk, high potential. - Operating Efficiency

Focus on cost discipline, optimization of server farms, energy efficiency. - Global Expansion & Regulatory Watch

Expansion into emerging markets, but regulatory risk (privacy, antitrust) increasing globally.

Technical Analysis

(Note: Technicals are supplemental; fundamentals drive long-term value but TA can help with entry/exit timing.)

- Support & Resistance: Strong support often seen near lower 52-week levels (~$140-150); resistance near recent highs (~$240+).

- Trend: Uptrend over longer term (3-5 yrs) driven by recurring revenue; but shorter-term may see pullbacks if macro weakens.

- Moving Averages: 50-day and 200-day MAs important; golden cross / death cross signals might matter to momentum traders.

- Volume Indicators: Watch spikes in volume on earnings releases or major product/AI announcements.

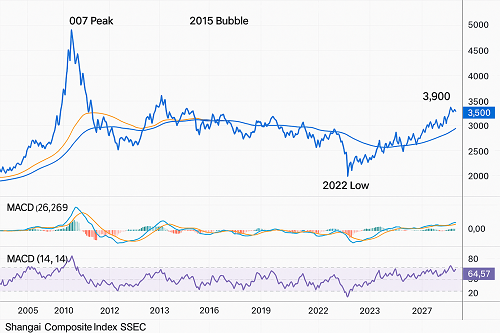

- Relative Strength Index (RSI), MACD, Bollinger Bands: Use to detect overbought/oversold conditions; RSI above 70 may suggest short-term pullback; below 30 could be a buying opportunity.

Analyst Forecasts & Price Targets

- Consensus Price Target: Analysts generally have price targets ranging across a spectrum (from moderately bullish to optimistic), depending heavily on assumptions about ad spend recovery and cloud margins.

- Recommendations: Many agencies have “Buy” or “Outperform” ratings; some more cautious ones reduce to “Hold” if they foresee regulatory headwinds or slower macro growth.

Example forecasts might range from $250-$300+ USD in bullish scenario over 12-18 months, assuming ad demand rebounds, cloud accelerates, and innovation (AI) pays off; more conservative estimates could peg fair value closer to $200-$230 USD based on current earnings projections and discounting risk.

Risks & Challenges

Even for a company as dominant as Alphabet, there are significant risks:

- Regulatory Pressure: Antitrust investigations in U.S., EU; privacy laws tightening (e.g. cookies, tracking).

- Ad Market Cyclicality: If global economic slowdown, advertisers cut budgets, hurting ad-based revenue.

- Competition in AI / Cloud: From Microsoft, Amazon, OpenAI, other startups; may eat margins.

- Dependence on Infrastructure Investments: Capital expenditure (data centers, energy) high; cost overruns possible.

- Currency / International Risk: Large exposure to foreign markets; currency fluctuations affect revenue.

- Technological Disruption / Other Bets: “Moonshot” projects may not yield returns; capital allocation risk.

Investment Thesis: For Whom Is GOOG Right Now?

| Investor Type | Likely Fit? | Why / Why Not |

|---|---|---|

| Long-Term Growth Investor (5-10+ years) | ✔️ Strong fit | Leading in search, AI, cloud; large cash flows to fuel reinvestment. |

| Dividend Seeker | ❌ Not a great fit | No dividend; return is via growth/capital gains. |

| Value Investor | ⚠️ Mixed | Valuations are premium; unless you believe in future growth strong, risk of overpaying. |

| Momentum/Technical Trader | ✔️ Moderate | Good liquidity and volatility; requires watching macro & earnings. |

| Risk-Averse Investor | ⚠️ Somewhat risky | Regulatory and competition risks; could be volatile in downturns. |

Frequently Asked Questions (FAQs)

Q: What’s the difference between GOOG and GOOGL?

A: GOOG shares are Class C (no voting rights). GOOGL shares are Class A (with voting rights). Financial performance is very similar, but voting control differs.

Q: Does Alphabet pay a dividend?

A: No, Alphabet currently does not pay a regular dividend. Investors expect returns via growth.

Q: What are “Other Bets”?

A: These are Alphabet’s non-core businesses like Waymo (autonomous vehicles), Verily (life sciences), etc. Mostly experimental, often loss-making, but potentially large upside.

Q: How does macro (interest rates, inflation) affect GOOG?

A: Higher rates tend to hurt growth stocks (discounted future cash flows). Inflation raises operational costs (data centers, energy). Ad budgets may shrink if economic outlook weakens.

Q: Is GOOG a good “buy the dip” candidate?

A: Potentially, if the price drop is due to short-term macro/regulatory concerns rather than fundamental deterioration. But timing matters.

Conclusion

Alphabet’s (GOOG) stock remains one of the more compelling plays for exposure to search, core advertising, cloud growth, and AI innovation. Its dominance in digital ads gives it a strong cash flow engine; cloud and other emerging businesses provide optionality for future upside.

However, its valuation is already premium, and investors must weigh regulatory, competitive, and macro risks carefully. For long-term investors who believe in AI’s potential and Google’s ability to monetize it, GOOG could offer strong returns. For more conservative or value-focused investors, it may be better to monitor for more attractive entry points or lower valuation multiples.

XAUT-USD

XAUT-USD  AMD

AMD  MARA

MARA  SHOP

SHOP  BULL

BULL  CL=F

CL=F