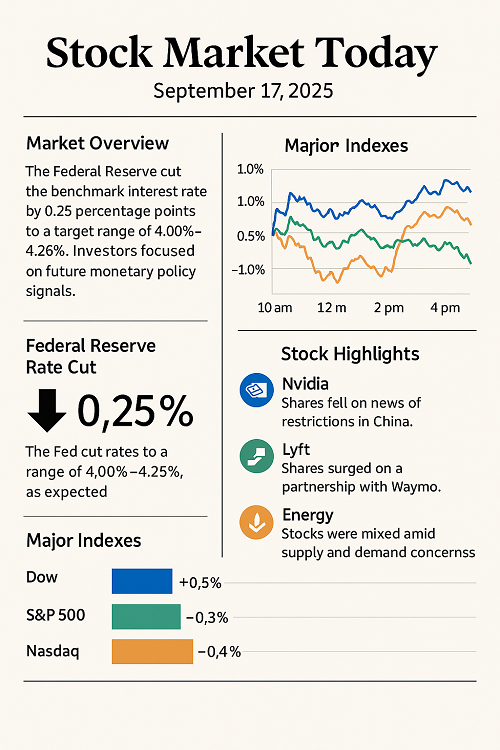

- Amid fluctuations in stock futures, the Federal Reserve cut its benchmark interest rate by 25 basis points, moving the target range to 4.00%–4.25%, as expected.

- The reaction in U.S. equities was muted: the Dow Jones ticked higher, while the S&P 500 and Nasdaq slipped modestly.

- Attention now shifts to the Fed’s updated “dot plot” and Chair Powell’s remarks, which investors see as critical for understanding the path of future rate cuts.

- In other notable moves: Nvidia fell after reports out of China, Lyft surged on a Waymo deal, and energy / financial stocks saw mixed responses.

Market Moves in Detail

Fed Rates & Policy Outlook

The big news was the Fed’s decision to cut rates by 0.25%, as most expected. Key points:

- The committee’s updated projections (dot plot) suggest perhaps two more cuts before end of 2025, with a slower pace or more cautious approach thereafter.

- Powell emphasized maintaining flexibility and warned markets not to over-interpret future cuts, especially given uncertainties in inflation and labor.

Index Performance

| Index | Movement | Notable Drivers |

|---|---|---|

| Dow Jones | + ~0.5%–0.6% | Financials outperformed, helping lift the Dow. |

| S&P 500 | Slight negative / flat | Tech weakness, especially tied to China concerns. |

| Nasdaq | Down ~0.3% | Pressure from key tech names, regulatory risk from China. |

| Russell 2000 / Small Caps | Mixed to slightly positive | Less volatile, but investors cautious on growth vs rate risk. |

Stock Spotlight

- Nvidia: Slipped ~2–3% post-rate announcement, largely due to reports that China’s internet regulator told major firms to stop buying its AI chips.

- Lyft: Jumped materially on news of a partnership with Waymo.

- Workday: Rose after Elliott Management disclosed a sizable stake.

- Energy & Financials: Mixed response. Financials benefited modestly post-rate cut; energy stocks were more influenced by global supply / demand issues.

Themes & Risks to Watch

- Interest Rates & Monetary Policy Path

The rate cut is now baked in. Now the market will be especially sensitive to forward guidance: how aggressive does the Fed anticipate being? Will inflation or labor data force a pause? - Macro Data Flow

Key upcoming data: labor market (jobs reports), inflation metrics (PCE, CPI, core inflation), and GDP. Any upside surprises could tighten monetary policy, downside could reinforce easing expectations. - China Regulatory Risk and Geopolitics

China’s actions (e.g. limitations on Nvidia chip purchases) are escalating risk for global tech supply chains. Tariffs, policy shifts, regulatory pressures continue to be “wildcards.” - Sector Rotation

Investors seem to be favoring financials over growth tech, or at least rotating away from sectors vulnerable to interest rate changes and regulatory risk. Defensive names may see renewed interest if volatility increases. - Valuations Stretch

Some of the recent rally (especially among AI / big tech) rests on elevated expectations. If forward guidance or earnings disappoint, there could be downside. Also, bond yields rising could dampen equity valuations in sensitive sectors.

What Traders & Investors Should Do

- Positioning: Consider balanced exposure with a tilt towards value, dividends, and financial sector names that benefit from a shallower yield curve.

- Hedging / Risk Management: Use options or pairs to hedge big tech exposure. Monitor volatility (VIX), as spikes are likely when data surprises (positive or negative).

- Earnings Checkpoints: Watch upcoming earnings for companies in sectors with over-optimistic expectations—tech, consumer discretionary. If guidance is conservative, these could be vulnerable.

- Monitor Fed Communication Closely: Powell’s speeches, minutes, and any commentary regarding inflation, labor, and the balance between supporting growth vs. avoiding overheating.

- Global / Geo Considerations: China policy actions, trade disputes, and supply chain disruptions remain impactful for many U.S.-listed multinationals.

Outlook: What’s Next

- Rate cuts are likely to continue, though not necessarily at the pace some participants hope.

- Inflation remains the key variable. Soft/slowing inflation gives the Fed room; sticky inflation — especially core — can create tension.

- We may see more divergence among sectors: winners in finance, certain industrials; laggards in rate-sensitive growth, parts of tech.

- Volatility is likely to rise around major data releases and Fed communication. Markets may oscillate around expectations rather than trend strongly until more clarity emerges.

FAQs

Q: Did the markets “like” the Fed cut?

A: Mixed feelings. The rate cut was expected, so the surprise factor was low. Investors were looking instead for the future path: how many cuts, and how fast.

Q: What’s the significance of the Fed’s dot plot?

A: It gives a forecast from Fed officials about where rates may go. It signals how aggressive the Fed might be with future cuts or holding steady, depending on economic data.

Q: Should I cut tech exposure?

A: Not necessarily entirely, but tech comes with higher risk right now (regulation, valuations, rate sensitivity). Hedging or underweighting may reduce downside.

Conclusion

The market’s reaction to the Fed’s move today reflects caution rather than celebration. With expectations already high for easing, the real test is in future guidance, inflation’s trajectory, and how much economic softening the Fed is willing to tolerate. For investors and traders, that means staying nimble, watching data closely, and avoiding overexposure to sectors that may be most vulnerable to changing rates or regulatory policy.

XAUT-USD

XAUT-USD  AMD

AMD  MARA

MARA  SHOP

SHOP  BULL

BULL  CL=F

CL=F