The world of ETFs has no shortage of funds promising to deliver strong returns. But very few can claim to have consistently outpaced the s p500—the gold standard for U.S. equities. The Capital Group Dividend Value ETF (CGDV) has done exactly that, combining dividend-paying stability with growth-oriented upside. For investors seeking a smart balance of income and capital appreciation, CGDV is quickly becoming a go-to choice.

What Makes CGDV Unique?

Unlike traditional passive dividend ETFs, CGDV is actively managed by Capital Group, a firm with nearly a century of investing expertise. Its philosophy blends:

- Dividend strength: Targeting stocks that offer yields about 25–30% higher than the average s p500 company.

- Growth potential: Including high-quality growth names (like Nvidia or Microsoft) alongside value-oriented stalwarts.

- Experienced managers: Multi-manager sleeves led by veterans with decades of track records.

This hybrid approach gives CGDV the ability to perform well in both rising growth markets and defensive value cycles.

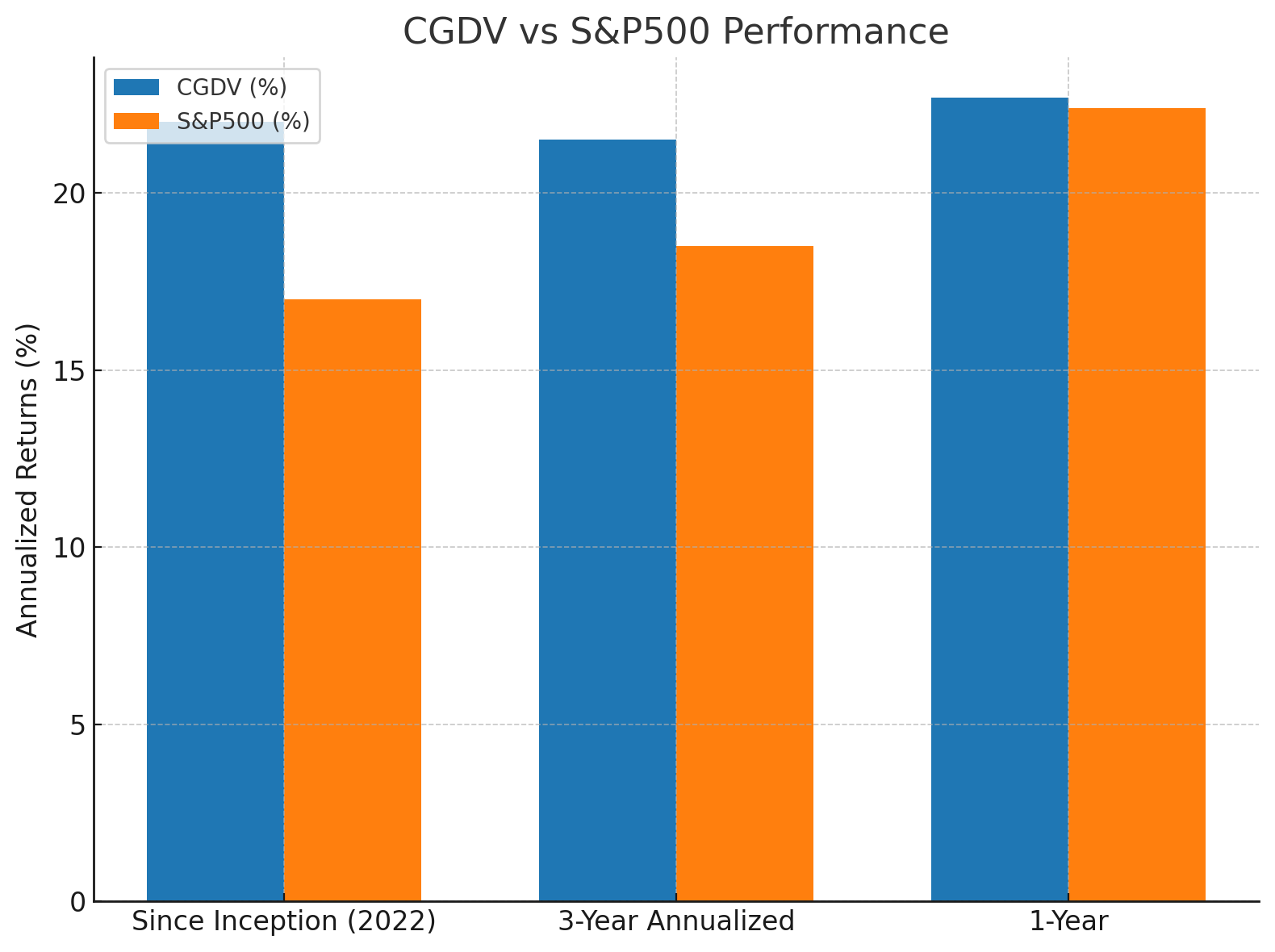

Performance: Numbers That Tell the Story

Performance is where CGDV truly shines. Since inception in 2022, the ETF has outpaced the s p500 by roughly 70% cumulatively. Even in shorter timeframes, it shows an impressive track record.

CGDV vs s p500 Returns

(Annualized performance comparison)

- Since inception: CGDV ~22% vs s p500 ~17%

- 3-Year Annualized: CGDV ~21.5% vs s p500 ~18.5%

- 1-Year Return: CGDV ~22.7% vs s p500 ~22.4%

CGDV doesn’t just keep up—it often outpaces its benchmark while offering a more defensive yield component.

Yield, Fees, and Comparisons

Here’s a quick snapshot comparing CGDV with the broader s p500 (via SPY ETF):

📊 CGDV vs s p500 Comparison Table

(See the interactive table above)

- Expense Ratio: CGDV at 0.33% is higher than SPY’s 0.09%, but still lower than many actively managed ETFs.

- Dividend Yield: CGDV ~1.6%, about 25% higher than the s p500 average (~1.25%).

- Top Holdings: CGDV leans on Microsoft, Nvidia, Broadcom, Eli Lilly—blending growth with value.

- Tax Efficiency: Like SPY, CGDV benefits from ETF tax advantages, helping shield investors from capital gains distributions.

Portfolio Composition & Strategy

CGDV holds roughly 90–93% U.S. large-cap stocks with a small international sleeve. Its sector mix is diversified across:

- Technology: Nvidia, Microsoft, Broadcom

- Healthcare: Eli Lilly

- Industrial & Defense: RTX, GE

- Consumer Discretionary: Starbucks, Las Vegas Sands

While marketed as a dividend ETF, CGDV is flexible enough to hold companies like Alphabet or Meta that may not fit traditional dividend molds but bring growth exposure.

Investor Risk Profiles: Who Should Consider CGDV?

Every ETF has a risk-return personality. Here’s where CGDV fits:

- Conservative Investors: ✔ Beneficial for those who want exposure to equities with the cushion of dividends. The yield isn’t sky-high, but it helps soften volatility.

- Growth-Oriented Investors: ✔ Attractive because CGDV isn’t a stodgy dividend-only fund—it invests in growth engines like Nvidia and Microsoft.

- Income-Only Investors: ✘ Probably not ideal for retirees or those seeking 4–5%+ income. Its 1.6% yield is better than the s p500 average but not high-yield territory.

- Tax-Sensitive Investors: ✔ Strong choice for taxable accounts since the ETF structure minimizes capital gains distributions despite high turnover.

In short: CGDV is best for investors who want balanced exposure—growth plus a yield premium, all with lower volatility than pure growth funds.

Why CGDV Looks Compelling Now

- AI and Tech Tailwinds: Nvidia and Broadcom exposure has already boosted results, and AI remains a secular growth driver.

- Dividend Discipline: Offers resilience during market downturns while keeping upside open.

- Proven Managers: Capital Group’s multi-sleeve structure reduces concentration risk and adds flexibility.

- Beating the Benchmark: Outperformance against the s p500 validates its hybrid approach.

Final Thoughts

The Capital Group Dividend Value ETF (CGDV) has quickly become one of the most attractive active ETFs available today. Its ability to blend growth-driven names with dividend resilience makes it a unique solution in a crowded ETF landscape. While its yield may not satisfy pure income seekers, for most long-term investors looking to outperform the s p500 with balance and tax efficiency, CGDV is a standout option.

XAUT-USD

XAUT-USD  AMD

AMD  MARA

MARA  SHOP

SHOP  BULL

BULL  CL=F

CL=F