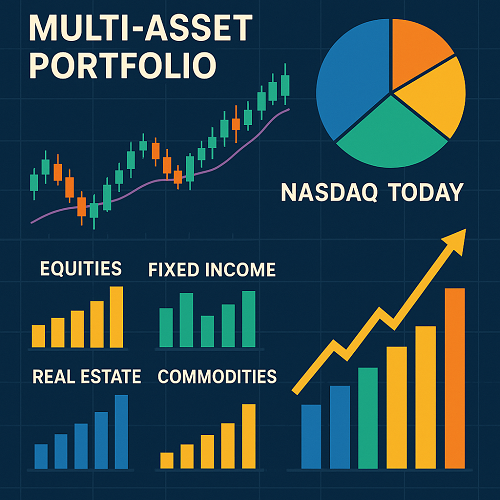

In today’s fast-moving markets, building a resilient multi-asset portfolio is no longer a luxury—it’s a necessity. With the Nasdaq Composite Index acting as a bellwether for technology and growth stocks, understanding “Nasdaq NDAQ” is crucial for making smart allocation decisions.

Whether you’re a seasoned trader or a long-term investor, the key to success lies in blending equities, bonds, commodities, real estate, and alternative assets to weather volatility and capture upside potential.

In this guide, you’ll learn:

- What a multi-asset portfolio is and why it matters now more than ever.

- How the Nasdaq today impacts broader market sentiment and asset allocation.

- Step-by-step strategies to build and manage a diversified investment plan.

- Real-world examples of portfolio mixes for different risk profiles.

Understanding the Multi-Asset Portfolio

A multi-asset portfolio combines different asset classes to achieve:

- Diversification: Reducing exposure to a single market downturn.

- Risk-adjusted returns: Smoothing performance across market cycles.

- Inflation protection: Including assets like gold or real estate.

Core Asset Classes

- Equities (Stocks)

- Growth: Tech-heavy indices like the Nasdaq Composite.

- Value: Dividend-paying blue chips.

- Fixed Income (Bonds)

- Government bonds for stability.

- Corporate bonds for higher yields.

- Commodities

- Gold, silver, oil for inflation hedging.

- Real Estate

- REITs for income and appreciation.

- Alternative Investments

- Private equity, hedge funds, crypto.

Nasdaq NDAQ: The Market’s Tech Pulse

The Nasdaq Composite Index represents more than 3,000 companies, heavily weighted toward technology, biotech, and innovative growth firms.

- High growth sensitivity: Nasdaq reacts sharply to interest rate shifts and economic data.

- Investor sentiment gauge: When the Nasdaq is up, risk appetite generally increases.

Why “Nasdaq NDAQ” Matters for Multi-Asset Strategies

- Bullish: Suggests risk-on sentiment—tilt toward equities and growth assets.

- Bearish: Risk-off sentiment—shift to bonds, gold, or defensive sectors.

Example:

If Nasdaq gains 2% on strong earnings from tech giants, your portfolio might benefit from overweighting growth ETFs or innovation funds.

If it drops 3% due to interest rate hikes, you might rotate into bonds or cash equivalents.

Building a Multi-Asset Portfolio Around Nasdaq NDAQ Trends

Define Your Risk Tolerance

- Aggressive: 70% equities, 20% bonds, 10% alternatives.

- Moderate: 50% equities, 30% bonds, 10% real estate, 10% commodities.

- Conservative: 30% equities, 50% bonds, 20% income-generating assets.

Asset Allocation Strategies

- Strategic Asset Allocation: Fixed mix rebalanced periodically.

- Tactical Asset Allocation: Adjust based on market signals.

- Dynamic Asset Allocation: Frequent changes based on macroeconomic indicators.

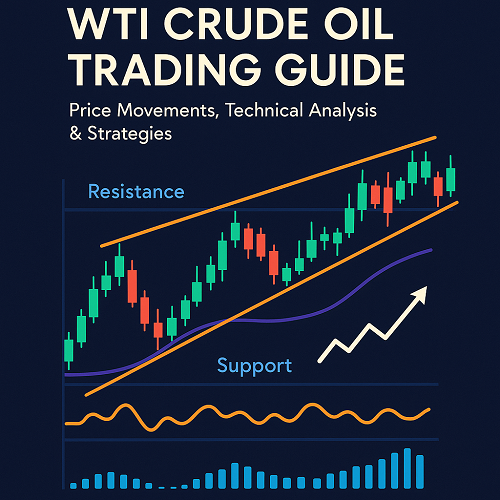

Incorporating Nasdaq Data

- Price trends: 50-day and 200-day moving averages.

- Market breadth: Advance/decline ratio in Nasdaq components.

- Sector rotation: Tech, biotech, semiconductors.

Example Portfolios

Aggressive Growth Portfolio

- 50%: Nasdaq 100 ETF (QQQ)

- 20%: International equities

- 15%: High-yield corporate bonds

- 10%: Commodities (gold/oil)

- 5%: Cryptocurrency

Balanced Portfolio

- 30%: Nasdaq 100 + S&P 500 blend

- 20%: International equities

- 30%: U.S. Treasuries & corporate bonds

- 10%: REITs

- 10%: Gold and commodities

Conservative Income Portfolio

- 20%: Nasdaq 100

- 30%: Dividend aristocrats

- 40%: Bonds (mix of Treasuries and munis)

- 5%: Gold

- 5%: Cash equivalents

Risk Management & Rebalancing

- Quarterly reviews: Adjust allocation to match goals.

- Stop-loss orders: Protect from major drawdowns.

- Hedging tools: Options on Nasdaq ETFs for downside protection.

Tools & Resources

- Market Data Platforms: Nasdaq.com, TradingView, Bloomberg.

- Portfolio Tracking: Morningstar, Personal Capital.

- Education: CFA Institute, Investopedia Academy.

Action Plan for Investors

- Monitor Nasdaq NDAQ for daily sentiment shifts.

- Align your portfolio tilt with market conditions.

- Keep 6–12 months of expenses in cash or liquid assets.

- Reassess allocation during major market events (rate hikes, earnings season).

The synergy between multi-asset portfolio design and monitoring the Nasdaq NDAQ can provide a powerful edge in modern investing. By strategically adjusting allocations based on market conditions, you can protect capital, capture opportunities, and stay ahead of market cycles.

XAUT-USD

XAUT-USD  AMD

AMD  MARA

MARA  SHOP

SHOP  BULL

BULL  CL=F

CL=F